Now this is what I call trading! As you can see from the FactSet chart, we're about 5% below where I called for cashing out our Member Portfolios on December 5th (see " Tempting Tuesday – Stop Buying that Dip and GET OUT!!! ") . At that time, I said the market was perhaps 20% overbought and, now that we've had a 5% rally and a 10% drop, I still think we're 5-10% overbought but I will concede 5% to better earnings and good global conditions (so far). At the time, our portfolios, after 4 years, were up 200-250% and we didn't want to risk our gains gambling on the holidays – as I expected what happened this week to happen in early January, not early February. My timing was off but the call was right and we restarted our portfolios on Jan 2nd with 1/3 of what we took off the table and then we deployed less than half of that on new positions. After getting off to a great start (up about 5%) they are all in the red but yesterday we took advantage of this 10% sell-off to press our longs and take some of our hedging profits off the table. We don't play our hedges to negate ALL downside damage – when you do that, you spend so much money on the hedges you can't make any money. What we use hedges for is to MITIGATE the damage, so we don't lose too much on a dip. All we need is some quick cash to put back into our long positions while they are low, like this adjustment to IMAX we made in our Options Opportunity Portfolio yesterday: 5 IMAX June $23 puts, now $4 ($2,000) can be rolled to 10 Sept $19 puts at $2.20 ($2,200) and, if we can pick up $4 in strike every 3 months, we'll be at $0 by 2020! We have 15 Sept $19 ($3.20)/25 ($1.10) bull call spreads at $2.10 ($3,150) and we can roll that down to 20 of the Sept $15 ($5.80)/20 ($2.70) bull call spreads at $3.10 ($6,200) . Our initial outlay was $2,415 and …

Now this is what I call trading!

Now this is what I call trading!

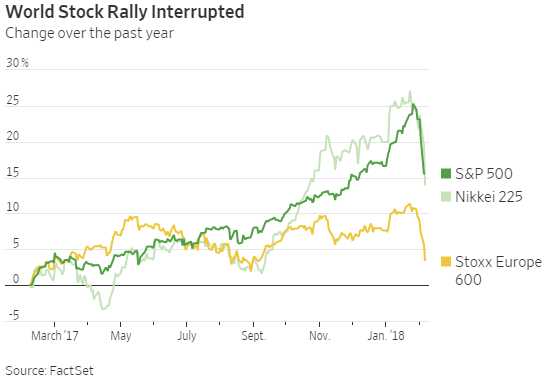

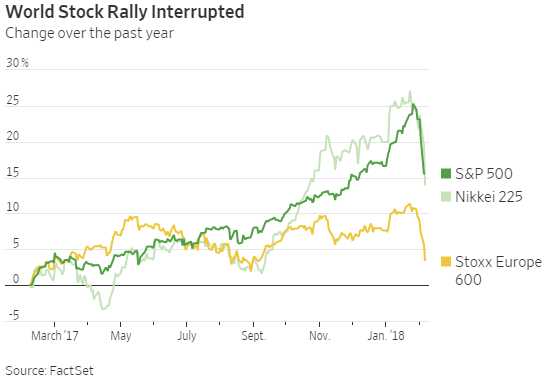

As you can see from the FactSet chart, we're about 5% below where I called for cashing out our Member Portfolios on December 5th (see "Tempting Tuesday – Stop Buying that Dip and GET OUT!!!"). At that time, I said the market was perhaps 20% overbought and, now that we've had a 5% rally and a 10% drop, I still think we're 5-10% overbought but I will concede 5% to better earnings and good global conditions (so far).

At the time, our portfolios, after 4 years, were up 200-250% and we didn't want to risk our gains gambling on the holidays – as I expected what happened this week to happen in early January, not early February. My timing was off but the call was right and we restarted our portfolios on Jan 2nd with 1/3 of what we took off the table and then we deployed less than half of that on new positions. After getting off to a great start (up about 5%) they are all in the red but yesterday we took advantage of this 10% sell-off to press our longs and take some of our hedging profits off the table.

We don't play our hedges to negate ALL downside damage – when you do that, you spend so much money on the hedges you can't make any money. What we use hedges for is to MITIGATE the damage, so we don't lose too much on a dip. All we need is some quick cash to put back into our long positions while they are low, like this adjustment to IMAX we made in our Options Opportunity Portfolio yesterday:

5 IMAX June $23 puts, now $4 ($2,000) can be rolled to 10 Sept $19 puts at $2.20 ($2,200) and, if we can pick up $4 in strike every 3 months, we'll be at $0 by 2020! We have 15 Sept $19 ($3.20)/25 ($1.10) bull call spreads at $2.10 ($3,150) and we can roll that down to 20 of the Sept $15 ($5.80)/20 ($2.70) bull call spreads at $3.10 ($6,200). Our initial outlay was $2,415 and

…

Now this is what I call trading!

Now this is what I call trading!