Selective Insurance Group has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9% to $84.94 per share while the index has gained 7.6%.

Is there a buying opportunity in Selective Insurance Group, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Selective Insurance Group Not Exciting?

We don't have much confidence in Selective Insurance Group. Here are three reasons you should be careful with SIGI and a stock we'd rather own.

1. Recent EPS Growth Below Our Standards

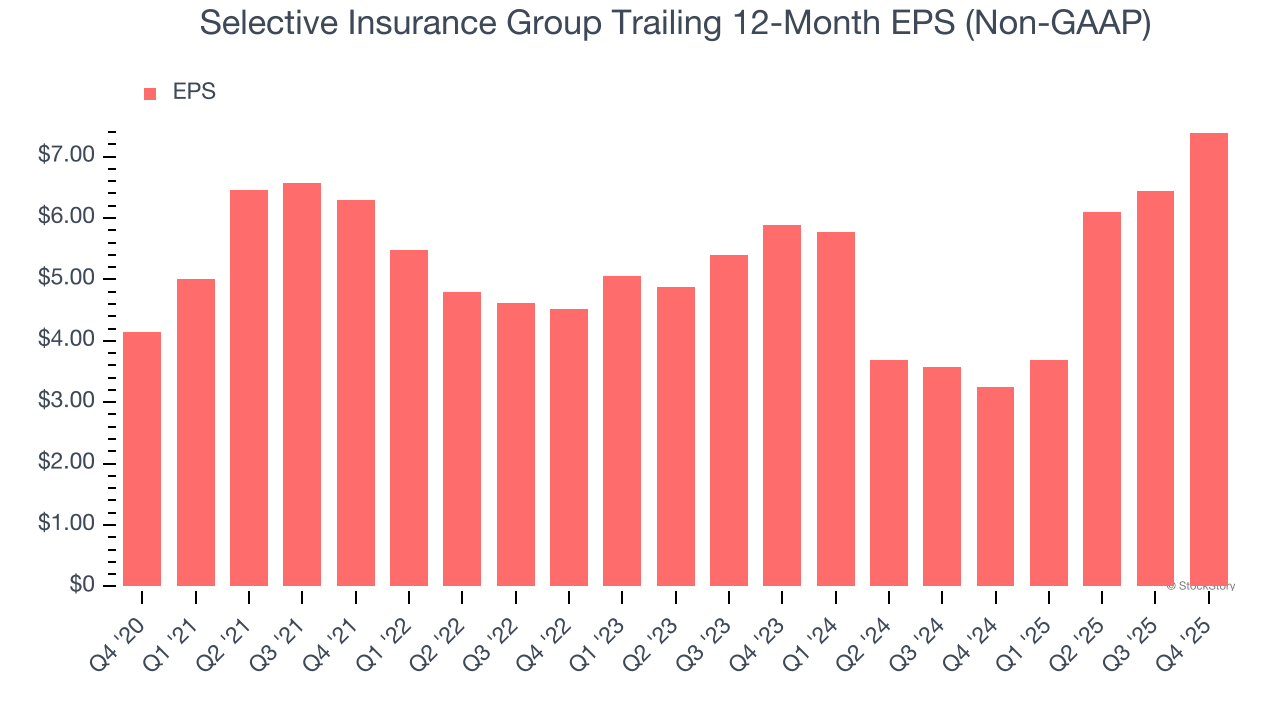

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Selective Insurance Group’s weak 12.1% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

