This is getting silly.

This is getting silly.

The Bank of Japan is already a top shareholder in 90% of the Nikkei's 225 companies so, on any given day, if you're selling shares in a Japanese company, chances are it's the BOJ that's taking it off your hands. 3,000,000,000,000 Yen is the current annual buy-in from the BOJ and the Central Bank is talking about doubling it – putting it on a pace for $1Bn/week of stock buying in an economy 1/4 the size of the US.

If the BOJ accelerates its ETF purchases this week to an annual rate of 7Tn Yen (the pace predicted by GS) the Central Bank could become the #1 shareholder in about 40 of the Nikkei’s companies by the end of 2017, according to Bloomberg calculations. It could hold the top ranking in about 90 firms using HSBC Holdings Plc’s estimate of 13Tn Yen.

This is a MASSIVE distortion of the markets and, to some extent, the same thing is beginning to happen in the US and Europe. As I was saying last week, this is the problem with TA as you can't discover value when there's an underlying buyer who will take shares at any price – regardless of the actual value of the company in question.

This is a MASSIVE distortion of the markets and, to some extent, the same thing is beginning to happen in the US and Europe. As I was saying last week, this is the problem with TA as you can't discover value when there's an underlying buyer who will take shares at any price – regardless of the actual value of the company in question.

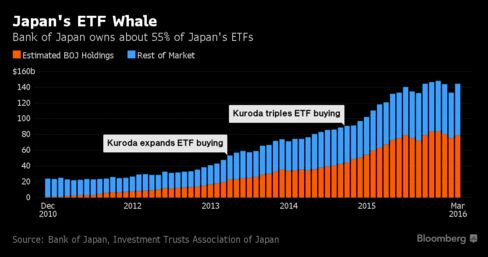

It's doubly bad because the BOJ is also buying 55% of the ETFs which, in turn, are indiscriminate buyers of stocks and, even worse, by inflating the price of the ETFs, the BOJ suckers the citizens of Japan into grossly overpaying for the ETFs and, as a throughput, for the underlying stocks. We're not dealing with reality here, folks and, to some extent and to some degree, this is being done by all of the World's Central Banksters in a desperate attempt to prop up the stock holdings of their Top 1% masters. As former Fed Chairman Alan Greenspan admitted last week in a CNBC interview: