To 3(%) or not to 3(%). As you can see from the Fed's GDPNow forecast, it's raging ahead of the forecasts of our leading Economorons by a wide margin. Usually, I bet against the Economorons but the Fed is full of them too so it's a toss-up as to who is likely to be more wrong but we have a short bet on the Dow Futures ( /YM ) at 21,900 that says it's the Fed . We took that bet in our Live Trading Webinar yesterday afternoon and added to it this morning as the Dow popped in early morning trading, getting all excited about a European open that's fading fast as of 6:35. To some extent, it's a hedge against our long Oil ( /CL ) bet at $46.15, which is a double-dip from the bet that made us gains $500 per contract in the first hour of our live webinar ( you're welcome !). This morning, Gasoline ( /RB ) is looking cheap again at $1.63, so I like a long there with tight stops below $1.625, which would still be a $210 loss as gasoline contracts are expensive at $420 per penny – so be very careful trading them. We'll see if the oil inventories (10:30) can get both to break higher, the API Data was encouraging for the bulls, showing a 5.78Mb draw in crude, up from 3.6Mb last week but that data was through Friday – ahead of the storm. Oh, and don't cry if you missed yesterday's PSW Report ( subscribe here and never miss one again ) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts , up $3,510 per contract – wasn't that easy? Remember, I can only tell you what is likely to happen and how to make money playing it – the rest is up to you… That's right, while I was writing this post (now 6:56), the …

To 3(%) or not to 3(%).

To 3(%) or not to 3(%).

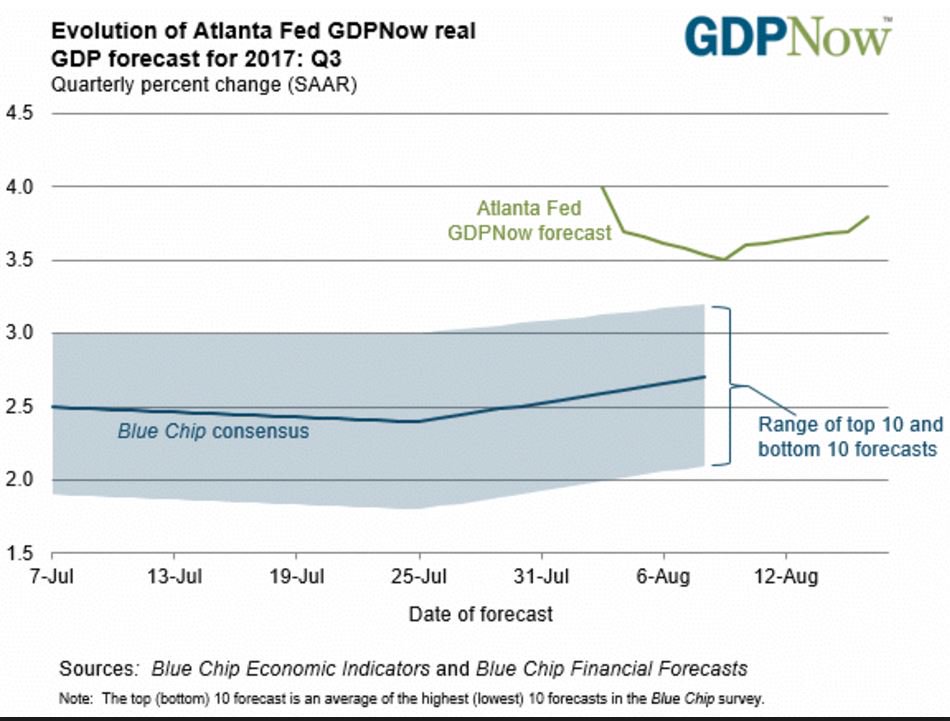

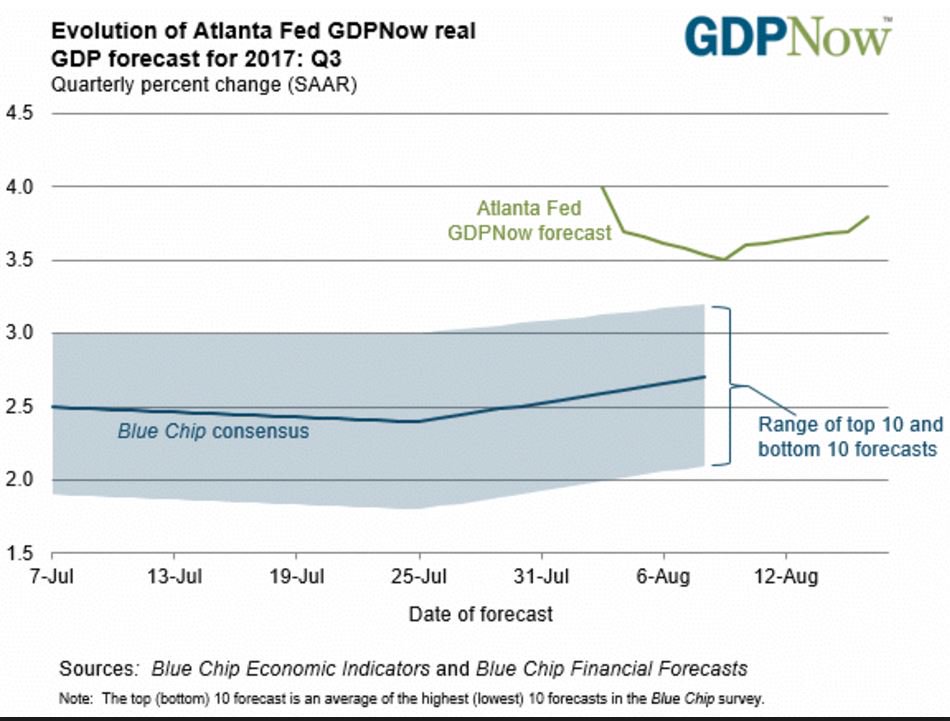

As you can see from the Fed's GDPNow forecast, it's raging ahead of the forecasts of our leading Economorons by a wide margin. Usually, I bet against the Economorons but the Fed is full of them too so it's a toss-up as to who is likely to be more wrong but we have a short bet on the Dow Futures (/YM) at 21,900 that says it's the Fed.

We took that bet in our Live Trading Webinar yesterday afternoon and added to it this morning as the Dow popped in early morning trading, getting all excited about a European open that's fading fast as of 6:35. To some extent, it's a hedge against our long Oil (/CL) bet at $46.15, which is a double-dip from the bet that made us gains $500 per contract in the first hour of our live webinar (you're welcome!).

This morning, Gasoline (/RB) is looking cheap again at $1.63, so I like a long there with tight stops below $1.625, which would still be a $210 loss as gasoline contracts are expensive at $420 per penny – so be very careful trading them. We'll see if the oil inventories (10:30) can get both to break higher, the API Data was encouraging for the bulls, showing a 5.78Mb draw in crude, up from 3.6Mb last week but that data was through Friday – ahead of the storm.

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?

Remember, I can only tell you what is likely to happen and how to make money playing it – the rest is up to you…

That's right, while I was writing this post (now 6:56), the …

To 3(%) or not to 3(%).

To 3(%) or not to 3(%).

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?

Oh, and don't cry if you missed yesterday's PSW Report (subscribe here and never miss one again) but you know those Gasoline (/RBV7) contracts that were up $1,755 early yesterday morning at $1.585 and I said you missed the first 0.02 of the move? Well, this morning we got the rest of the 0.10 to $1.655, so that's another $7,020 gained on our 2 long contracts, up $3,510 per contract – wasn't that easy?