Ladder Capital currently trades at $10.86 per share and has shown little upside over the past six months, posting a small loss of 2.6%. The stock also fell short of the S&P 500’s 5.6% gain during that period.

Is now the time to buy Ladder Capital, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Ladder Capital Will Underperform?

We don't have much confidence in Ladder Capital. Here are three reasons why you should be careful with LADR and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

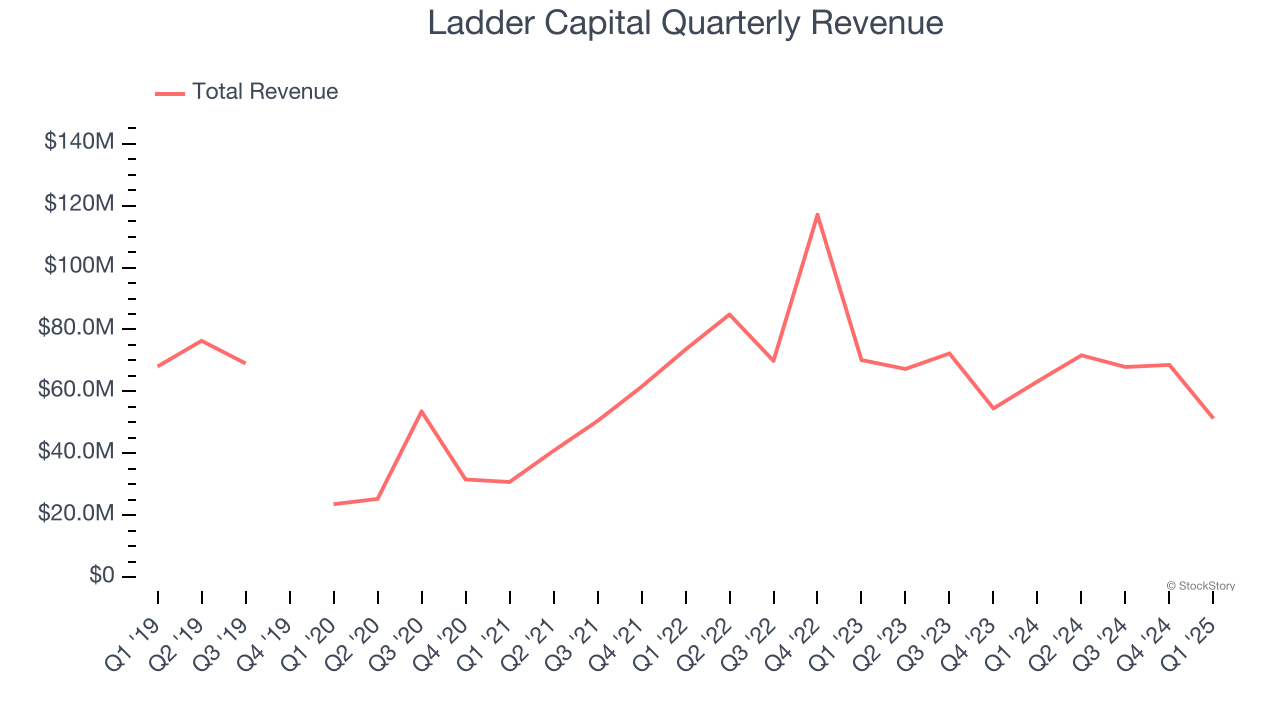

Unfortunately, Ladder Capital struggled to consistently increase demand as its $259.4 million of revenue for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. EPS Trending Down

