What an incredible rally!

That's INcredible as in, NOT credible. Oil is up almost 50% in 3 months and INcredibly, we now have 23 MILLION MORE BARRELS in inventory than we had then, representing an average build of 1.9M barrels in each of the 12 weeks. That's why yesterday's 6.2Mb draw in inventories came as such a shock and sent oil flying up from $45.25 ahead of the report (10:30) to $46.40 (+2.5%) after the report and again the real surprise is the small reaction – unless you take into account the fact that this completes a 10% run on oil this week. Somebody knew that the EIA data would surprise us.

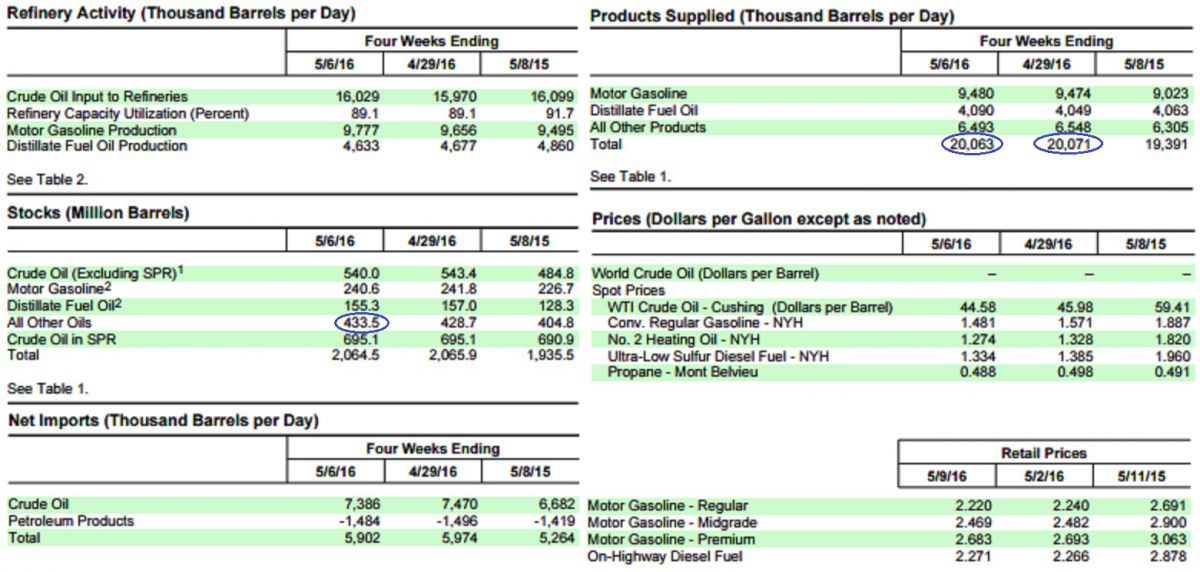

Since our toothless regulators certainly won't be investigating this, we decided to and we found something very interesting. Looking at the EIA's full report for the week, we noticed that, in fact, inventories as a whole were at 2.0645Bn barrels (yes, that's enough to cover 278 days of imports) but that's only down from 2.0659Bn barrels last week (and up 130.4M from 1.9355Bn last year). How is that possible if the report said:

- Crude -3.4M barrels vs. +0.7M consensus, +2.8M last week.

- Gasoline -1.2M barrels vs. -0.7M consensus, +0.5M last week.

- Distillates -1.7M barrels vs. -1M consensus, -1.3M last week.

As it turns out, there was an unreported 4.8Mb build in "Other Oils", which is a bundle that includes Aviation Gas (but not Jet Fuel, which is a Distillate), Kerosene, LNG, Lube Oils, Waxes, Asphalt, Coke, etc. – things we usually don't care about. But we should care when almost the entire draw on inventory was clearly nothing to do with a change in demand but merely a change in the mix the refiners put into the inventory.

As it turns out, there was an unreported 4.8Mb build in "Other Oils", which is a bundle that includes Aviation Gas (but not Jet Fuel, which is a Distillate), Kerosene, LNG, Lube Oils, Waxes, Asphalt, Coke, etc. – things we usually don't care about. But we should care when almost the entire draw on inventory was clearly nothing to do with a change in demand but merely a change in the mix the refiners put into the inventory.

We caught this discrepency during our Live Trading Webinar yesterday (replay available here) and ended up shorting 2 oil contracts (/CL) at $46.30 with the intent to DD as we tested $47, which we're doing this morning. That will make for an average short at $46.65 on 4 contracts and I have yet to see anything to change my conviction. Note also, on the EIA chart above, that we are EXPORTING 10.388Mb of Petroleum Products PER WEEK – and even with that massive amount of product being shipped out of the country – we're STILL building our reserves to record levels.

We caught this discrepency during our Live Trading Webinar yesterday (replay available here) and ended up shorting 2 oil contracts (/CL) at $46.30 with the intent to DD as we tested $47, which we're doing this morning. That will make for an average short at $46.65 on 4 contracts and I have yet to see anything to change my conviction. Note also, on the EIA chart above, that we are EXPORTING 10.388Mb of Petroleum Products PER WEEK – and even with that massive amount of product being shipped out of the country – we're STILL building our reserves to record levels.

IN PROGRESS