The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how beverages, alcohol, and tobacco stocks fared in Q3, starting with Boston Beer (NYSE: SAM).

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 15 beverages, alcohol, and tobacco stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

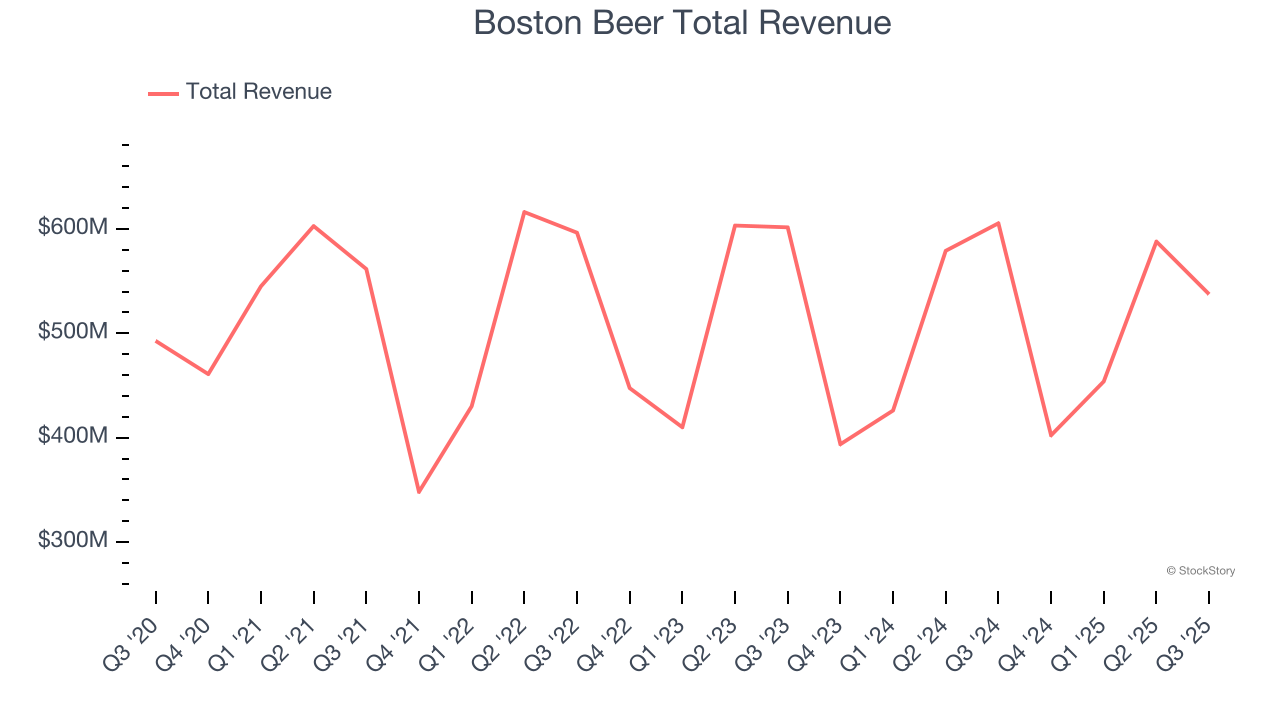

Boston Beer (NYSE: SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE: SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $537.5 million, down 11.2% year on year. This print fell short of analysts’ expectations by 0.9%, but it was still a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

“Our depletions declined by 3% in the third quarter as volumes were pressured across the beer industry” said Chairman, Founder and CEO Jim Koch.

Unsurprisingly, the stock is down 11.3% since reporting and currently trades at $194.80.

Is now the time to buy Boston Beer? Access our full analysis of the earnings results here, it’s free for active Edge members.

