Electricity storage and software provider Fluence (NASDAQ: FLNC) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 154% year on year to $475.2 million. On the other hand, the company’s full-year revenue guidance of $3.4 billion at the midpoint came in 1.3% above analysts’ estimates. Its GAAP loss of $0.34 per share was 63% below analysts’ consensus estimates.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it’s free.

Fluence Energy (FLNC) Q4 CY2025 Highlights:

- Revenue: $475.2 million vs analyst estimates of $484.3 million (154% year-on-year growth, 1.9% miss)

- EPS (GAAP): -$0.34 vs analyst expectations of -$0.21 (63% miss)

- Adjusted EBITDA: -$52.06 million (-11% margin, 4.8% year-on-year decline)

- The company reconfirmed its revenue guidance for the full year of $3.4 billion at the midpoint

- EBITDA guidance for the full year is $50 million at the midpoint, below analyst estimates of $51.5 million

- Adjusted EBITDA Margin: -11%, up from -26.6% in the same quarter last year

- Free Cash Flow was -$236.1 million compared to -$216.4 million in the same quarter last year

- Backlog: $5.5 billion at quarter end, up 7.8% year on year

- Market Capitalization: $4.26 billion

“Accelerating data center growth, utility demand and rising industrial loads continue to drive energy storage demand globally, reflected in our pipeline which has grown by approximately 30% to $30 billion since September, 2025,” said Julian Nebreda, the Company’s President and Chief Executive Officer.

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ: FLNC) helps store renewable energy sources with battery systems.

