Popular homestay provider Airbnb, Inc. (ABNB) is gearing up to unveil its fourth-quarter and full-year 2023 financials tomorrow. In the last reported quarter, the company reported a $3.40 billion revenue, registering an 18% year-over-year growth and topping the analyst projection of $3.37 billion.

ABNB’s net income came in at $4.37 billion, up significantly from the prior year’s quarter. However, this included a hefty one-time tax benefit. Moreover, the company expected a turbulent fourth-quarter scenario, as travel demand was anticipated to be affected by geopolitical turmoil and the macroeconomic scenario.

For the fourth quarter, ABNB expects its revenue to be between $2.13 billion and $2.17 billion, reflecting year-over-year growth between 12% and 14%. This guidance is more subdued than the $2.18 billion figure that analysts expect.

The company is striving to lower the cost of stays for consumers. Their efforts seem to be working as amid broad-based price increases, the average nightly price of a one-bedroom listing in September was $120, only 1% higher than it was in the prior year period. On the other hand, ABNB also has to pay €576 million ($621.20 billion) to the Italian Revenue Agency to settle outstanding income tax obligations for the 2017-2021 tax years.

Against such a scenario, let’s look at the trends of ABNB’s key financial metrics to understand why it could be prudent to watch and wait for a better entry point in the stock.

