Chip designer Allegro MicroSystems (NASDAQ: ALGM) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 28.9% year on year to $229.2 million. Guidance for next quarter’s revenue was optimistic at $235 million at the midpoint, 2.7% above analysts’ estimates. Its GAAP profit of $0.04 per share was $0.01 below analysts’ consensus estimates.

Is now the time to buy Allegro MicroSystems? Find out by accessing our full research report, it’s free.

Allegro MicroSystems (ALGM) Q4 CY2025 Highlights:

- Revenue: $229.2 million vs analyst estimates of $221.3 million (28.9% year-on-year growth, 3.6% beat)

- EPS (GAAP): $0.04 vs analyst estimates of $0.05 ($0.01 miss)

- Adjusted EBITDA: $46.18 million vs analyst estimates of $38.86 million (20.1% margin, 18.8% beat)

- Revenue Guidance for Q1 CY2026 is $235 million at the midpoint, above analyst estimates of $228.7 million

- EPS (GAAP) guidance for Q1 CY2026 is $0.16 at the midpoint, beating analyst estimates by 156%

- Operating Margin: 4.2%, up from 0% in the same quarter last year

- Free Cash Flow was $41.26 million, up from -$21.8 million in the same quarter last year

- Inventory Days Outstanding: 133, down from 135 in the previous quarter

- Market Capitalization: $6.40 billion

“We delivered strong third quarter results, with sales of $229 million exceeding the high end of our guidance range. Additionally, non-GAAP EPS more than doubled year-over-year to $0.15. This performance was driven by broad strength in Automotive sales, which grew 28% year-over-year, including a 46% increase in e-Mobility. Our Industrial sales also saw robust growth, increasing 31% year-over-year, led by another record quarter in Data Center,” said Mike Doogue, President and CEO of Allegro.