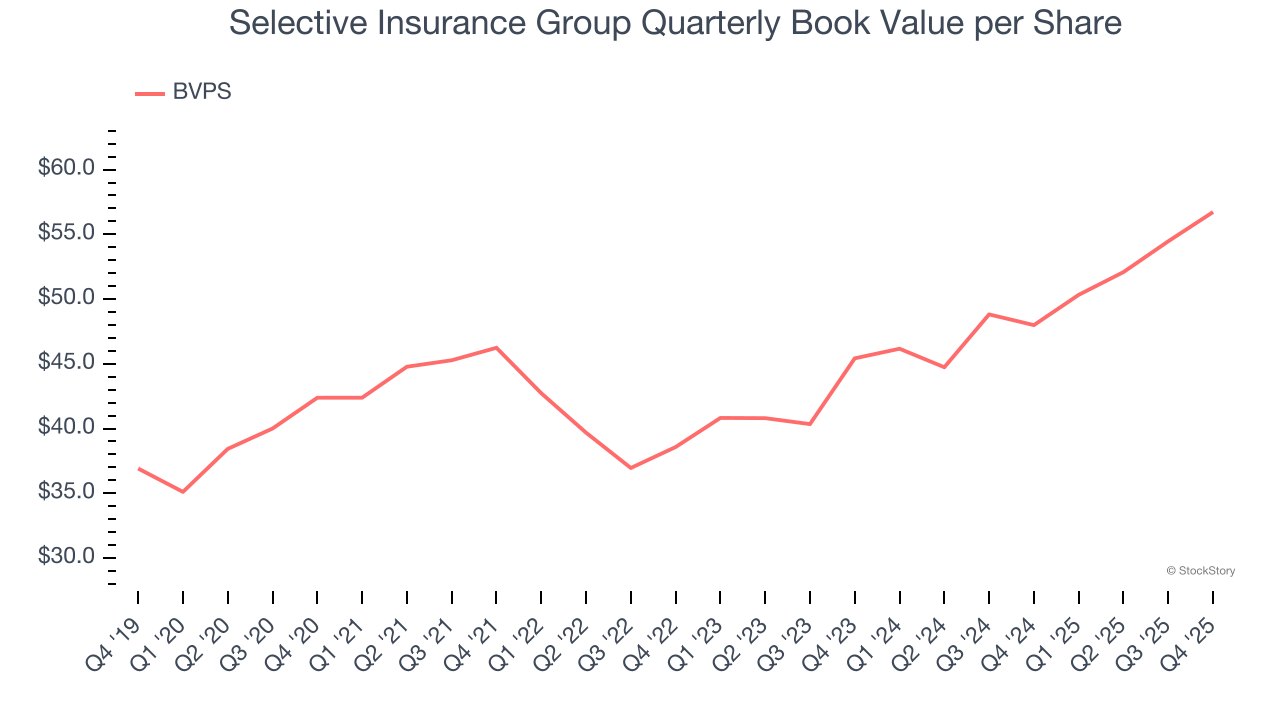

2. Substandard BVPS Growth Indicates Limited Asset Expansion

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

To the detriment of investors, Selective Insurance Group’s BVPS grew at a mediocre 11.7% annual clip over the last two years.

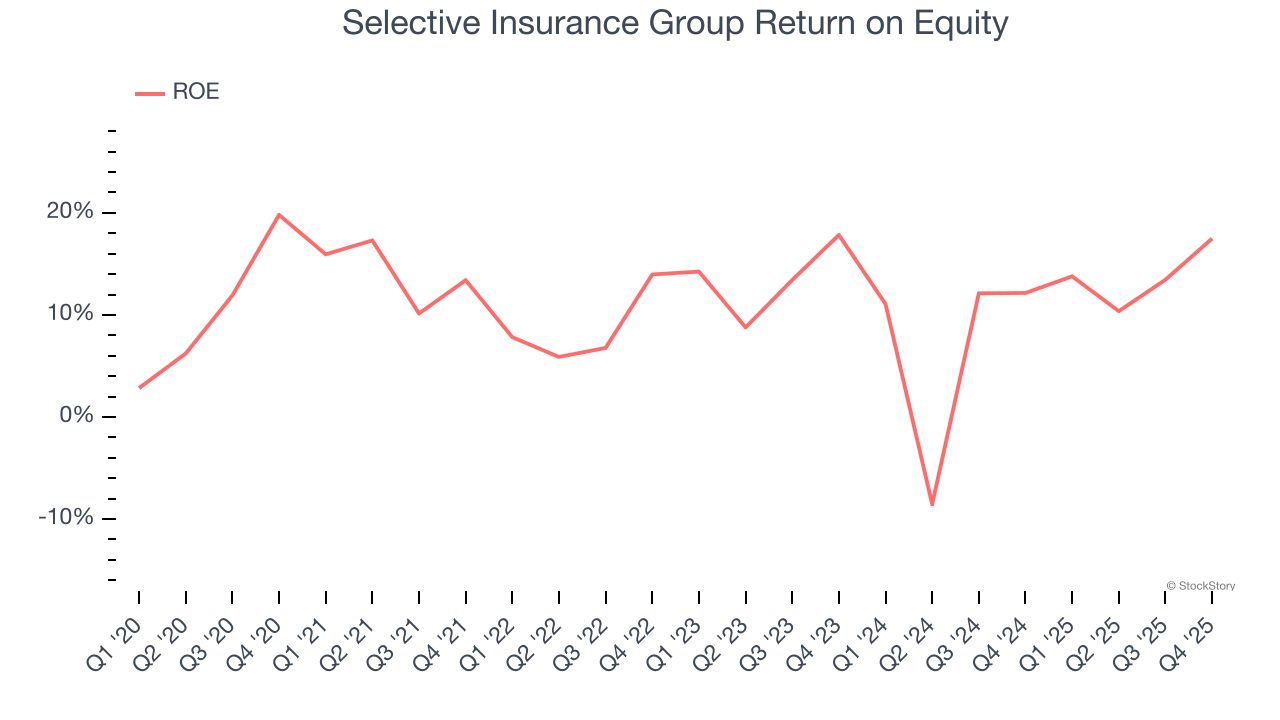

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Selective Insurance Group has averaged an ROE of 11.4%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Selective Insurance Group isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 1.4× forward P/B (or $84.94 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.