Airbnb's Financial Scenario: From 2021 To 2023

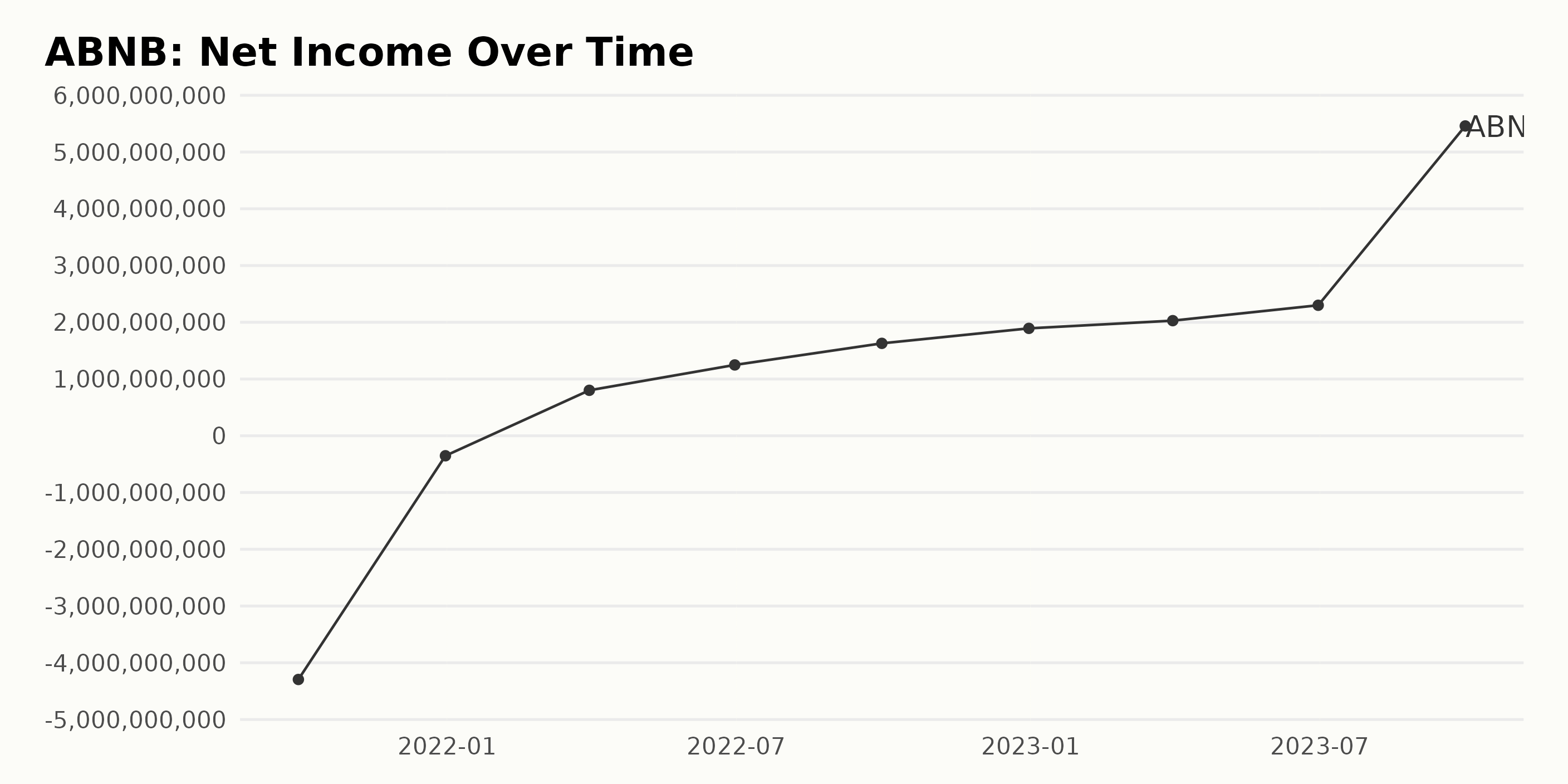

The trailing-12-month net income of ABNB exhibits a remarkable upward trend from September 2021 to September 2023. Key Highlights:

- Starting at a net loss of -$4.29 billion in September 2021, the net income improved significantly to a surplus of $5.46 billion in September 2023.

- Despite minor fluctuations between periods, there was a consistent improvement in net income for ABNB over the years. From negative trends in late 2021, it started achieving positive net income by the first quarter of 2022.

- An abrupt but notable increase is evident in the period between June 2023 ($2.3 billion) and September 2023 ($5.46 billion).

- At the end of the series in September 2023, ABNB posted a record net income of $5.46 billion.

Calculating growth using the first and last values in this series: ABNB's net income has surged by approximately $9.75 billion over the two-year period from September 2021 ($-4.29B) to September 2023 ($5.46B). This phenomenal progression represents a compelling recovery and elevation in the company's financial performance.

