Veeva Systems’s stock price has taken a beating over the past six months, shedding 35.8% of its value and falling to $182.43 per share. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy VEEV? Find out in our full research report, it’s free.

Why Does Veeva Systems Spark Debate?

Originally named "Verticals onDemand" before rebranding in 2009, Veeva Systems (NYSE: VEEV) provides cloud software, data solutions, and consulting services that help life sciences companies develop and bring products to market more efficiently.

Two Positive Attributes:

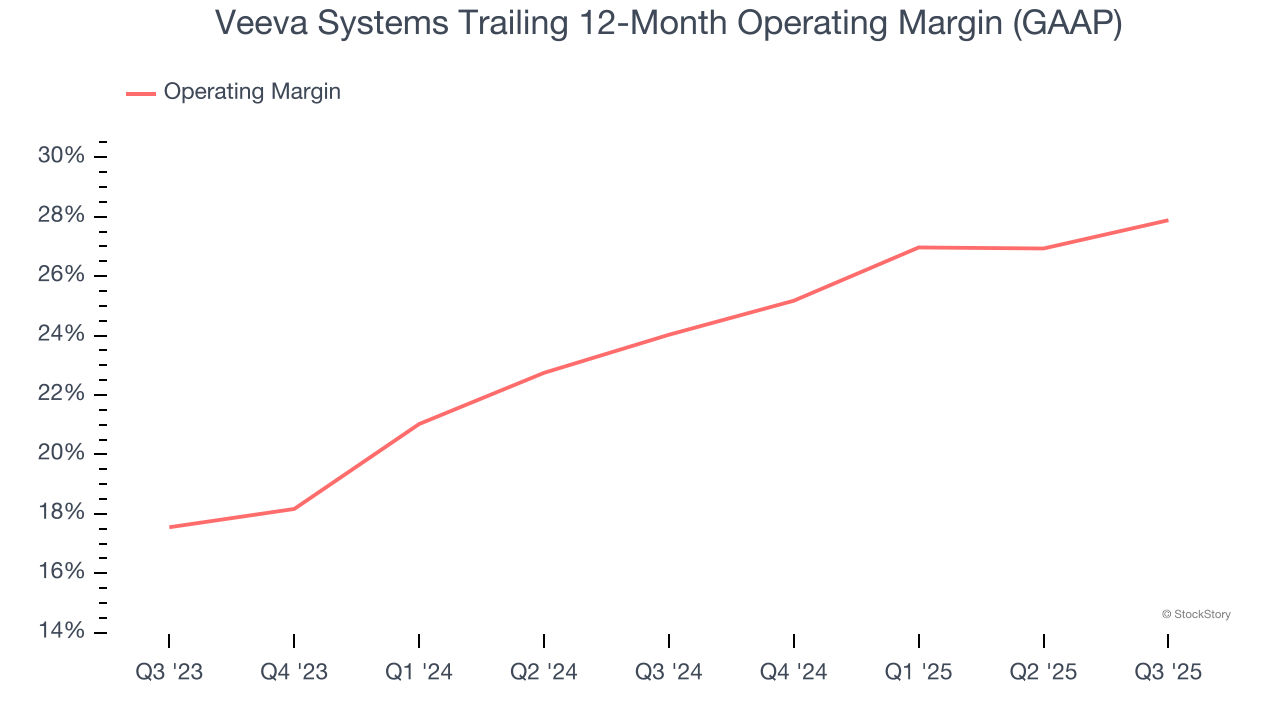

1. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Veeva Systems has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 27.9%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

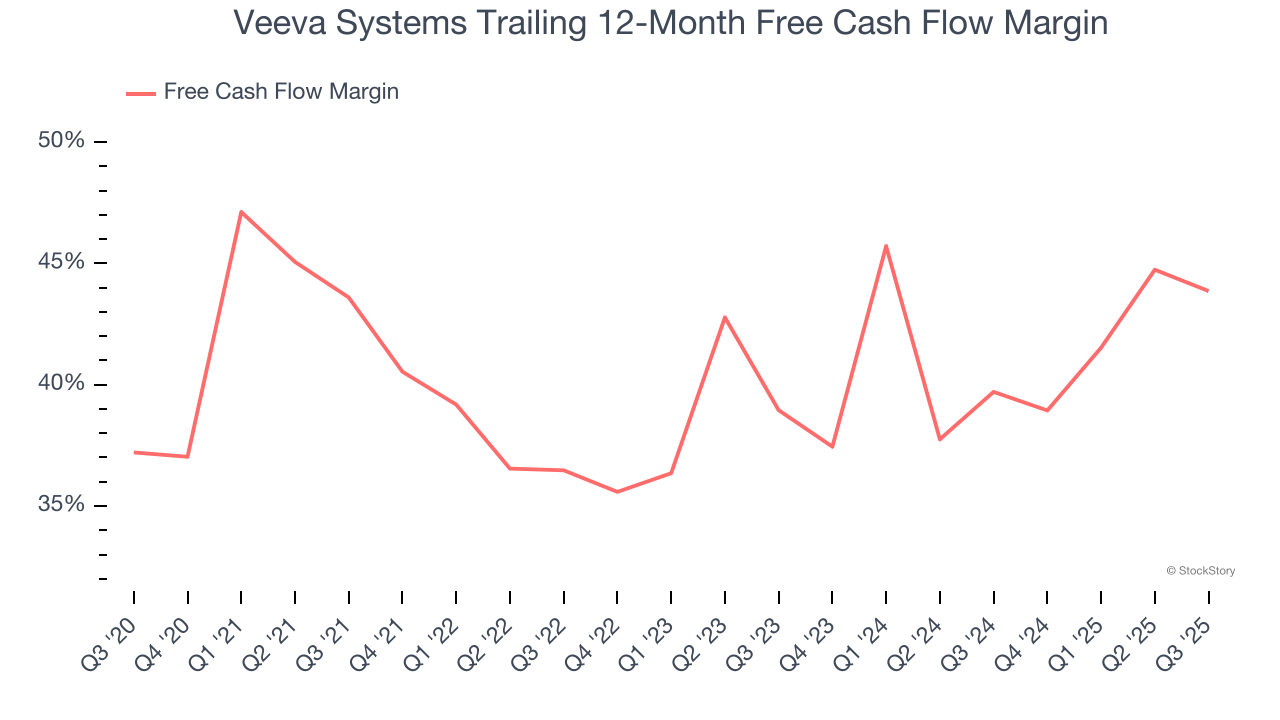

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Veeva Systems has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 43.9% over the last year.

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Veeva Systems’s revenue to rise by 12.1%, a deceleration versus its 17.4% annualized growth for the past five years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Final Judgment

Veeva Systems has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 8.9× forward price-to-sales (or $182.43 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Veeva Systems

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.