Really?

Really?

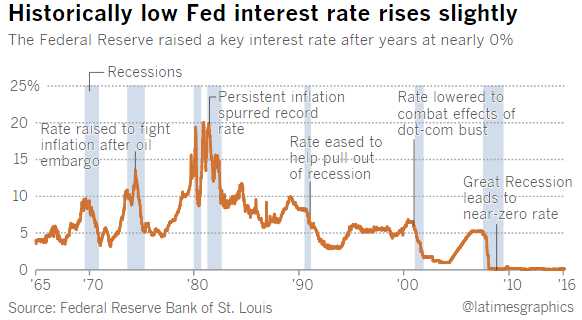

Of all the things that could have or, frankly, should have stopped this ridiculous rally, is it finally going to be the long-anticipated, totally baked-in, quarter-point Fed rate hike that causes a correction? And yes, we bet on it – I just told you yesterday that we cashed in our Dow longs and picked up the TZA spread (and we shorted the Russell Futures (/TF) for a fantastic gain too!) but that doesn't mean it isn't stupid – it only means we know how to bet on stupid!

The Dow took a nice 200-point plunge after the Fed's rate announcement, right after having spiked up to the high of the day at 19,900 on the /YM Futures (we don't really care what the index does). We were doing a Live Trading Webinar yesterday afternoon and our main trade of the day was 5 Russell (/TF) Futures shorts and the Russell plunged from 1,372.50 to 1,352.50 for a very nice $5,000 gain during the webinar so congratulations to all who played along.

This morning, we're settling around 19,750 on the Dow and 1,355 on the Russell but that's actually pretty strong when you take into consideration that the Dollar has climbed to 103, which is up another 1.3% from yesterday's close so of course the indexes, which are priced in Dollars, will be looking weaker when the Dollars they are divided by are stronger.

The problem is that technical indicators don't take Dollar strength into account so when the Dollar moves up 2% in 24 hours, the TA people just look at the charts and see a market dropping 2% in response and assume there's technical weakness and that triggers all their sell signals and then real selling begins and you can begin to have a cascading failure but hopefully the people who run the ever-increasing number of trade-bots have turned them off post Fed and are waiting to see how today shakes out before hitting the panic button (which is what happened last year).

Meanwhile, gold and silver already panicked and we particularly like Silver Futures (/SI) at the $16 line…