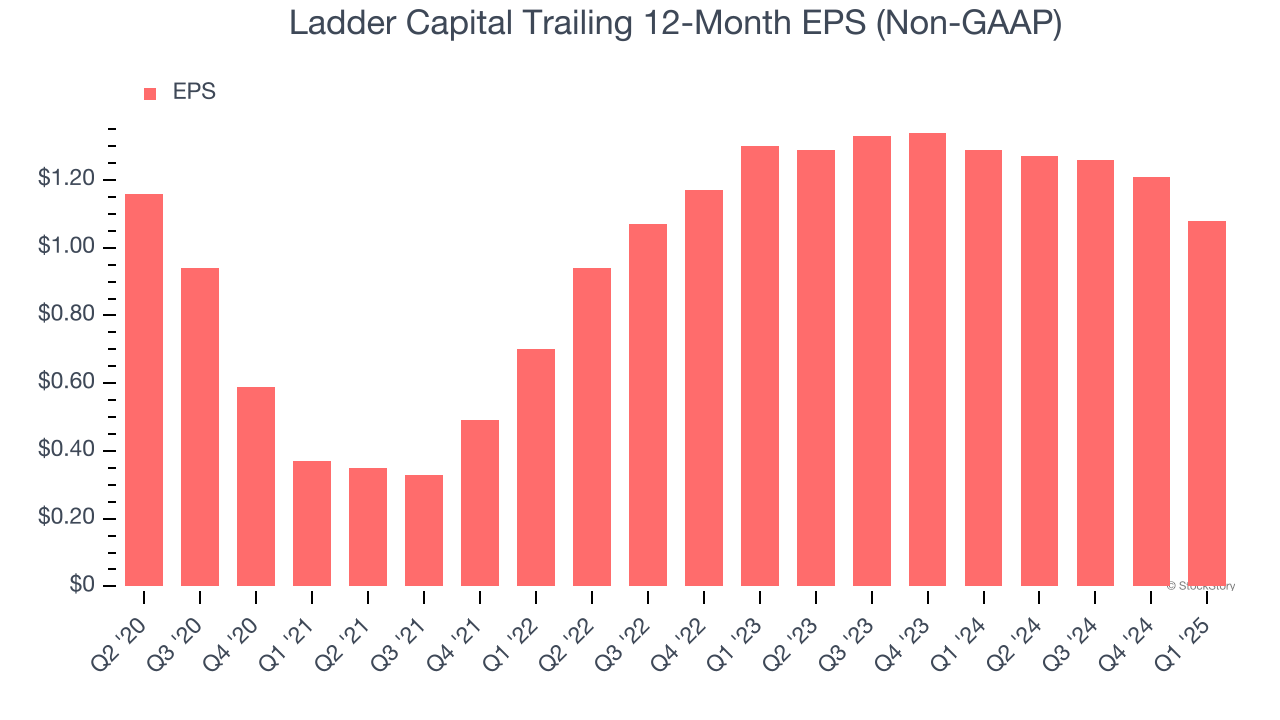

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Ladder Capital, its EPS declined by 5.8% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

3. TBVPS Has Plateaued, Reflecting Stagnating Assets

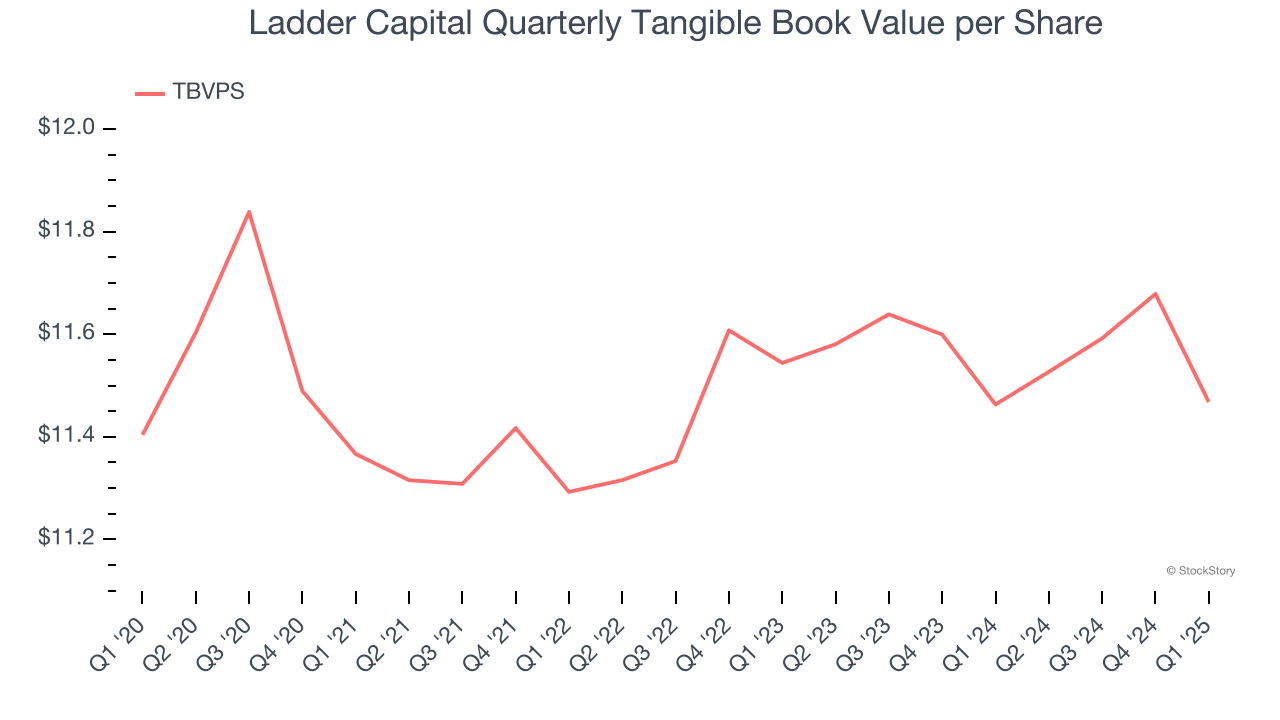

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, Ladder Capital’s TBVPS was flat over the last two years.

Final Judgment

Ladder Capital doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 0.9× forward P/B (or $10.86 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Ladder Capital

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.