Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Astec (NASDAQ: ASTE) and its peers.

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 4 construction machinery stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 2.5%.

While some construction machinery stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

Best Q2: Astec (NASDAQ: ASTE)

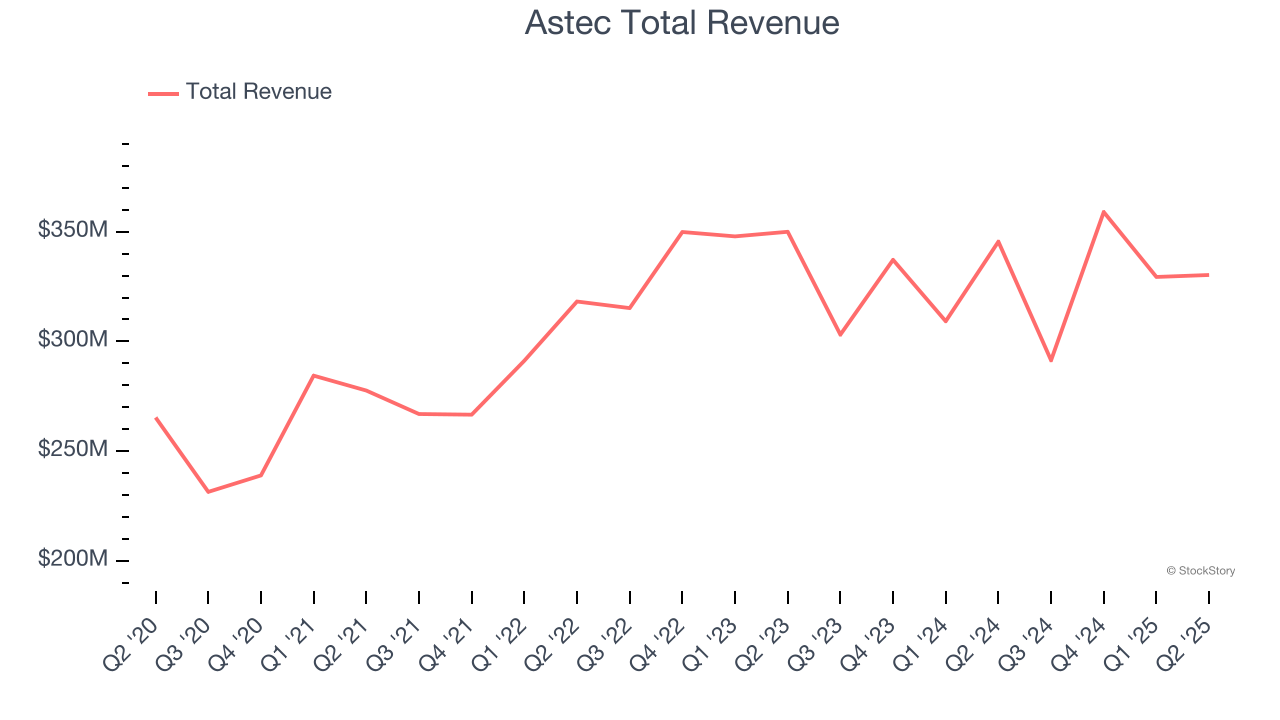

Inventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ: ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete.

Astec reported revenues of $330.3 million, down 4.4% year on year. This print fell short of analysts’ expectations by 6.7%, but it was still a strong quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

"Astec reported another strong quarter building on its strategic initiatives to deliver consistency, profitability and growth," said Jaco van der Merwe, Chief Executive Officer.

Astec delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 15.3% since reporting and currently trades at $46.55.

Is now the time to buy Astec? Access our full analysis of the earnings results here, it’s free.