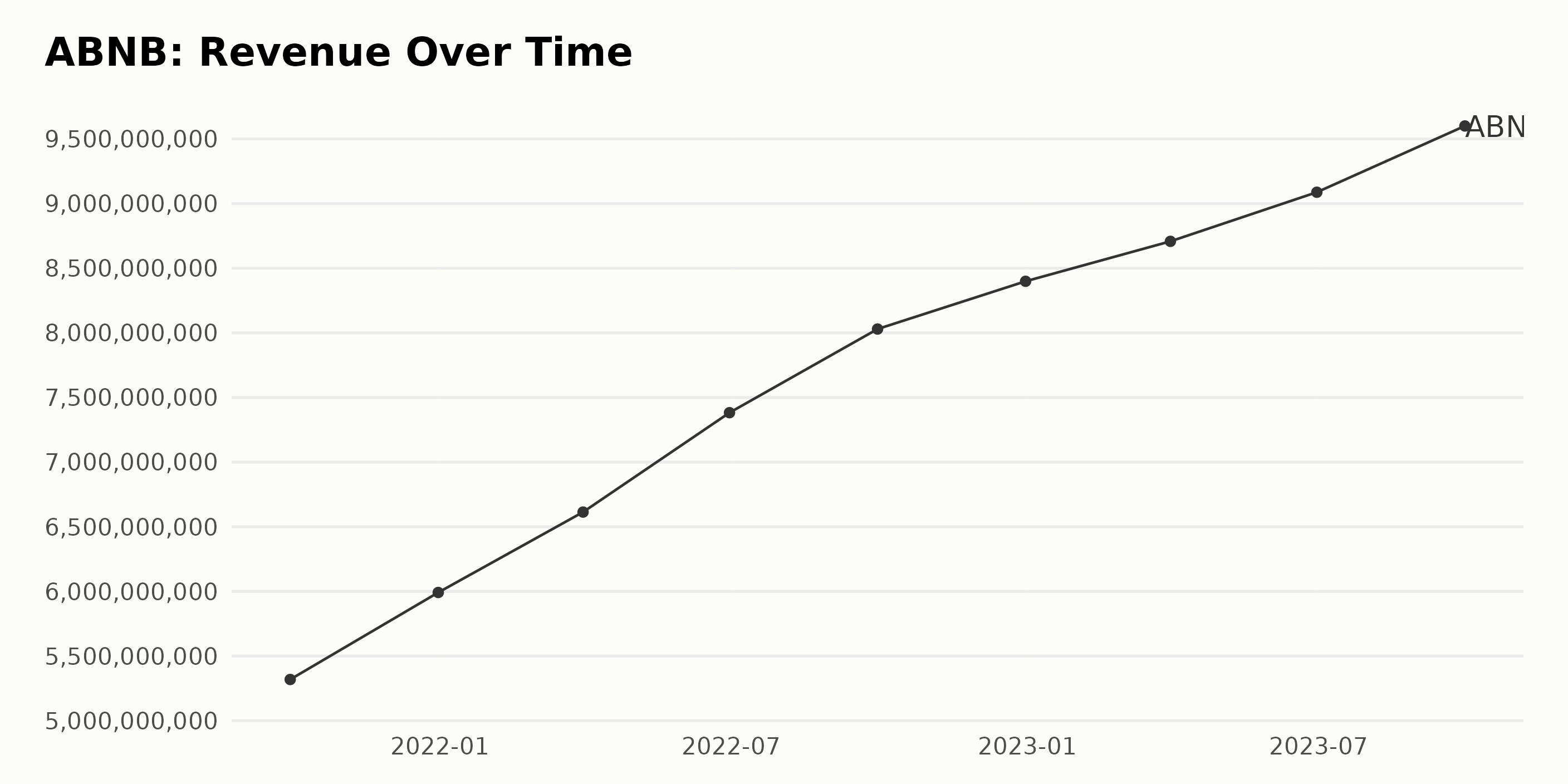

The trailing-12-month revenue of ABNB has shown consistent growth from September 2021 to September 2023.

- September 2021: $5.32 billion

- December 2021: $5.99 billion

- March 2022: $6.61 billion

- June 2022: $7.38 billion

- September 2022: $8.03 billion

- December 2022: $8.40 billion

- March 2023: $8.71 billion

- June 2023: $9.09 billion

- September 2023: $9.60 billion

This shows an overall upward trend, indicating increasing revenue for ABNB over the stated period. The data reveals persistent fluctuation in the rate of growth from one period to another, yet maintaining a positive growth trajectory. In terms of growth rate calculated from the first value ($5.32 billion in September 2021) to the last recorded value ($9.60 billion in September 2023), there is a significant increase of around 80%.

To sum up, ABNB's revenue has generally been rising with occasional fluctuations in the rate of growth across this period. However, the company has presented remarkable growth between September 2021 and September 2023.

