Have we finally gone too far? Of course we have, what kind of question is that? On the right is the SPY volume for the week and we haven't cracked 40M shares trading vs. an average of 62M this year, which is already half of last year. This came on a day, yesterday, when the Dow popped 160 points but, as we noted in yesterday morning's PSW Report (and in our Live Trading Webinar) , it was on the backs of just IBM and GS, while the other 28 stocks in the index were effectively flat. So the very, very narrow "rally" continues but it can very easily be overwhelmed by any kind of volume selling and we called for more CASH!!! in our porfolios during yesterday's webinar – as this market may finally be approaching peak ridiculous . If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell ( /TF ), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members ( also tweeted out ) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right? We also played the Dow ( /YM ) Futures short at 23,100 and the Dow fell below 22,900 this morning and that was good for gains of $1,000 per contract and Oil ( /CL ), which we discussed shorting in yesterday morning's report (subscribe here so you don't miss them) which fell from our predicted spike of $52.50 on inventories all the way back to $51.50 this morning, also good for $1,000 per contract gain while our Webinar Gasoline shorts ( /RB ) at $1.65 are already up $840 per contract at $1.63 so – you're welcome ! We also called a long on Silver ( /SI ) at $17 and that's popping this morning and Coffee (/KCH8) is already moving up but Natural Gas (/NGV8) is still under $3 and we love those next October contracts, especially …

Have we finally gone too far?

Have we finally gone too far?

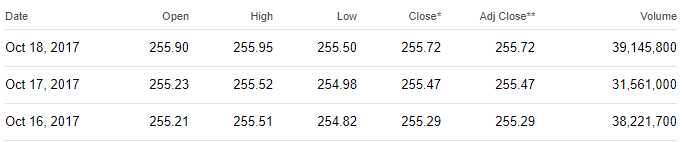

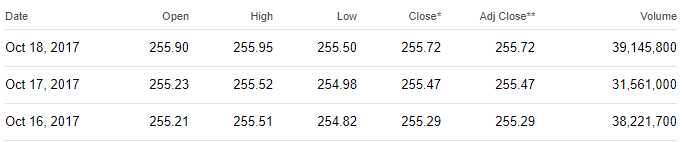

Of course we have, what kind of question is that? On the right is the SPY volume for the week and we haven't cracked 40M shares trading vs. an average of 62M this year, which is already half of last year. This came on a day, yesterday, when the Dow popped 160 points but, as we noted in yesterday morning's PSW Report (and in our Live Trading Webinar), it was on the backs of just IBM and GS, while the other 28 stocks in the index were effectively flat. So the very, very narrow "rally" continues but it can very easily be overwhelmed by any kind of volume selling and we called for more CASH!!! in our porfolios during yesterday's webinar – as this market may finally be approaching peak ridiculous.

If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?

If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?

We also played the Dow (/YM) Futures short at 23,100 and the Dow fell below 22,900 this morning and that was good for gains of $1,000 per contract and Oil (/CL), which we discussed shorting in yesterday morning's report (subscribe here so you don't miss them) which fell from our predicted spike of $52.50 on inventories all the way back to $51.50 this morning, also good for $1,000 per contract gain while our Webinar Gasoline shorts (/RB) at $1.65 are already up $840 per contract at $1.63 so – you're welcome!

We also called a long on Silver (/SI) at $17 and that's popping this morning and Coffee (/KCH8) is already moving up but Natural Gas (/NGV8) is still under $3 and we love those next October contracts, especially…

Have we finally gone too far?

Have we finally gone too far?  If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?

If it's not, we'll get back in but yesterday our Webinar Trade Idea was to short the Russell (/TF), which was 1,510 at the time (1-3pm) and this morning we fell all the way to 1,495, which is up $750 per contract and we took a $7,320 gain and ran in our Morning Alert to Members (also tweeted out) on our 12 contract play near the bottom (our average entry was 1,503.27 as we started earlier than the Webinar). Still, it's not bad for a day-trade, right?