Another day, another 1.5% rally?

Another day, another 1.5% rally?

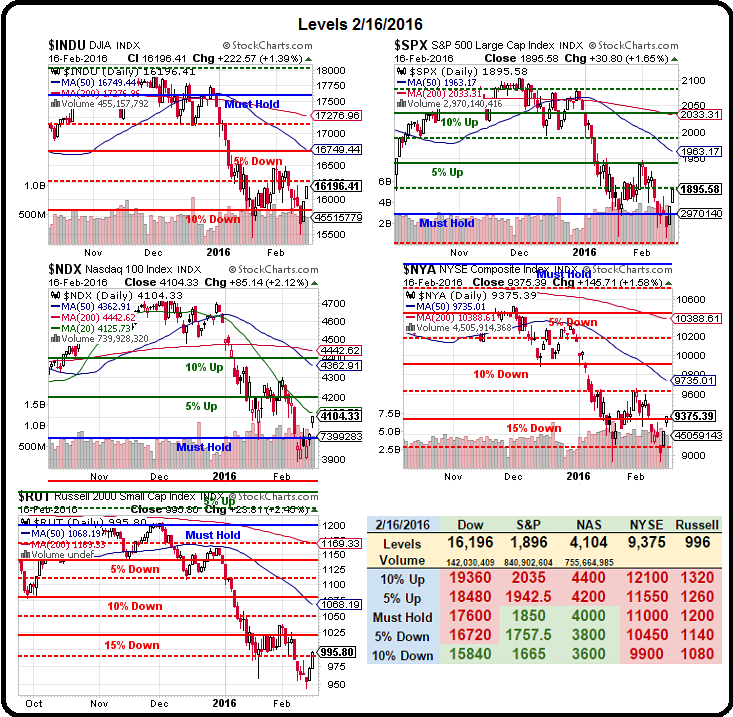

That's what we need to get a 5% bounce off of Thursday's lows and we're getting there – exactly as we predicted we would last Tuesday (and the Tuesday before that). It's not hard at all to predict these market gyrations using our fabulous 5% Rule™ since these are Bot-driven rallies and tend to closely obey the pre-programmed lines. Our index targets were as follows:

- Dow: 15,840 low, 16,000 weak bounce, 16,150 strong bounce – now 16,196 (strong).

- S&P: 1,850 low, 1,887 weak bounce, 1,925 strong bounce – now 1,895 (weak)

- Nasdaq 3,900 low, 4,050 weak bounce, 4,200 strong bounce – now 4,104 (weak)

- NYSE 8,800 low, 9,152 weak bounce, 9,500 strong bounce – now 9,375 (weak)

- Russell 960 low, 1,000 weak bounce, 1,040 strong bounce – now 996 (weak)

That's 4 out of 5 major indexes not over their strong bounce lines yet so there's nothing to get bullish about (we got bullish at the bottom, of course but now getting cautious again) until we have more green crosses and, as you can see on our Big Chart (click it for bigger), we're well below holding 3 of 5 of our Must Hold lines so it's signaling caution anyway.

We have the Fed Minutes today at 2pm and, if spun correctly, those can get us back over our lines but more likely we're rejected at our strong bounce lines and, if we're not over them by Friday – we'll be hedging again into the weekend. Today we have a Live Trading Webinar at 1pm, EST, so we'll be live on the Fed release and we can make some adjustments there.

1,000 will be a tough line for the Russell to cross so we'll be watching that closely for a shorting opportunity in the Futures (/TF) and it would be confirmed if the S&P (/ES) fails to hold 1,900 and that would line up with 4,140 on the Nasdaq Futures (/NQ), 16,300 on the Dow Futures (/TF) and 16,000 on the Nikkei (/NKD), which we were just long on yesterday at 15,800. Hopefully those lines hold and we can remain hopefull.

IN PROGRESS