Thank you sir, may I have another.

How many Thursdays in a row are they going to ramp oil prices up despite a poor inventory report and set it up for a nice short? You can go back all the way to December and all the way to last summer, for that matter to see how many times we were able to short oil between $53 and $54 and make $250,$500, $1,000 per contract on our oil shorts. At some point you would think this is an expensive habit for the pumpers who jack up the price – as they have to take some sort of loss on their bogus orders (none are ever actually delivered).

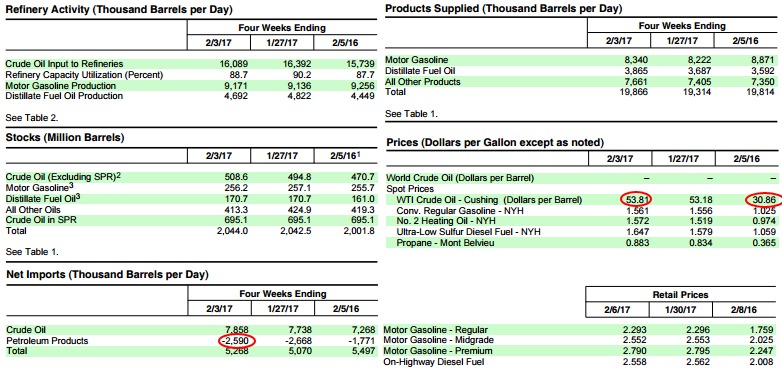

But, of course, the real game isn't to beat PSW Members out of a few Thousand Dollars, the game is to beat consumers out of a few Billion Dollars by jacking up the prices you pay at the pump or for products that use petroleum as a base. Now $53 isn't the best short but it may be all we get after yesterday's MASSSIVE 13.8Bn barrel build in crude inventories – that's 2 full days of imports we didn't need at all!

But, of course, the real game isn't to beat PSW Members out of a few Thousand Dollars, the game is to beat consumers out of a few Billion Dollars by jacking up the prices you pay at the pump or for products that use petroleum as a base. Now $53 isn't the best short but it may be all we get after yesterday's MASSSIVE 13.8Bn barrel build in crude inventories – that's 2 full days of imports we didn't need at all!

This is happening despite the fact that we are now EXPORTING 2.6M barrels of refined products PER DAY (18.2Mb/week) - now making the US one of the largest petroleum exporters in the World. We are swimming in oil and there is no sign of increasing demand and OPEC already cut the supply – this is a very poorly-balanced market.

By sending 18.2 Million barrels of refined product out of the country each week "THEY" fake US demand for oil and keep the prices high, $23 per barrel higher than they were last year and we use 16.1M barrels per day so this shell game they are playing is costing the American consumer an extra $370M/day or $2.6 BILLION per week or $135Bn a year – "THEY" just reach into your pocket and steal that money to the tune of $1,000 per working American over the course of a year.

And, of course, this is just another disproportionate "tax" on the poor that transfers their income…