Company Overview

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Revenue Growth

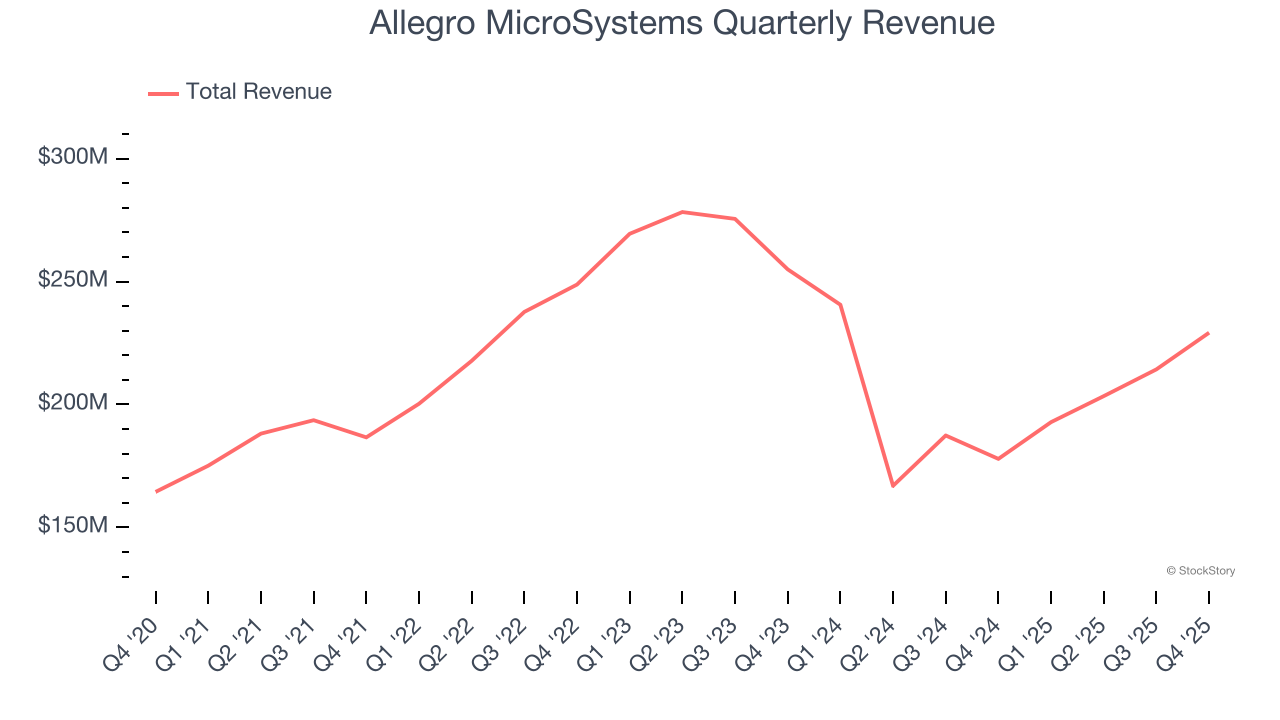

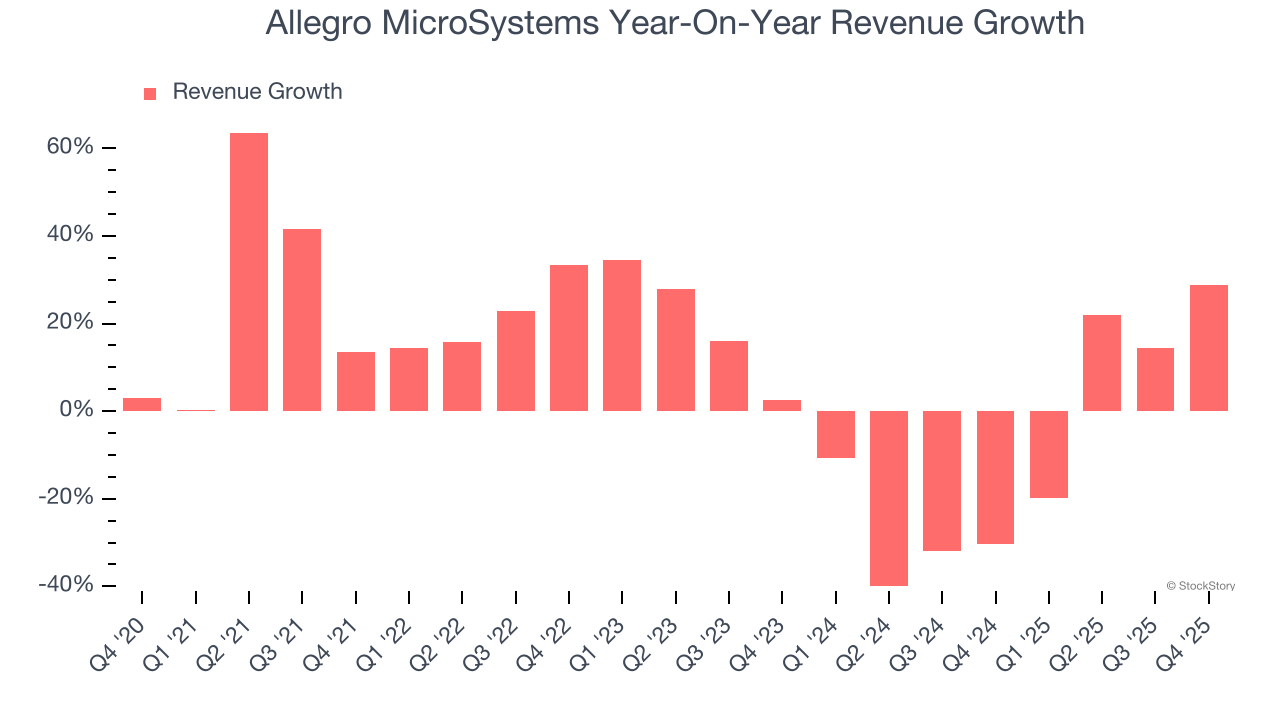

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Allegro MicroSystems grew its sales at a decent 7.3% compounded annual growth rate. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Allegro MicroSystems’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11.8% over the last two years.