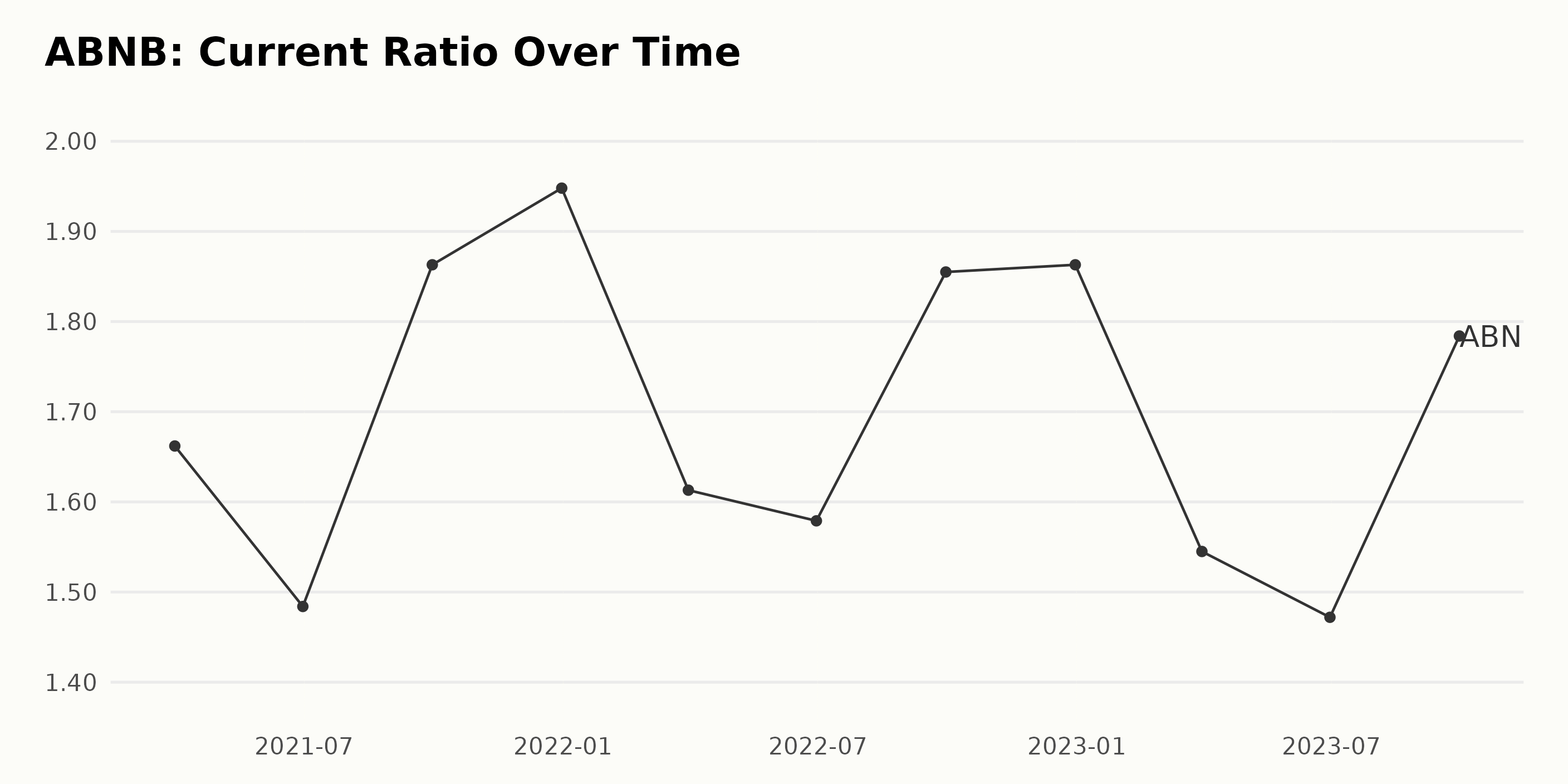

The current ratio of ABNB has shown noticeable fluctuations over the observed period. A careful inspection of the data conveys the following insights:

- The series started with a current ratio of 1.66 on March 31, 2021.

- There was a downward slope until June 30, 2021, with the current ratio reaching 1.48.

- From this point, ABNB's current ratio surged to 1.86 by September 30, 2021.

- A high peak was seen at 1.95 on December 31, 2021.

- A notable dip was registered by March 31, 2023, when the company posted a current ratio of 1.55.

- The lowest current ratio in the series was reported on June 30, 2023, with a value of 1.47.

- However, the company has shown signs of recovery, with the current ratio rising to 1.78 by September 30, 2023.

More recently, the focus lies on the 11% growth from 1.47 to 1.78 between June 2023 and September 2023. Overall, between March 2021 and September 2023, ABNB's current ratio has experienced a slight decline of approximately 0.12 or 7.3%. This reflects the ratio's fluctuation amid economic conditions, financial strategies, and market demands the company dealt with in the considered period.

The Analyst Price Target (APT) for ABNB, based on the given data series, shows remarkable fluctuations with an overall descending trend from November 2021 to July 2023, followed by slight volatility and a stable period towards January 2024. The significant movements are detailed below:

- Starting at $194 in November 2021, the APT shows a gentle rise to reach $198.59 by March 2022.

- Subsequently, a consistent downward shift occurred, such that by August 2022, the APT had fallen to $146.09, further shrinking to $140 by September of the same year.

