I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

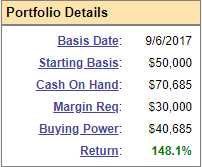

The last time I was on the show was back in on April 24th and we only make changes to the Money Talk Portfolio live on the show so we decided to lock into a neutral position over the summer and that's just where we ended up, dropping to $124,043 from April's $127,663 so down $3,620 for the summer is about as neutral as we can get it and we're still up $74,043 (148%) from our $50,000 start just about 2 years ago on the button.

Since there's a lot of uncertainty going into Q4 and it has been just about 2 years – I think this is a good time to cash out this portfolio and we will begin a new portfolio with a new $50,000 around Thanksgiving – beginning with our still-undecided Stock of the Year.

Our 2019 Stock of the Year is IBM (IBM) and our IBM position is already 100% in the money at net $2,707 out of a potential $7,500 so, if I were going to keep one trade active – that would be the one as all IBM has to do between now and January of 2021 is hold $135 and that spread will make another $4,793 (177%) so we could, for example, put $27,070 of our $124,043 in cash back to work on just the IBM trade and, if all goes well, it will turn into $75,000 – making almost 100% of our original total in just over a year – so why be more complicated than that?

There's still a lot of potential in all these positions, as noted in the April review, the portfolio has the potential to hit over $200,000 by Jan 2020 but, as I noted, if we cash out now at $124,043 and make another $50,000 on the IBM trade – that's $174,000(ish) anyway but we'd have $100,000 in our pockets NOT at risk through the holidays – that is certainly a much wiser way to go – especially in a portfolio we are unable to adjust between shows.

So the decision is final, we're cashing out and endorsing our Stock of…