This quarter, Allegro MicroSystems reported robust year-on-year revenue growth of 28.9%, and its $229.2 million of revenue topped Wall Street estimates by 3.6%. Beyond the beat, we believe the company is still in the early days of an upcycle as this was the third consecutive quarter of growth - a typical upcycle tends to last 8-10 quarters. Company management is currently guiding for a 21.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

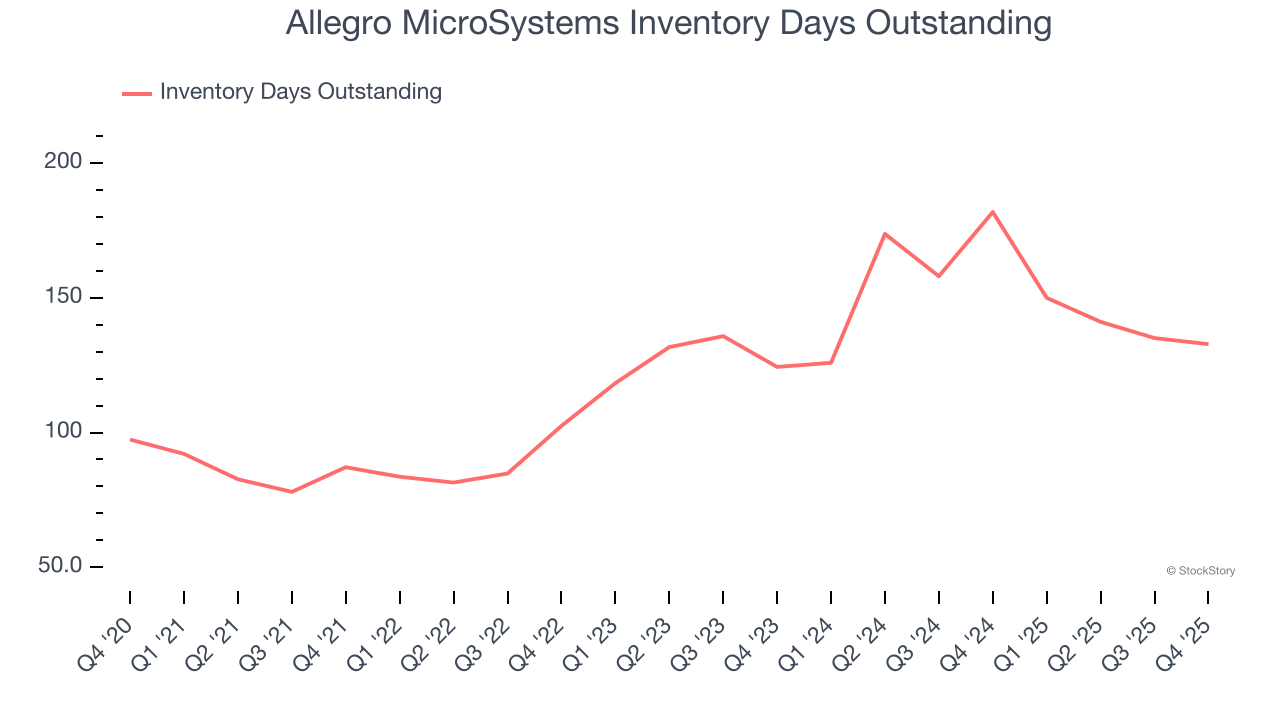

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Allegro MicroSystems’s DIO came in at 133, which is 13 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Allegro MicroSystems’s Q4 Results

We enjoyed seeing Allegro MicroSystems beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Overall, this print had some key positives. The stock traded up 4.9% to $36.25 immediately after reporting.

Is Allegro MicroSystems an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).