- In the later part of 2022, the APT continued to diminish, reaching its lowest point of $125 in December 2022.

- However, February 2023 marked the beginning of a recovery with an increase to $133.9 and maximized to $143.5 by March 2023, maintaining this position up to April 2023.

- An unstable period follows, with the APT slightly decreasing again to $135.76 in May 2023 but regaining momentum by August 2023, hitting a high point of $142.35.

- The APT held steadily at $145 from September 2023 to October 2023, followed by a minor drop to $136.32 in November 2023.

- Overall, there's minor fluctuation towards the end of the series, where the APT descended slightly to settle at $135 by January 2024.

We must place a greater emphasis on the more recent data. Although initial months display a downward trend, the latter part of the series shows signs of stabilization around $135 to $145. As per the calculation for growth rate measuring the last value from the first, ABNB's APT has declined by around -30.4% from November 2021 to January 2024.

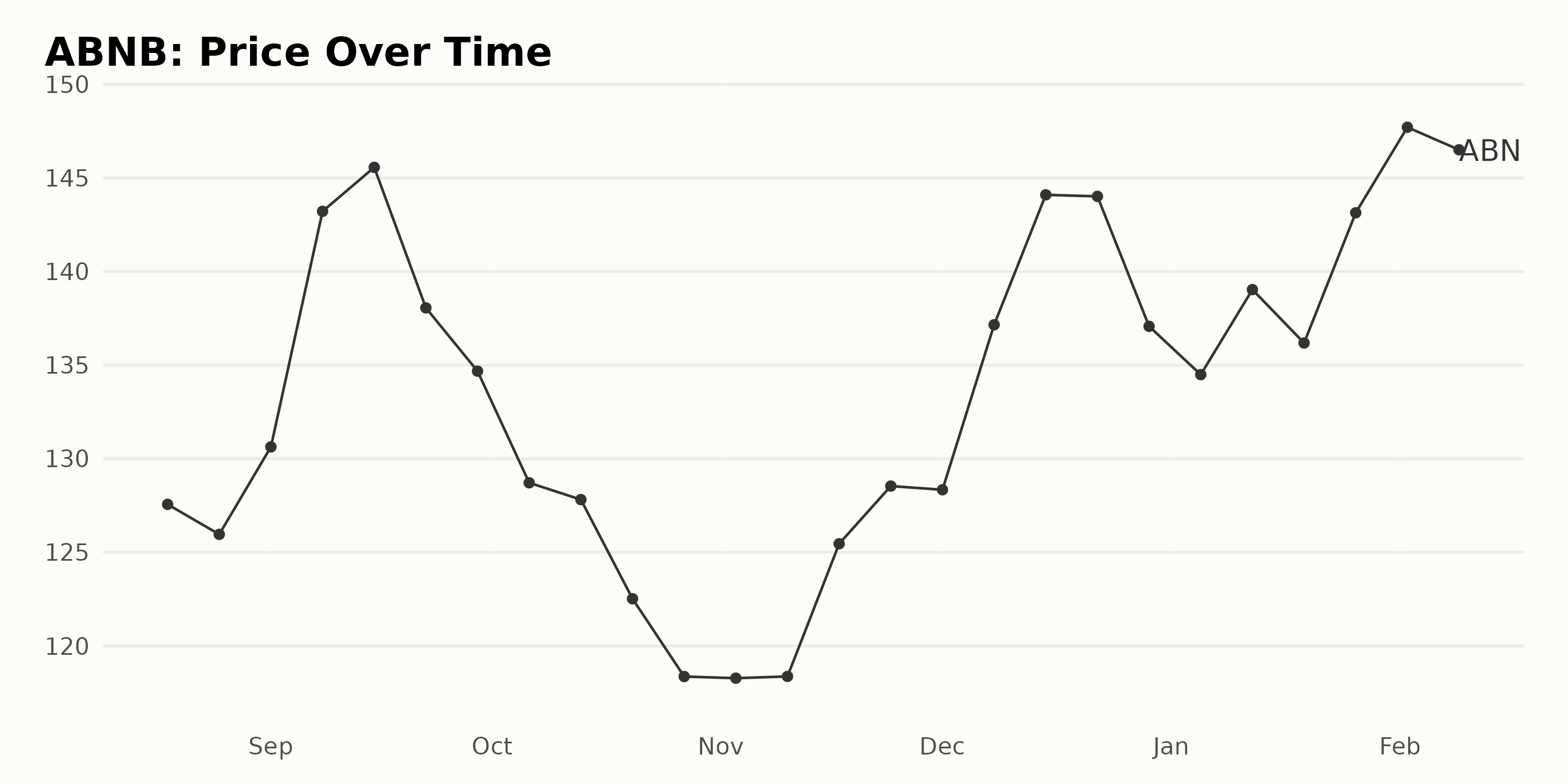

Examining ABNB's Share Price Fluctuations from August 2023 to February 2024

Analyzing the data provided on the share price of ABNB over a period stretching from August 2023 to February 2024, the following key trends can be identified:

- On August 18, 2023, the share price was at $127.56.

- There was a marginal drop in the share price to $125.96 by August 25, 2023.

- Following this, till September 15, 2023, there was a noticeable upward trend, with the price reaching $145.57.

- However, a phase of deceleration then followed, with the share price falling to $118.27 by November 3, 2023.

