Here's another thing we can pretend doesn't matter.

Here's another thing we can pretend doesn't matter.

Emerging-market debt has grown $28Tn since 2009, according to the Institute of International Finance, which on Monday introduced a database tracking 18 developing markets. Global debt has soared $50Tn during the period to surpass a total of $240Tn, or 320% of global gross domestic product, in early 2015. That's right, the Planet Earth is now more than 3 TIMES it's annual gross salary on debt!

Non-financial corporate sector debt in emerging markets has risen $13Tn since 2009, increasing more than five-fold over the past decade to surpass $23.7Tn in the first quarter of 2015. The advance has been most concentrated in emerging Asia, where it rose to 125% of GDP. As noted in the chart above, OVER 100% of the GDP growth since 2007 has simply been more debt: more stimulus, more bailouts, more ZIRP policies by our Central Banksters – all masking NEGATIVE real economic growth.

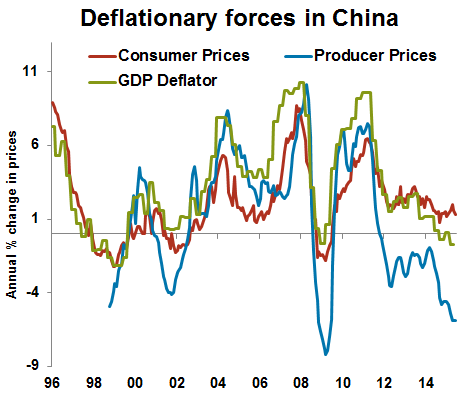

Take China… please. Today we got a NEGATIVE 5.9% reading in their PPI Report with CPI up just 1.3% – clearly in a deflationary state yet The State continues to claim the economy is growing at a 6.9% annual pace. That is totally and completely BULLSHIT and shame on you for putting up with it!

Take China… please. Today we got a NEGATIVE 5.9% reading in their PPI Report with CPI up just 1.3% – clearly in a deflationary state yet The State continues to claim the economy is growing at a 6.9% annual pace. That is totally and completely BULLSHIT and shame on you for putting up with it!

Yes, shame on you if you are a fellow Financial Analayst, shame on you if you are a Financial Writer and shame on you if you are a consumer of this information and just passively let yourself be lied to – SHAME!!! Where is the outrage? Don't you deserve to know the truth? Shouldn't there be an investigation or are we so frightened of China that we don't even have the balls to demand an audit?

That's right, China is our biggest trading partner – it is in the interest of the United States in general and investors in particular to have a fair and accurate assessement of their real economy. Why does no one demand this? Conveniently, we have a GOP debate tonight – let's ask the candidates what they plan to do about it!

Chinese Imports fell 18.8% in October and Exports were down 6.9%…

Chinese Imports fell 18.8% in October and Exports were down 6.9%…