With a market cap of $73 billion, Hilton Worldwide Holdings Inc. (HLT) is one of the world’s largest hospitality companies, operating and franchising a broad portfolio of hotel and resort brands across luxury, lifestyle, full-service, and focused-service segments. Headquartered in McLean, Virginia, Hilton manages thousands of properties in more than 120 countries, including well-known brands such as Waldorf Astoria, Conrad, Hilton Hotels & Resorts, DoubleTree, and Hampton.

The hospitality giant has notably surpassed the broader market over the past year. HLT stock prices have gained 21% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% returns. In 2026, the stock is up 12.7%, surpassing the index’s 1.4% rise.

Narrowing the focus, Hilton has outpaced the sector-focused State Street Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.6% uptick over the past 52 weeks and marginal fall on a YTD basis.

Hilton benefits from its asset-light, fee-based structure, which generates stable, high-margin revenue and reduces capital intensity relative to traditional hotel ownership models. Over the past year, Hilton Worldwide has outpaced the broader market largely due to strong fundamentals in the hospitality sector and investor confidence in its business model. Additionally, its diverse global brand portfolio and large loyalty program help drive pricing power and sustained demand, with RevPAR performance often outpacing competitors.

For FY2025 that ended in December, analysts expect HLT to deliver an adjusted EPS of $8.03, up 12.8% year over year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

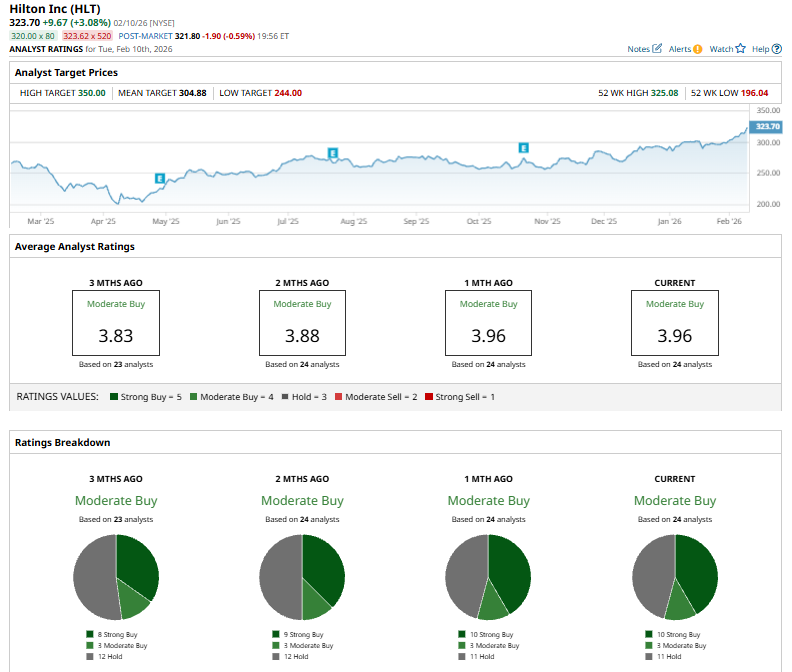

Among the 24 analysts covering the HLT stock, the consensus rating is a “Moderate Buy.” That’s based on ten “Strong Buys,” three “Moderate Buys,” and 11 “Holds.”

This configuration is more bullish than two months ago, when the stock had nine “Strong Buy” recommendations.

On Feb. 3, JPMorgan Chase & Co. (JPM) raised its price target on Hilton Worldwide to $318 from $288 while reaffirming an “Overweight” rating, as part of its fourth-quarter lodging sector preview. The firm noted that investor expectations appear reasonably balanced amid mixed U.S. lodging trends, supporting a constructive but measured outlook on the stock.

While Hilton currently trades above its mean price target of $304.88, the street-high target of $350 suggests a notable 8.1% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?