- Between November 3, 2023, and December 22, 2023, the share price experienced another growth phase, surging to $144.02.

- This was followed by another slight downturn, bringing the price down to $134.49 by January 5, 2024.

- From January 2023, the share price showed an overall accelerating trend, reaching $147.71 by February 2, 2024. However, there was a slight dip to $147.60 by February 9, 2024.

In an overall context, while there were fluctuations and phases of acceleration and deceleration, the data indicates a general upward trend over the period from August 2023 to February 2024. Here is a chart of ABNB's price over the past 180 days.

Examining ABNB's Performance: Insights from Quality, Momentum, and Growth Ratings

Based on the supplied data, the ABNB stock, which falls within the Travel - Hotels/Resorts category, carried a consistent POWR Ratings grade of C (Neutral) throughout the period from August 19, 2023, to February 12, 2024. A summary of the performance is presented below:

- In both August and September of 2023, ABNB maintained the 15th position except for two weeks in September, when it fell to the 16th and 17th ranks.

- Throughout October of 2023, the stock’s rank remained steady at the 15th place.

- In November 2023, the rank of ABNB improved considerably, ending the month at position 9, which was its best ranking during this time period.

- December 2023 saw a slight dip, with the rank spanning between 10 and 11.

- During the first half of January 2024, the rank was consistently held at the 10th position.

In conclusion, as of the latest data on February 12, 2024, ABNB carried a POWR Grade of C (Neutral) and ranked ninth out of a total of 19 stocks in the Travel - Hotels/Resorts category.

