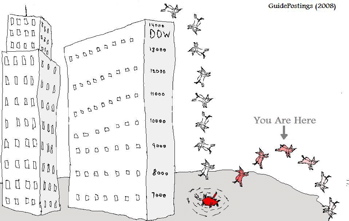

Well, we're right on track…

Well, we're right on track…

Back on Dec 26th, in our Morning Report, when the market was collapsing, we began playing for a bounce. At the time I said:

Each month the Government is closed knocks 2% off our GDP and the slowing economy will contract wages and Corporate Profits and, guess what? That will make the deficit explode as it lowers the rate of tax collections. That's why the market had such a harsh reaction to this shut-down but it's still been an over-reaction nonetheless and we are certainly now looking for at least a weak-bounce correction, which would be a 4% gain on the indexes from these levels. Let's call it from the 20% correction lines:

- Dow 27,000 to 21,600 is 5,400 points so 1,080-point bounces to 22,680 (weak) and 23,760 (strong)

- S&P 2,950 to 2,360 is 590 points so 120-point bounces to 2,480 (weak) and 2,600 (strong)

- Nasdaq 7,700 to 6,160 is 1,540 points so 300-point bounces to 6,460 (weak) and 6,760 (strong)

- NYSE 13,200 to 10,560 is 2,640 points so 528-point bounces to 11,058 (weak) and 11,586 (strong)

- Russell 1,750 to 1,400 is 350 points so 70-point bounces to 1,470 (weak) and 1,540 (strong)

Remember: I can only tell you what is likely to happen and how to profit from it – the rest…