Wheeeee!

Wheeeee!

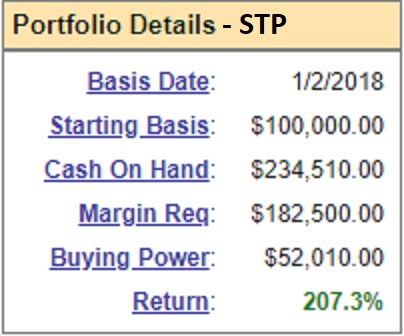

There's nothing like a nice sell-off when you're ready for it. Yesterday's dip blasted our Short-Term Portfolio over the 200% line, up $207,272 for the year and up $23,088 (23%) since our 10/18 review as we briefly flipped more bullish for the bounce but then, since the bounce didn't make it over our Strong Bounce Levels, we doubled back down on our SQQQ hedges last week and turned ourselves back to bearish – just in time for this week's catastrophe.

The primary purpose of the Short-Term Portfolio, which started with $100,000 on Jan 2nd of this year, is to protect the Long-Term Portfolio so we're always looking for bearish hedges – no matter how well the market is doing – but we also hedge our hedges with short-term long positions, to help lower the cost of our insurance. For example, we sent out a Top Trade Alert to our Members on Sept 6th with the followin hedging idea (we very rarely add hedges to Top Trades, so it was a big deal):

- Sell 10 MU 2021 $42 puts for $6.40 ($6,400)

- Buy 100 SDS March $34 calls for $2.60 ($26,000)

- Sell 100 SDS March $40 calls for $1.50 ($15,000)

That was net $4,600 on the $60,000 spread and, unfortunately, we used Micron (MU), which turned around and fell 20% since then but, fortunately, we only promised to buy it for net $35.60 and it's now $34.60 so not a panic but those put contracts are now $12 ($12,000) so a bit of a drag but the S&P Ultra-Short (SDS) March $34s are now $7.50 ($75,000) and the $40s are now $4 ($40,000) so net $35,000 on the spread less $12,000 if we buy back the puts is $23,000 which is up $18,400 (400%), which is why the Short-Term Portfolio puts up such crazy gains in a pullback.

Now I do still like MU but, as I said at the time – any stock you REALLY want to buy at the net put price will do. Meanwhile, all SDS has to do is stay over $40 and the premium on the short calls will expire and the net of the spread will rise to $60,000 – so…