Terex (NYSE: TEX)

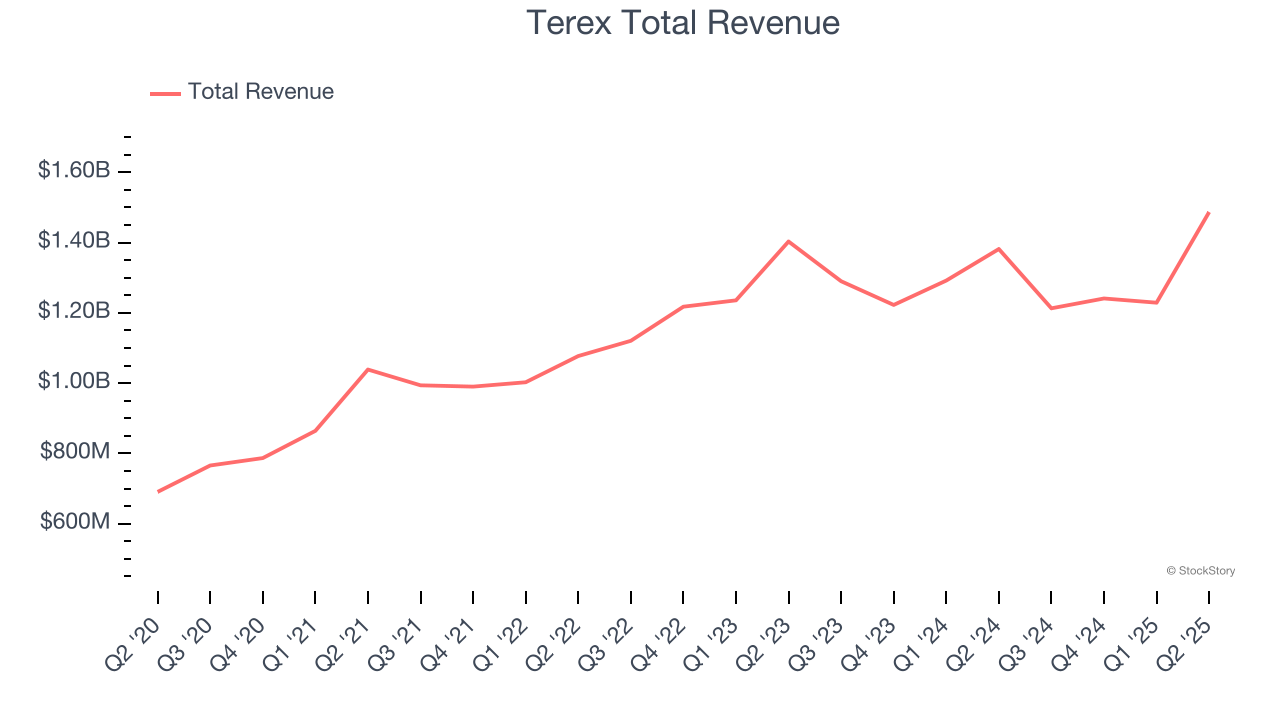

With humble beginnings as a dump truck company, Terex (NYSE: TEX) today manufactures lifting and material handling equipment designed to move and hoist heavy goods and materials.

Terex reported revenues of $1.49 billion, up 7.6% year on year, outperforming analysts’ expectations by 3.4%. The business had a satisfactory quarter with a solid beat of analysts’ organic revenue estimates but full-year EBITDA guidance missing analysts’ expectations significantly.

Terex pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.2% since reporting. It currently trades at $49.27.

Is now the time to buy Terex? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Manitowoc (NYSE: MTW)

Contracted by the United States Navy during WWII, Manitowoc (NYSE: MTW) provides cranes and lifting equipment.

Manitowoc reported revenues of $539.5 million, down 4% year on year, falling short of analysts’ expectations by 7.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Manitowoc delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 21.1% since the results and currently trades at $9.90.

Read our full analysis of Manitowoc’s results here.

Caterpillar (NYSE: CAT)

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE: CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Caterpillar reported revenues of $16.57 billion, flat year on year. This number beat analysts’ expectations by 1.2%. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

The stock is down 4.4% since reporting and currently trades at $414.99.

Read our full, actionable report on Caterpillar here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.