Back in black

Forget the hearse 'cause I never die

Look at me now

I'm just makin' my play

Don't try to push your luck, just get out of my way – AC/DC

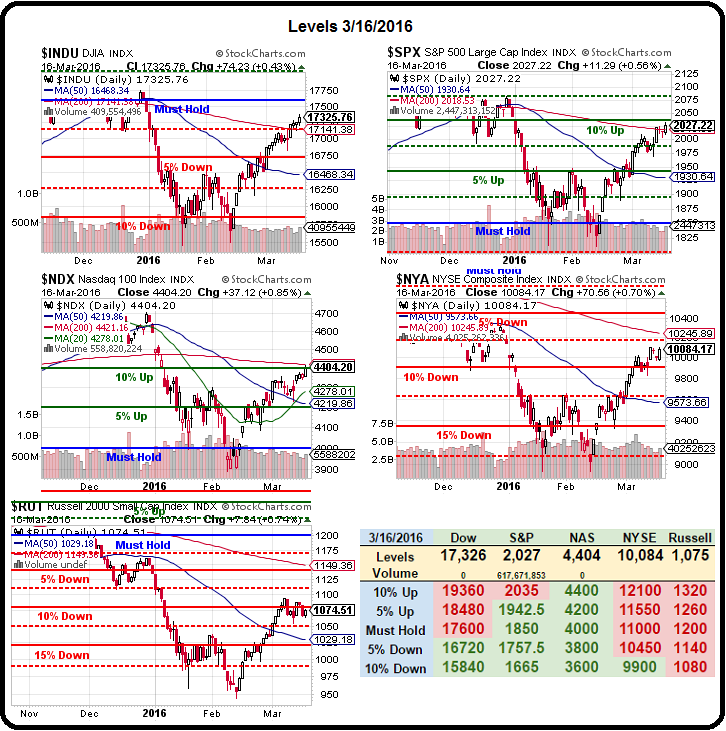

Wow, what a month we are having! 15,500 to 17,500 is 2,000 Dow points and lucky 13% off the bottom as of yesterday's close. Of course we mark 15,840 as the -10% line on our Big Chart and the Must Hold Line is 17,600, which is where the Dow needs to go just to get back to the middle of our predicted trading range for 2016 so let's not get too exhausted congratulating ourselves on mediocrity just yet.

At the same time, the Nasdaq has blased up 10% from it's Must Hold Line (4,000) and is already well over 4,400 led, of course, by a 15% pop in Apple (AAPL), who have their event day on Monday. We're already long on AAPL which means we can't be too short on the Nasdaq but 4,400 is the top of the range and, if AAPL disappoints even a little – things can come crashing down very quickly.

S&P 1,850 was our Must Hold line and we hit our +10% target of 2,035 yesterday and popped through that though the S&P June Futures (/ESM6) are right on the 2,035 line, and we care a lot more about them than we do about the index. The Russell (/TF) is the huge underperformer, only just getting back over the -10% line at 1,080. If we want to play a long – the Russell is absolutely the way to go.

A nice upside hedge would be to use the ultra-long Russell ETF (TNA):

- Buy 40 TNA April $59 calls at $1.15 ($4,600)

- Sell 40 TNA April $61 calls at 0.70 ($2,800)

- Sell 10 CLF 2018 $2 puts for $1.25 ($1,250)

That's net $550 on the $8,000 spread and, as you can see from the chart, last time the other indexes were this high in the range, TNA was in the $70s, so $61 is not much…