Aren't you glad we added hedges last week? We did a review of our Short-Term Portfolio last week and our timing was excellent as this has been a rough week for the markets but we were able to relax as our STP bumped up from $245,485 to $281,128 as of yesterday's close, gaining $35,643 (14.5%) for the week. Meanwhile, our Long-Term Portfolio (LTP) positions, which the STP is designed to protect, are down $79,067 (4%) since our April 16th review , so our STP is mitigating about 1/2 of the damages – as it's designed to. Of course the STP kicks in a bit harder between a 10-20% drop but no real signs of that so far as we're bouncing nicely this week after a 7% drop in the Nasdaq (more on that later). Let's take a look at where we stand now in our STP: XRT – We went from 20 to 70 last week and caught a nice downturn and a lot of retail earnings are coming out next week – so we'll leave these for now – even though we should take 1/2 off the table now that we're even(ish). SCO – During the week we doubled down on the long calls as oil got expensive ($66.50), taking advantage of the lower price on the calls. We also shorted Oil Futures ( /CL ) in our Live Trading Webinar and we bottomed out at $63.50 – up $3,000 per contract – that's another way we can enhance our returns while we wait for these longer options to play out. At net $13,000, this is a $30,000 spread if oil is under $60 in January and half of our gains are uncapped – so I still like this spread but we do expect oil near $70 in the summer – so it's going to be a rough ride. Rembmer, these are hedges – if the economy collapses, oil goes down and we win. If the economy stays hot – we still think $60 is too much for oil – that's what makes it a good hedge. …

Aren't you glad we added hedges last week?

Aren't you glad we added hedges last week?

