Really, Sweden? Well, it's just an excuse to sell off on a 30-year auction day (happens almost every one) because it panics people into TBills at ridiculously low rates and makes it look like the Fed is doing its job and people really do want to lend the Government money for 30 years at 2.5% rather than do something productive with the money. Why? Because if people don't want to by 30-year Treasury Notes at 2.5% then one would have to question our Government's $19,000,000,000,000 debt load which, at 2.5%, costs $475Bn in interest payments alone to sustain and if we were to assume rates climb to 5%, then another $475Bn per year would have to be figured into the budget (without asking the Top 1% or Corporations to contribute, of course!). On the other hand, with Sweden now CHARGING 0.5% to put money in the Riksbank, 2.5% on US debt looks like a pretty good deal, doesn't it? I already sent out an Alert this morning ( tweeted too, with the hashtag #CurrencyWars ) on what happened and how we're playing the Futures, so I won't rehash all that boring stuff here. Oil, meanwhile, is down another 4% this morning ($26.25) and that's on me as I told Canada that oil was not going to make a comeback on Money Talk last night – and it was not a happy conversation. We would like to play the $25 line for a bounce on /CL but we're EXTREMELY concerned about the MASSIVE overhang of FAKE!!! contracts ( see Monday's post and here is a good place to say " I told you so! ") with 324,000 open orders still remaining in the March contracts (but they did cancel 191,000 fake orders in 3 days, so catching up). In fact, since I get a lot of mail from people who can't believe the NYMEX is a complete and utter scam used only to defraud the American people by creating a false demand for oil and driving up prices, let's compare the "open order "demand"" (had to double quote demand as it's such BS) from Monday morning to yesterday's close. Here's Monday's NYMEX contract strip: Here's yesterday's…

Really, Sweden?

Really, Sweden?

Well, it's just an excuse to sell off on a 30-year auction day (happens almost every one) because it panics people into TBills at ridiculously low rates and makes it look like the Fed is doing its job and people really do want to lend the Government money for 30 years at 2.5% rather than do something productive with the money. Why? Because if people don't want to by 30-year Treasury Notes at 2.5% then one would have to question our Government's $19,000,000,000,000 debt load which, at 2.5%, costs $475Bn in interest payments alone to sustain and if we were to assume rates climb to 5%, then another $475Bn per year would have to be figured into the budget (without asking the Top 1% or Corporations to contribute, of course!).

On the other hand, with Sweden now CHARGING 0.5% to put money in the Riksbank, 2.5% on US debt looks like a pretty good deal, doesn't it? I already sent out an Alert this morning (tweeted too, with the hashtag #CurrencyWars) on what happened and how we're playing the Futures, so I won't rehash all that boring stuff here.

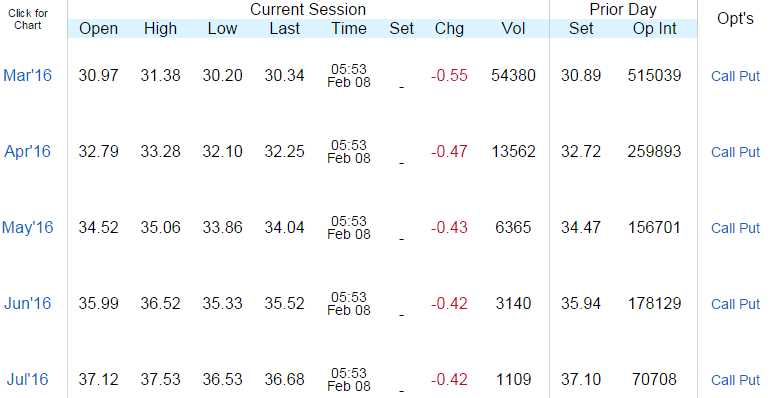

Oil, meanwhile, is down another 4% this morning ($26.25) and that's on me as I told Canada that oil was not going to make a comeback on Money Talk last night – and it was not a happy conversation. We would like to play the $25 line for a bounce on /CL but we're EXTREMELY concerned about the MASSIVE overhang of FAKE!!! contracts (see Monday's post and here is a good place to say "I told you so!") with 324,000 open orders still remaining in the March contracts (but they did cancel 191,000 fake orders in 3 days, so catching up).

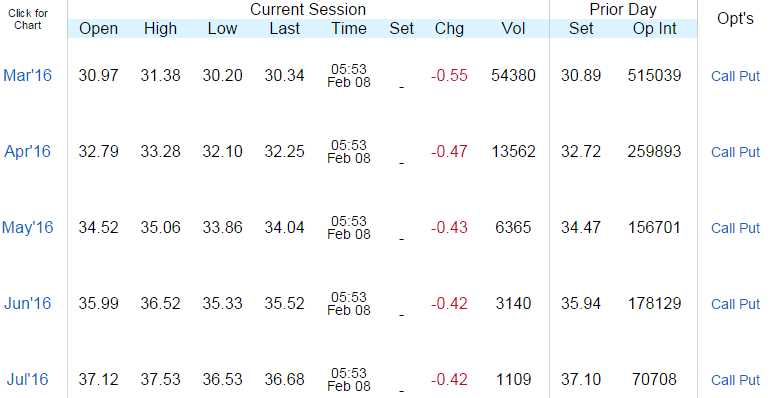

In fact, since I get a lot of mail from people who can't believe the NYMEX is a complete and utter scam used only to defraud the American people by creating a false demand for oil and driving up prices, let's compare the "open order "demand"" (had to double quote demand as it's such BS) from Monday morning to yesterday's close. Here's Monday's NYMEX contract strip:

Here's yesterday's…

Really, Sweden?

Really, Sweden?