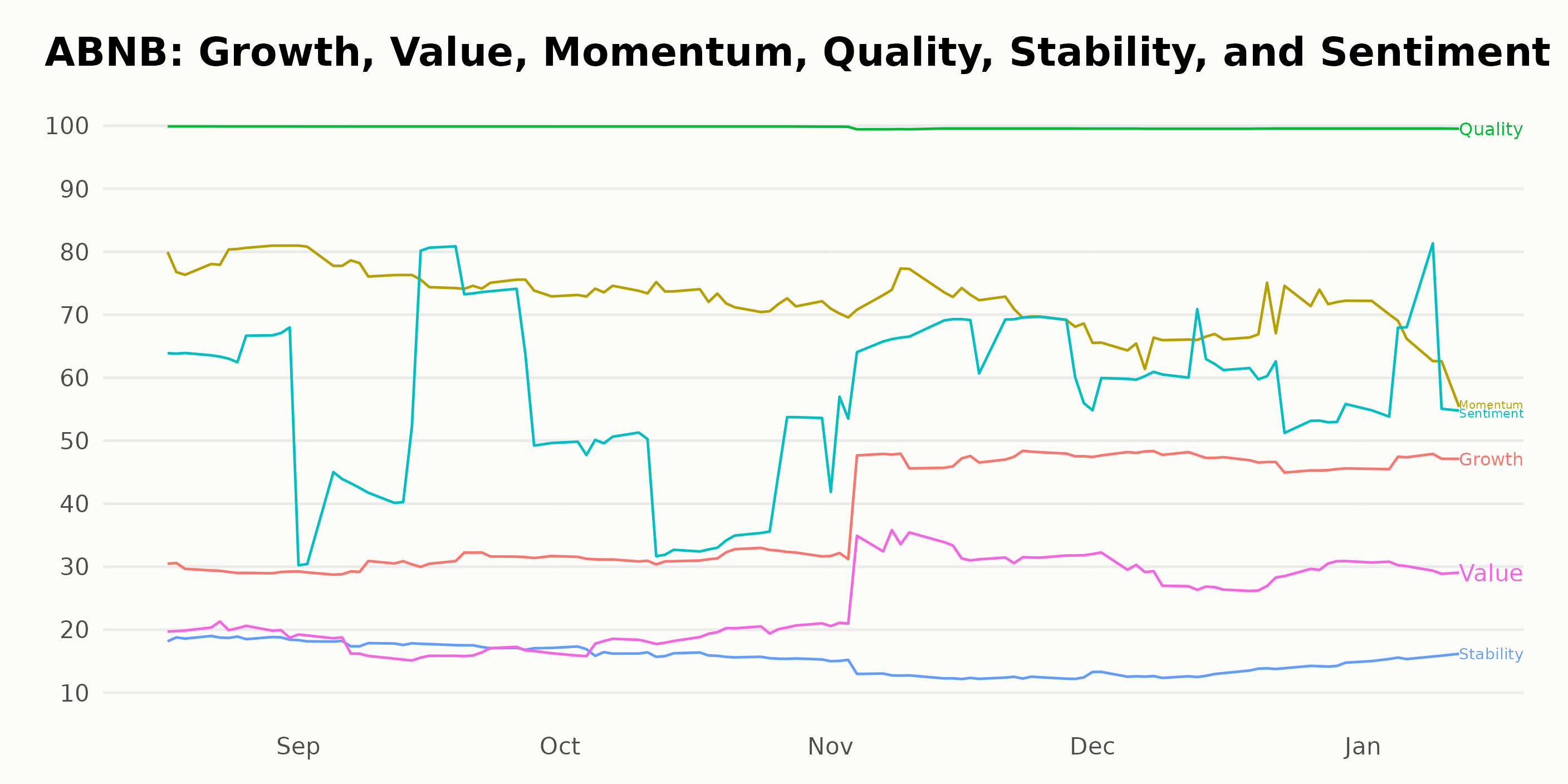

The POWR Ratings for ABNB highlight three noteworthy dimensions, evaluated from August 2023 to January 2024: Quality, Momentum, and Growth.

Quality: In the Quality dimension, ABNB consistently maintains a top score. This indicates a steady, high quality of ABNB's operations and performances according to the rating metrics.

Momentum: The Momentum dimension shows a slight diminishing trend over the months:

- August 2023: 79

- September 2023: 76

- October 2023: 73

- November 2023: 72

- December 2023: 68

- January 2024: 65

Despite minor fluctuations, the Momentum dimension points towards a gradual decrease, indicating a slowing pace of growth or potential profit realization for ABNB.

Growth: On the other hand, data in the Growth dimension reflects an ascending trajectory:

- August 2023: 29

- September 2023: 31

- October 2023: 32

- November 2023: 45

- December 2023: 47

- January 2024: 47

The rising Growth score during this period signifies a robust growth potential for ABNB despite potential hiccups highlighted by the Momentum score.

How does Airbnb, Inc. (ABNB) Stack Up Against its Peers?

Other stocks in the Travel - Hotels/Resorts sector that may be worth considering are Genting Berhad (GEBHY), Atour Lifestyle Holdings Limited (ATAT), and Travel + Leisure Co. (TNL) - they have better POWR Ratings. Click here to explore more Travel - Hotels/Resorts stocks.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

ABNB shares were trading at $153.94 per share on Monday morning, up $6.34 (+4.30%). Year-to-date, ABNB has gained 13.07%, versus a 5.67% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post ABNB: Buy or Watch Ahead of Earnings? appeared first on StockNews.com