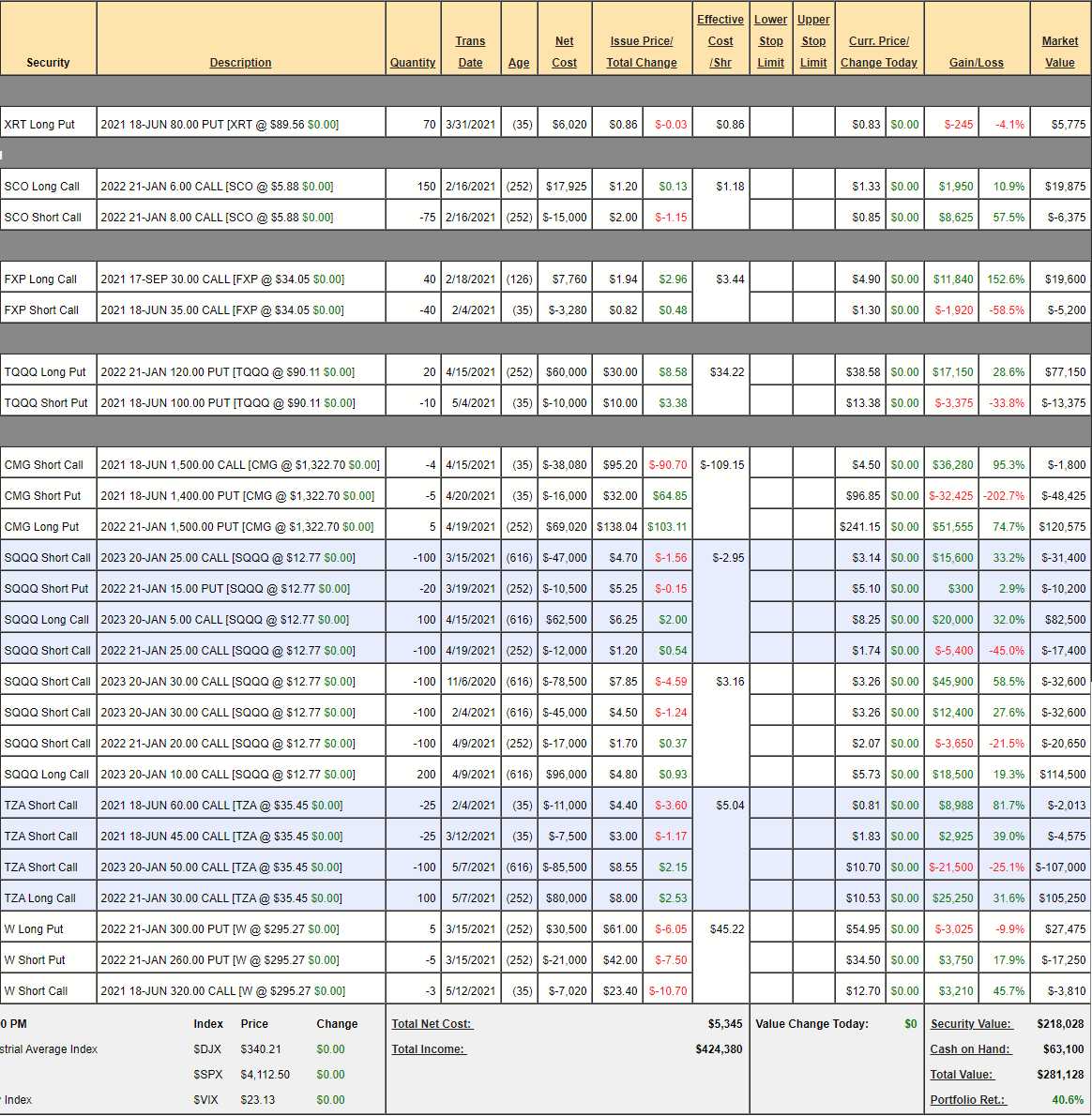

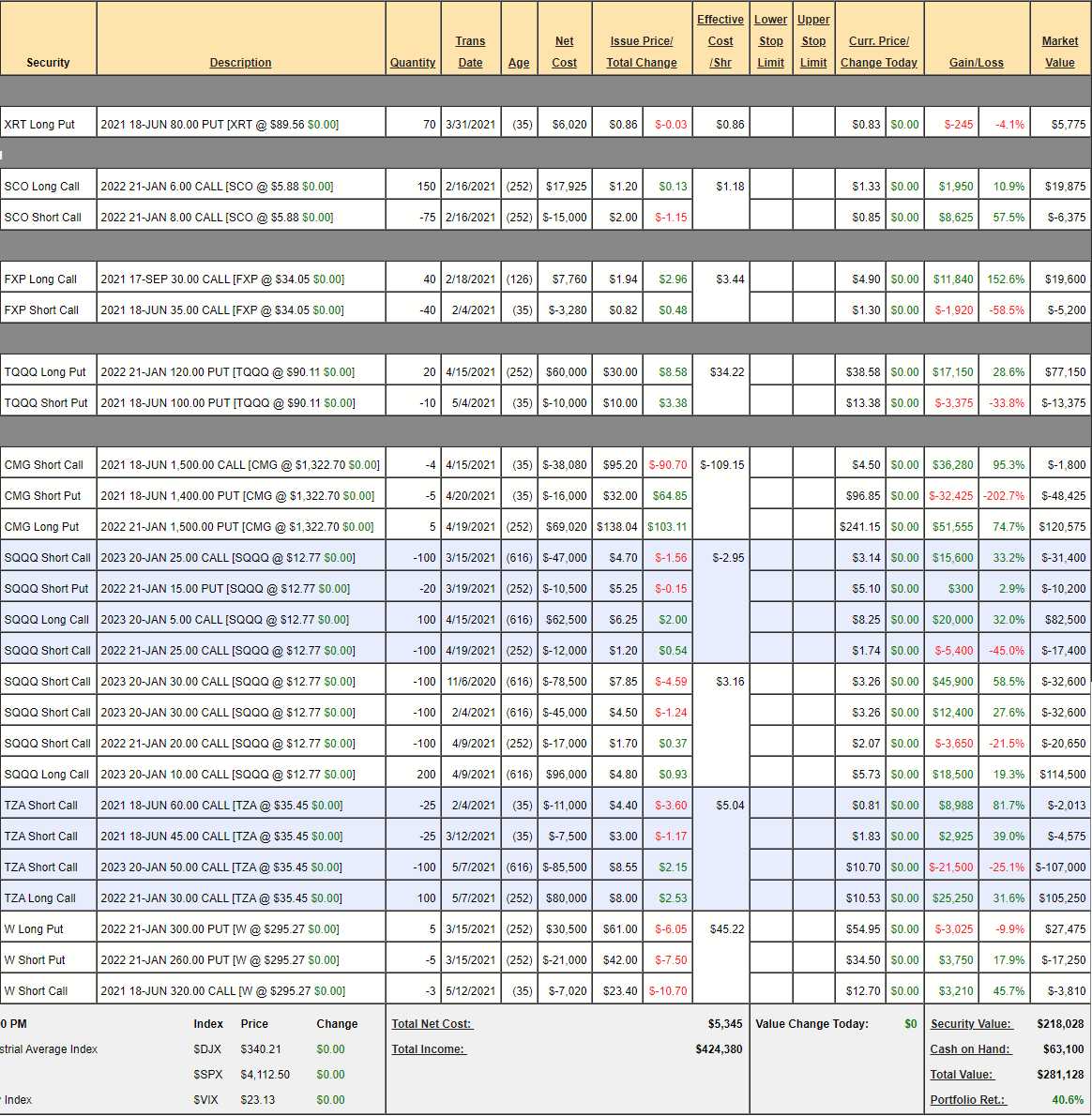

We did a review of our Short-Term Portfolio last week and our timing was excellent as this has been a rough week for the markets but we were able to relax as our STP bumped up from $245,485 to $281,128 as of yesterday's close, gaining $35,643 (14.5%) for the week. Meanwhile, our Long-Term Portfolio (LTP) positions, which the STP is designed to protect, are down $79,067 (4%) since our April 16th review, so our STP is mitigating about 1/2 of the damages – as it's designed to. Of course the STP kicks in a bit harder between a 10-20% drop but no real signs of that so far as we're bouncing nicely this week after a 7% drop in the Nasdaq (more on that later).

Let's take a look at where we stand now in our STP:

- XRT – We went from 20 to 70 last week and caught a nice downturn and a lot of retail earnings are coming out next week – so we'll leave these for now – even though we should take 1/2 off the table now that we're even(ish).

- SCO – During the week we doubled down on the long calls as oil got expensive ($66.50), taking advantage of the lower price on the calls. We also shorted Oil Futures (/CL) in our Live Trading Webinar and we bottomed out at $63.50 – up $3,000 per contract – that's another way we can enhance our returns while we wait for these longer options to play out. At net $13,000, this is a $30,000 spread if oil is under $60 in January and half of our gains are uncapped – so I still like this spread but we do expect oil near $70 in the summer – so it's going to be a rough ride. Rembmer, these are hedges – if the economy collapses, oil goes down and we win. If the economy stays hot – we still think $60 is too much for oil – that's what makes it a good hedge.

…

Aren't you glad we added hedges last week?

Aren't you glad we added hedges last week?