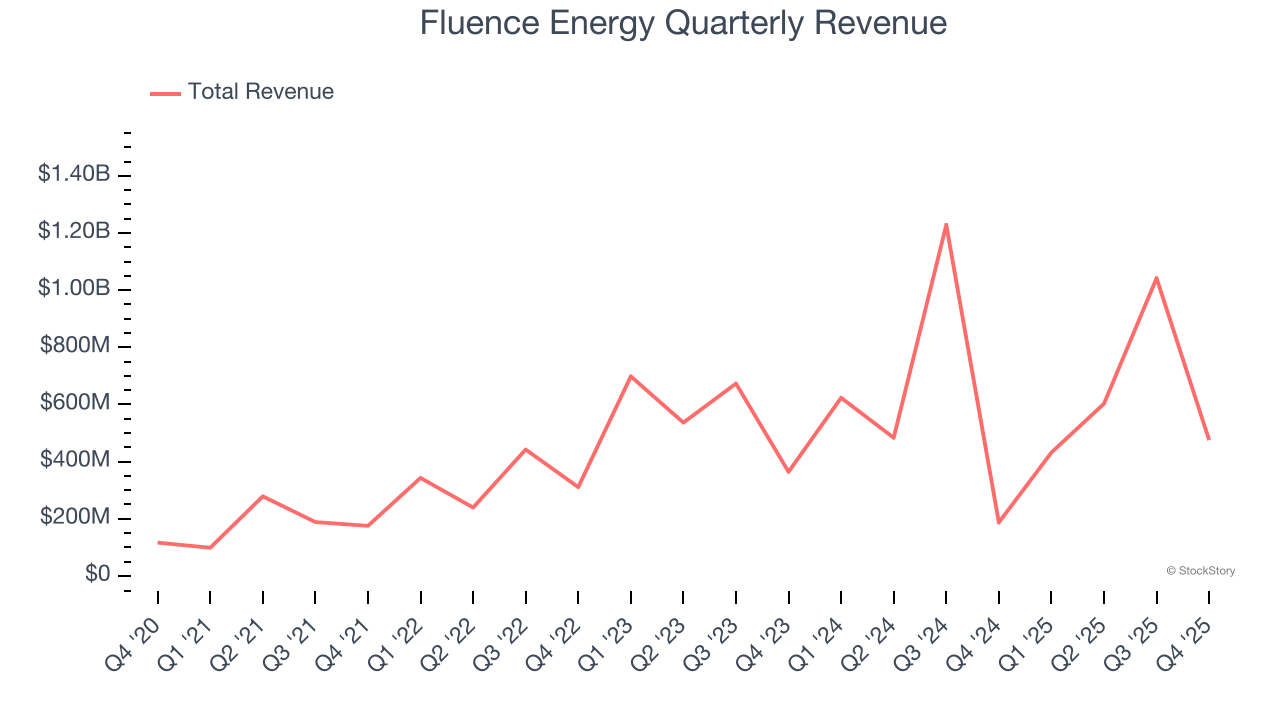

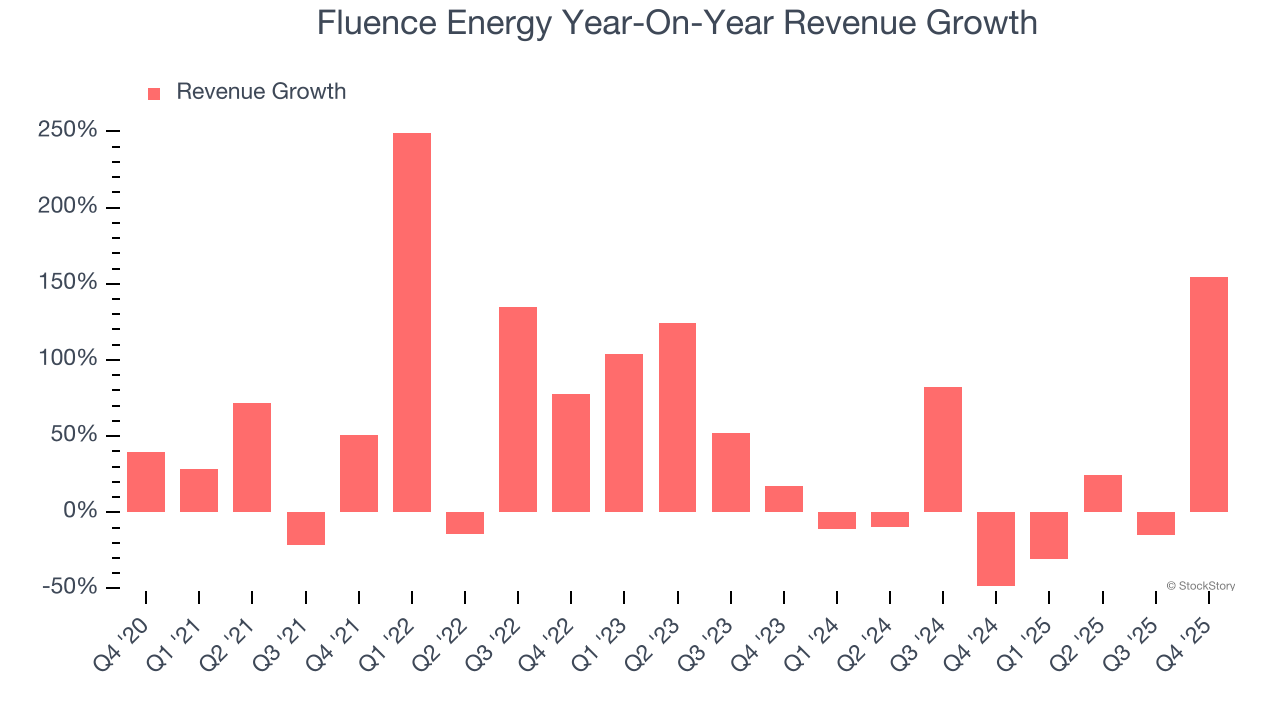

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Fluence Energy’s sales grew at an incredible 33.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6% over the last two years was well below its five-year trend.

This quarter, Fluence Energy achieved a magnificent 154% year-on-year revenue growth rate, but its $475.2 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 37.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

