Curse you Jon Hilsenrath! This guy (who writes for the WSJ) has WAY too much influence over the market due to his supposedly tight relationship with the Fed. At this point, it no longer matters what the Fed actually says – what matters is what Jon Hilsenrath tells you the Fed said. In this case, we had a nice uptick on reading the very doveish 2pm Fed minutes that lasted all the way until 2:03, when Hilsenrath opined in the article pictured here. I had to use the snapshot (which, fortunately we captured during our Live Webinar) because, after I called him out for being totally WRONG in his snap interpretation of the Fed Statement (and we went long on the Dow Futures ( YM ) into the sell-off) - his article has been DRASTICALLY altered. Now it reads : Federal Reserve officials expressed renewed worry about financial-market turbulence and slow economic growth abroad, leaving doubts about whether the central bank will raise interest rates as early as March . … the policy statement, released Wednesday after a two-day meeting, raised questions about whether the Fed would follow through with a rate move when it gathers again on March 15-16. Futures markets place just a 25% probability on rate increase by then. Raised questions? I was the one raising the questions!!! If you want to hear me screaming about this live, you can check out our Webinar Replay later today (not ready yet) but, as far as investors who were not lucky enough to have me calling shenanigans on Hilsenrath and the Wall Street Journal – the damage was already done. The WSJ didn't even point out that the article was corrected – they just shoved their tail between their legs and tried to pretend they didn't make a mistake that cost the Dow 300 points. Of course, the great thing about participating in one of our Live Webinars (see yesterday's post for your invite) is that we know how to trade this kind of market BS and what we did was take a long position on the Dow Futures ( YM ) , averaging into a position at 15,879 and exiting early this morning …

Curse you Jon Hilsenrath!

Curse you Jon Hilsenrath!

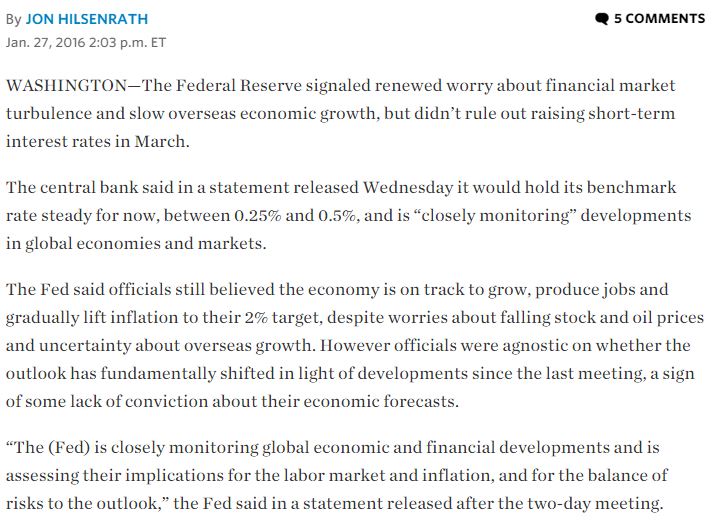

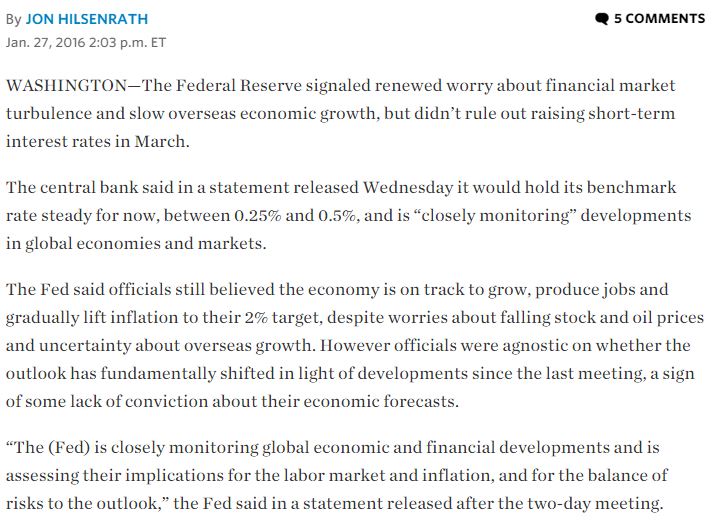

This guy (who writes for the WSJ) has WAY too much influence over the market due to his supposedly tight relationship with the Fed. At this point, it no longer matters what the Fed actually says – what matters is what Jon Hilsenrath tells you the Fed said. In this case, we had a nice uptick on reading the very doveish 2pm Fed minutes that lasted all the way until 2:03, when Hilsenrath opined in the article pictured here.

I had to use the snapshot (which, fortunately we captured during our Live Webinar) because, after I called him out for being totally WRONG in his snap interpretation of the Fed Statement (and we went long on the Dow Futures (YM) into the sell-off) - his article has been DRASTICALLY altered. Now it reads:

Federal Reserve officials expressed renewed worry about financial-market turbulence and slow economic growth abroad, leaving doubts about whether the central bank will raise interest rates as early as March.

…the policy statement, released Wednesday after a two-day meeting, raised questions about whether the Fed would follow through with a rate move when it gathers again on March 15-16. Futures markets place just a 25% probability on rate increase by then.

Raised questions? I was the one raising the questions!!! If you want to hear me screaming about this live, you can check out our Webinar Replay later today (not ready yet) but, as far as investors who were not lucky enough to have me calling shenanigans on Hilsenrath and the Wall Street Journal – the damage was already done. The WSJ didn't even point out that the article was corrected – they just shoved their tail between their legs and tried to pretend they didn't make a mistake that cost the Dow 300 points.

Of course, the great thing about participating in one of our Live Webinars (see yesterday's post for your invite) is that we know how to trade this kind of market BS and what we did was take a long position on the Dow Futures (YM), averaging into a position at 15,879 and exiting early this morning…