$1,545,421! That's up $945,421 (157%) in just under 3 years (11/26/2013) from our original $600,000 allocation on our paired portfolios. We are, however, down $27,008 (1.7%) from our September high ( reviewed 9/30 ) and that's just fine as our portfolios are about 80% CASH!!! and very defensive into the election uncertainty. When you make 157% in 3 years, you need to know how to protect it . We're well ahead of the market, the S&P was at 2,180 on the close of Sept 2nd and Friday we closed at 2,085 so down 95 points is 4.3% and falling at less than 1/2 the rate of the market is all we can hope for when we have so many leveraged positions. Of course, some of our bigger hedges don't kick in until the market is down more than 5% and, depending on the outcome of Tuesday's election – we may be seeing that and much more. Other than our paired Long-Term and Short-Term Portfolios (and the STP is 20% of the LTP and it's main function is to protect our Long-Term positions), our two self-hedging portfolios are doing surprisingly well. Our $100,000 Options Opportunity Portfolio finished the week at $211,332 and that's up $111,332 (111%) in one year and 3 months since we began it. In our September 3rd Review, the OOP was at $189,027 so we've gained $22,105 in two months – not bad with hardly any changes. Finally, our steadiest and oldest portfolio, the Butterfly Portfolio, finished the week at $296,092, up $196,092 from our $100,000 start on 7/29/13. That's up $8,212 since our 9/3 review and that's exactly what the Butterfly Portfolio is designed to do, grind out a steady income in virtually all market conditions. The Butterfly Portfolio is very low-touch, fantastic for retired investors who don't want to watch the market every day – or every week for that matter. In fact, no new positions were added in the last two months – only adjustments the existing positions, made once a month ahead of option expirations. PSW Members can access the full portfolio and positions HERE . …

$1,545,421!

$1,545,421!

That's up $945,421 (157%) in just under 3 years (11/26/2013) from our original $600,000 allocation on our paired portfolios. We are, however, down $27,008 (1.7%) from our September high (reviewed 9/30) and that's just fine as our portfolios are about 80% CASH!!! and very defensive into the election uncertainty. When you make 157% in 3 years, you need to know how to protect it.

We're well ahead of the market, the S&P was at 2,180 on the close of Sept 2nd and Friday we closed at 2,085 so down 95 points is 4.3% and falling at less than 1/2 the rate of the market is all we can hope for when we have so many leveraged positions. Of course, some of our bigger hedges don't kick in until the market is down more than 5% and, depending on the outcome of Tuesday's election – we may be seeing that and much more.

Other than our paired Long-Term and Short-Term Portfolios (and the STP is 20% of the LTP and it's main function is to protect our Long-Term positions), our two self-hedging portfolios are doing surprisingly well. Our $100,000 Options Opportunity Portfolio finished the week at $211,332 and that's up $111,332 (111%) in one year and 3 months since we began it. In our September 3rd Review, the OOP was at $189,027 so we've gained $22,105 in two months – not bad with hardly any changes.

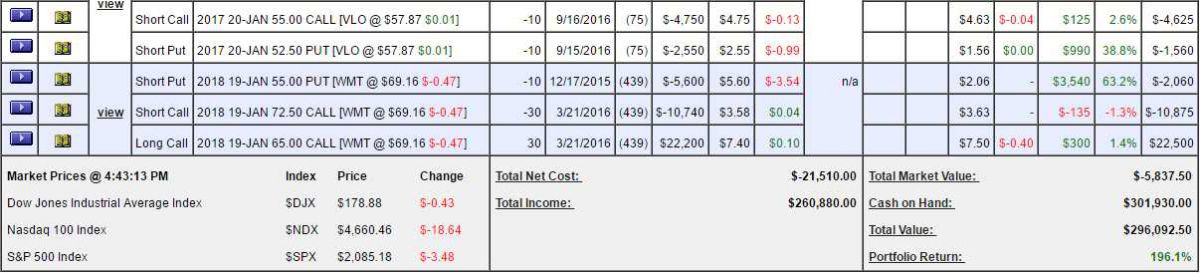

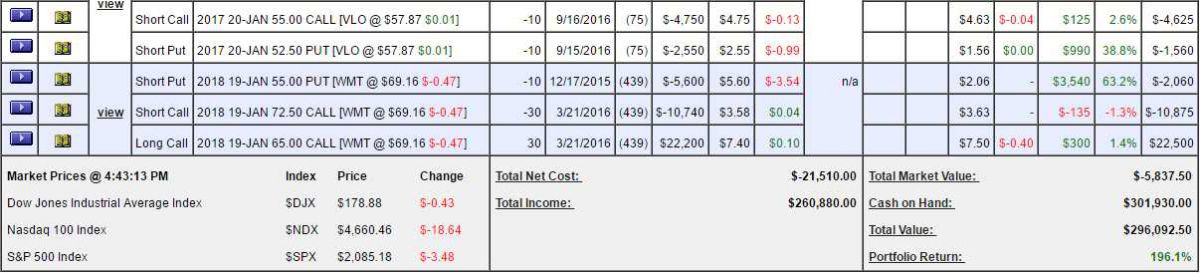

Finally, our steadiest and oldest portfolio, the Butterfly Portfolio, finished the week at $296,092, up $196,092 from our $100,000 start on 7/29/13. That's up $8,212 since our 9/3 review and that's exactly what the Butterfly Portfolio is designed to do, grind out a steady income in virtually all market conditions.

The Butterfly Portfolio is very low-touch, fantastic for retired investors who don't want to watch the market every day – or every week for that matter. In fact, no new positions were added in the last two months – only adjustments the existing positions, made once a month ahead of option expirations.

PSW Members can access the full portfolio and positions HERE.

…

…

$1,545,421!

$1,545,421!  …

…