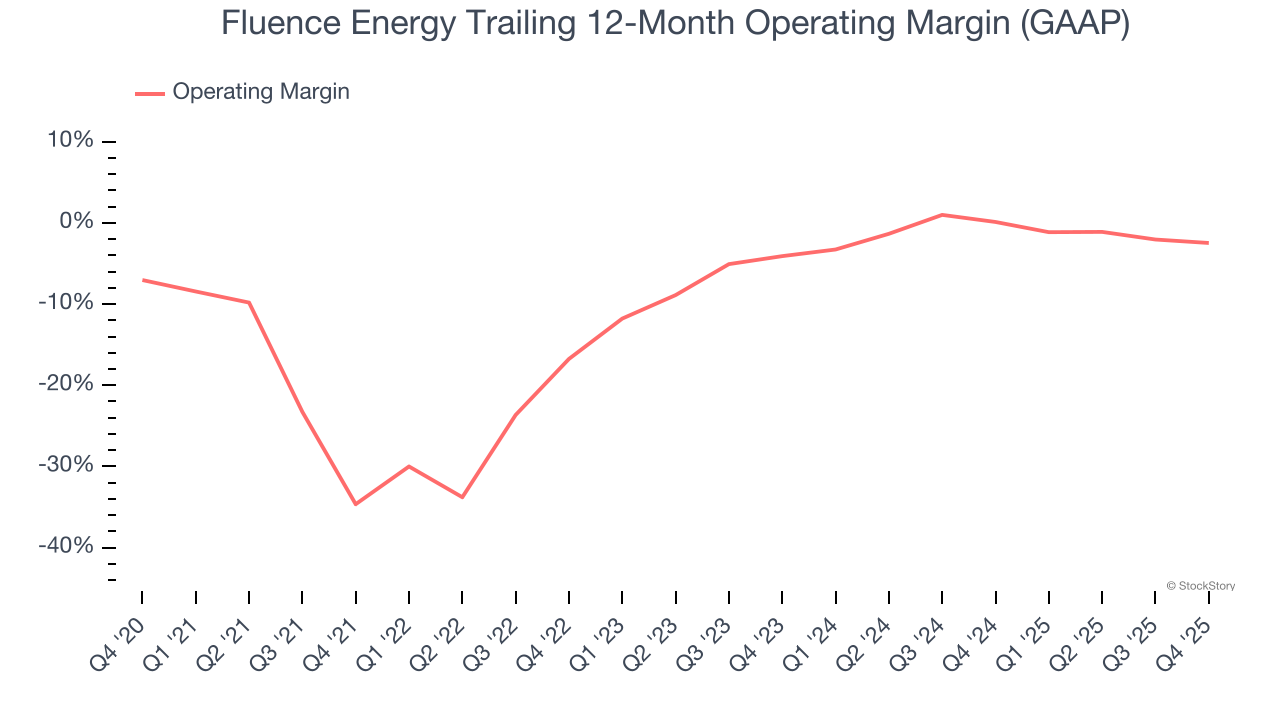

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Fluence Energy’s high expenses have contributed to an average operating margin of negative 6.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Fluence Energy’s operating margin rose by 32.2 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, Fluence Energy generated a negative 14.8% operating margin.

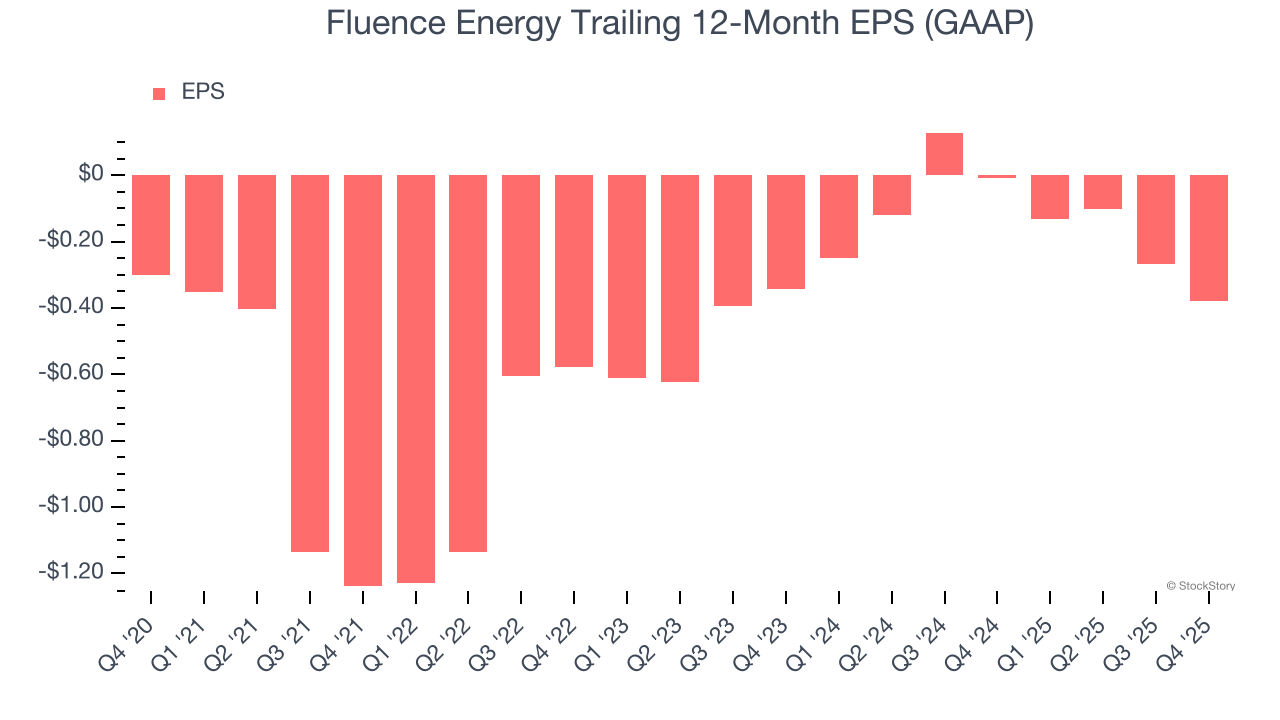

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Fluence Energy’s earnings losses deepened over the last five years as its EPS dropped 4.6% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Fluence Energy’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fluence Energy, its two-year annual EPS declines of 5.1% are similar to its five-year trend. These results were bad no matter how you slice the data.

In Q4, Fluence Energy reported EPS of negative $0.34, down from negative $0.23 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fluence Energy to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.38 will advance to negative $0.08.

Key Takeaways from Fluence Energy’s Q4 Results

It was good to see Fluence Energy provide full-year revenue guidance that slightly beat analysts’ expectations. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 11.5% to $25.68 immediately following the results.

Fluence Energy underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).