100% Those are the odds that Draghi will provide more stimulus in Europe this Thursday based on the recent speeches he's been making. That means, most likely, that it will be a " sell on the news " even at the rumor has already been bought – sending the DAX up 500 points (5%) in 5 days . The ECB Deposit Rate has already been at -0.1% since June and is expected to go down to -0.3-0.4%, which is an actual penalty for banks who wish to store their cash with the ECB, rather than lending it out to the Private Sector. While this will, of course, be a boost for the Private Sector, keep in mind that the banks who have looked at their books and analyzed their prospects have to be FORCED to lend these businesses money. As with many of our economic " solutions " since the 2008 crisis – this one simply masks one problem (businesses are not worth lending to) with another (forcing banks to make bad loans again) and now we can stagger forward for another few years until our banks need bailing out because they have too many bad loans – again. The evidence from the eurozone, Switzerland and Scandinavia is mixed . The worst-case scenarios of cash-hoarding and broad-based asset bubbles, due to plowing money into investments such as real estate, haven’t materialized. But despite the negative rates, Switzerland’s central bank, which sees the franc’s exchange rate against the euro as key, still has a stronger currency than it would like. In the ECB’s case, any transmission to private-sector lending has been modest at best. Still, ECB officials are convinced that negative rates and large-scale asset purchases are a powerful combo to boost activity and prices by increasing the incentive to lend to households and businesses rather than accepting tiny or negative returns on government bonds or deposits at the central bank. IN PROGRESS

100%

100%

Those are the odds that Draghi will provide more stimulus in Europe this Thursday based on the recent speeches he's been making. That means, most likely, that it will be a "sell on the news" even at the rumor has already been bought – sending the DAX up 500 points (5%) in 5 days.

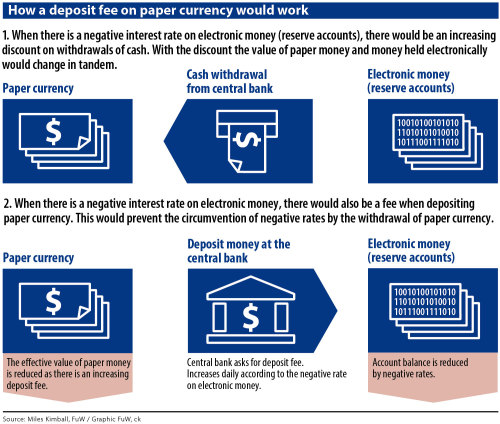

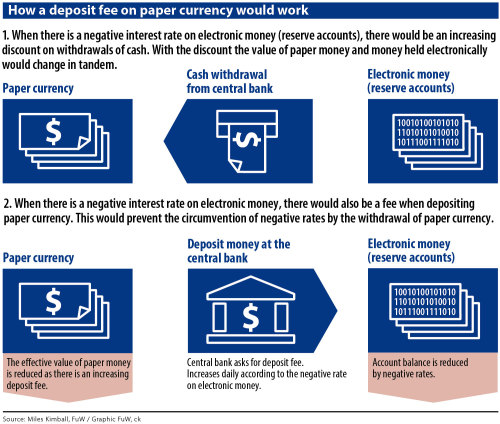

The ECB Deposit Rate has already been at -0.1% since June and is expected to go down to -0.3-0.4%, which is an actual penalty for banks who wish to store their cash with the ECB, rather than lending it out to the Private Sector. While this will, of course, be a boost for the Private Sector, keep in mind that the banks who have looked at their books and analyzed their prospects have to be FORCED to lend these businesses money.

As with many of our economic "solutions" since the 2008 crisis – this one simply masks one problem (businesses are not worth lending to) with another (forcing banks to make bad loans again) and now we can stagger forward for another few years until our banks need bailing out because they have too many bad loans – again.

The evidence from the eurozone, Switzerland and Scandinavia is mixed. The worst-case scenarios of cash-hoarding and broad-based asset bubbles, due to plowing money into investments such as real estate, haven’t materialized. But despite the negative rates, Switzerland’s central bank, which sees the franc’s exchange rate against the euro as key, still has a stronger currency than it would like. In the ECB’s case, any transmission to private-sector lending has been modest at best.

Still, ECB officials are convinced that negative rates and large-scale asset purchases are a powerful combo to boost activity and prices by increasing the incentive to lend to households and businesses rather than accepting tiny or negative returns on government bonds or deposits at the central bank.

IN PROGRESS

100%