Over the past six months, Simmons First National’s shares (currently trading at $18.85) have posted a disappointing 5.9% loss, well below the S&P 500’s 9.9% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Simmons First National, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Simmons First National Will Underperform?

Despite the more favorable entry price, we're cautious about Simmons First National. Here are three reasons there are better opportunities than SFNC and a stock we'd rather own.

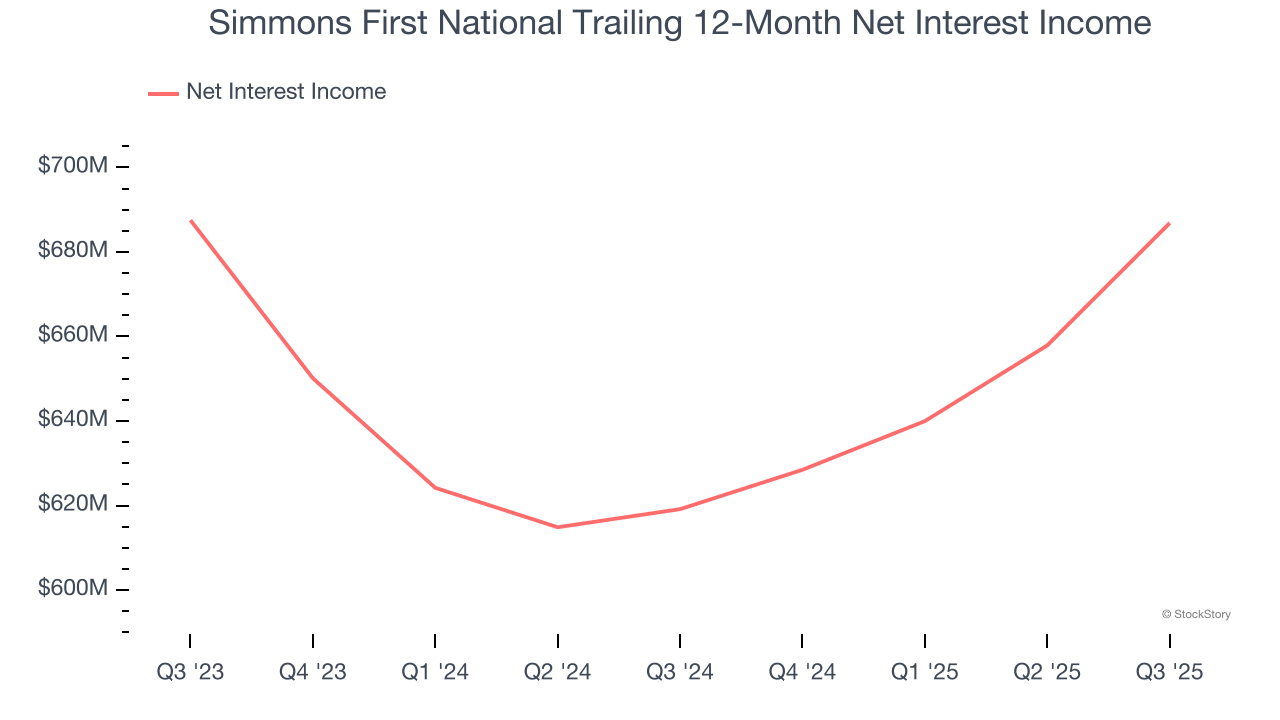

1. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Simmons First National’s net interest income has grown at a 1.1% annualized rate over the last five years, much worse than the broader banking industry and in line with its total revenue.

2. Efficiency Ratio Expected to Falter

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Simmons First National to become less profitable as it anticipates an efficiency ratio of 58.7% compared to 42.6% over the past year.

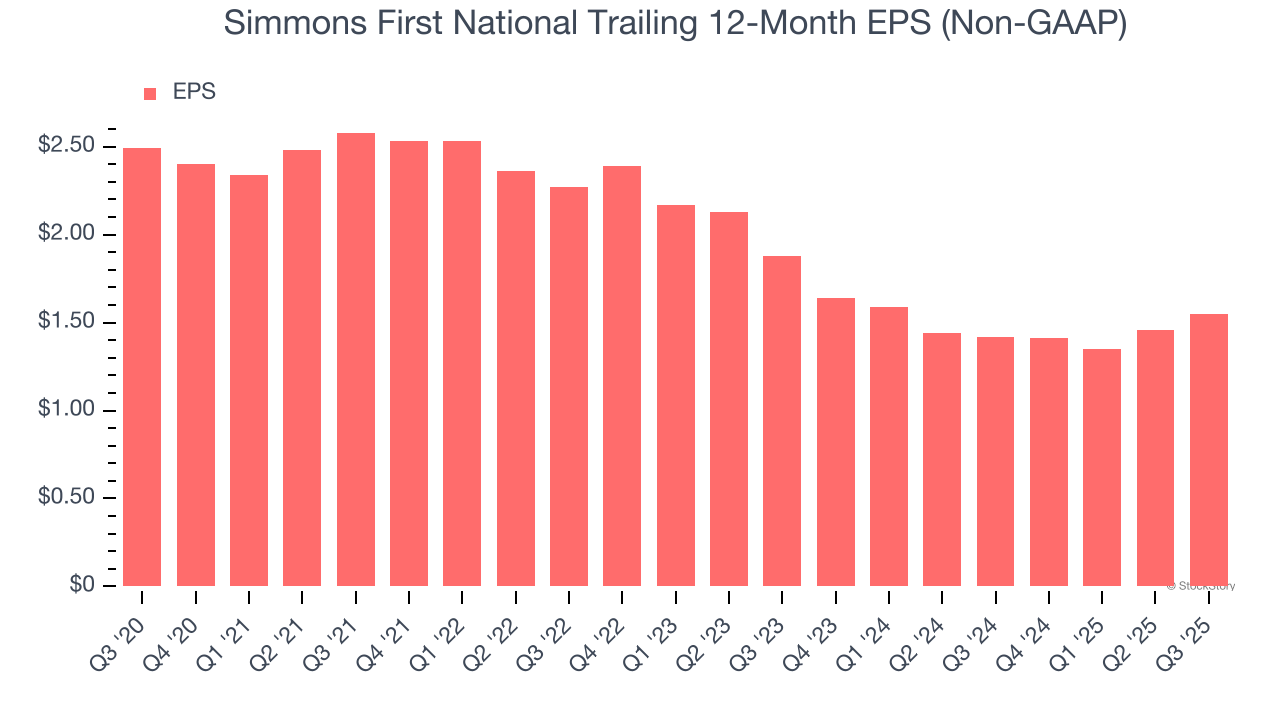

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Simmons First National, its EPS declined by 9% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

We cheer for all companies supporting the economy, but in the case of Simmons First National, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 0.8× forward P/B (or $18.85 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Simmons First National

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.