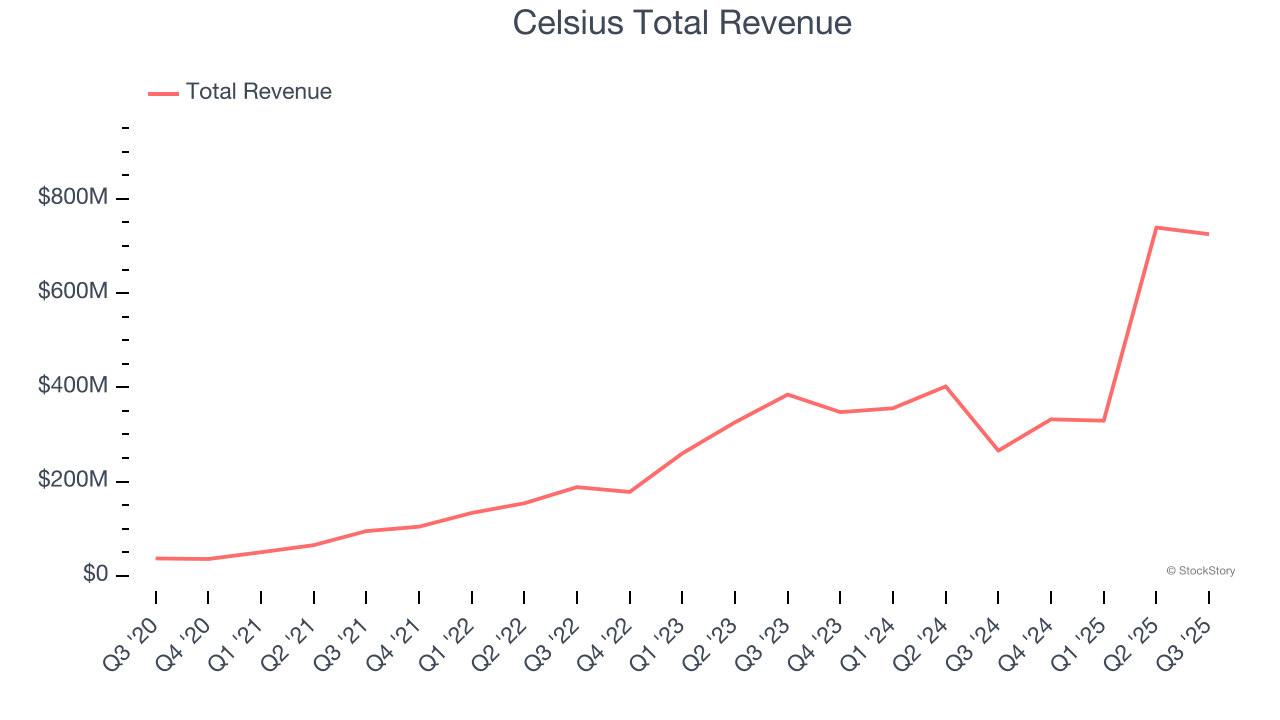

Best Q3: Celsius (NASDAQ: CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $725.1 million, up 173% year on year, outperforming analysts’ expectations by 1.2%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Celsius achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 24.6% since reporting. It currently trades at $45.73.

Is now the time to buy Celsius? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Altria (NYSE: MO)

Best known for its Marlboro brand of cigarettes, Altria (NYSE: MO) offers tobacco and nicotine products.

Altria reported revenues of $5.25 billion, down 1.7% year on year, falling short of analysts’ expectations by 1.3%. It was a slower quarter as it posted a significant miss of analysts’ gross margin estimates and a slight miss of analysts’ revenue estimates.

As expected, the stock is down 6.9% since the results and currently trades at $57.69.

Read our full analysis of Altria’s results here.

Philip Morris (NYSE: PM)

Founded in 1847, Philip Morris International (NYSE: PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

Philip Morris reported revenues of $10.85 billion, up 9.4% year on year. This number surpassed analysts’ expectations by 2%. Zooming out, it was a satisfactory quarter as it also logged a decent beat of analysts’ revenue estimates but a slight miss of analysts’ EBITDA estimates.

The stock is up 1.9% since reporting and currently trades at $161.

Read our full, actionable report on Philip Morris here, it’s free for active Edge members.

Monster (NASDAQ: MNST)

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ: MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Monster reported revenues of $2.20 billion, up 16.8% year on year. This print topped analysts’ expectations by 4.3%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 16.4% since reporting and currently trades at $77.21.

Read our full, actionable report on Monster here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.