PennyMac Financial Services has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 6.3% to $102.29 per share while the index has gained 7.5%.

Is PFSI a buy right now? Find out in our full research report, it’s free.

Why Does PennyMac Financial Services Spark Debate?

Founded during the 2008 financial crisis to help address the mortgage market meltdown, PennyMac Financial Services (NYSE: PFSI) is a specialty financial services company that originates, services, and manages investments related to residential mortgage loans in the United States.

Two Things to Like:

1. EPS Moving Up Steadily

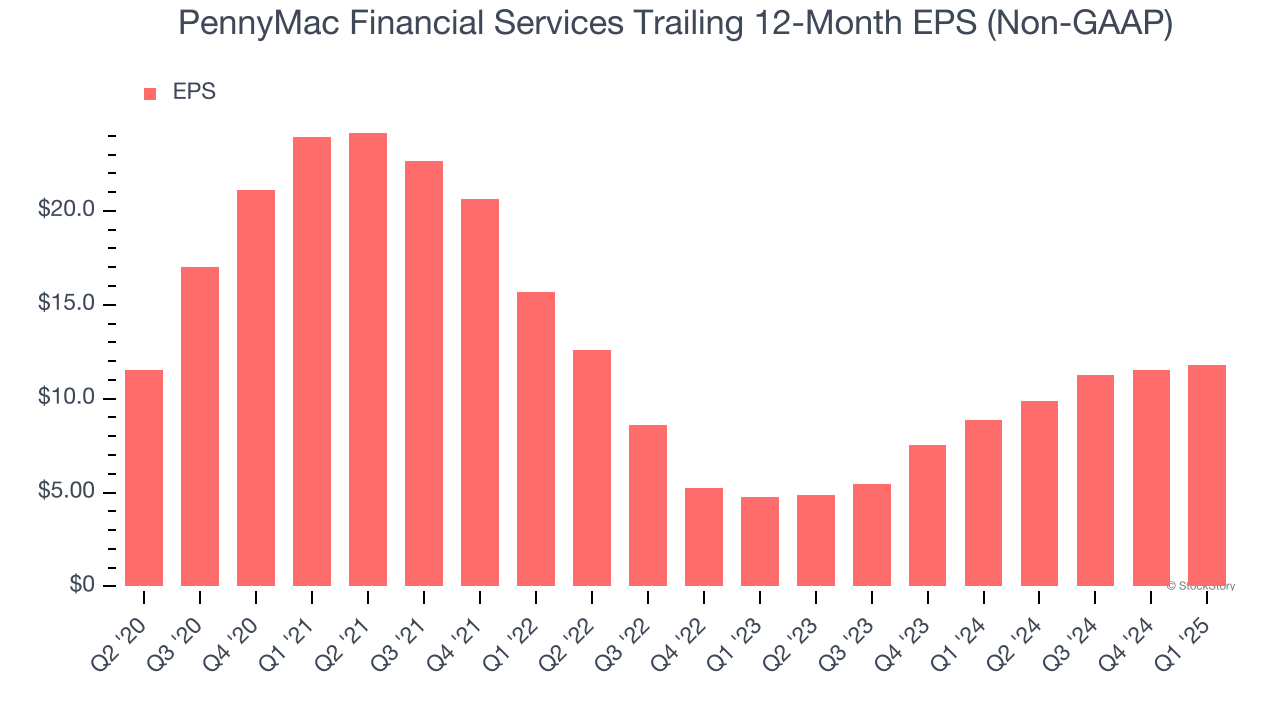

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

PennyMac Financial Services’s EPS grew at a decent 5.1% compounded annual growth rate over the last five years, higher than its 2.5% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

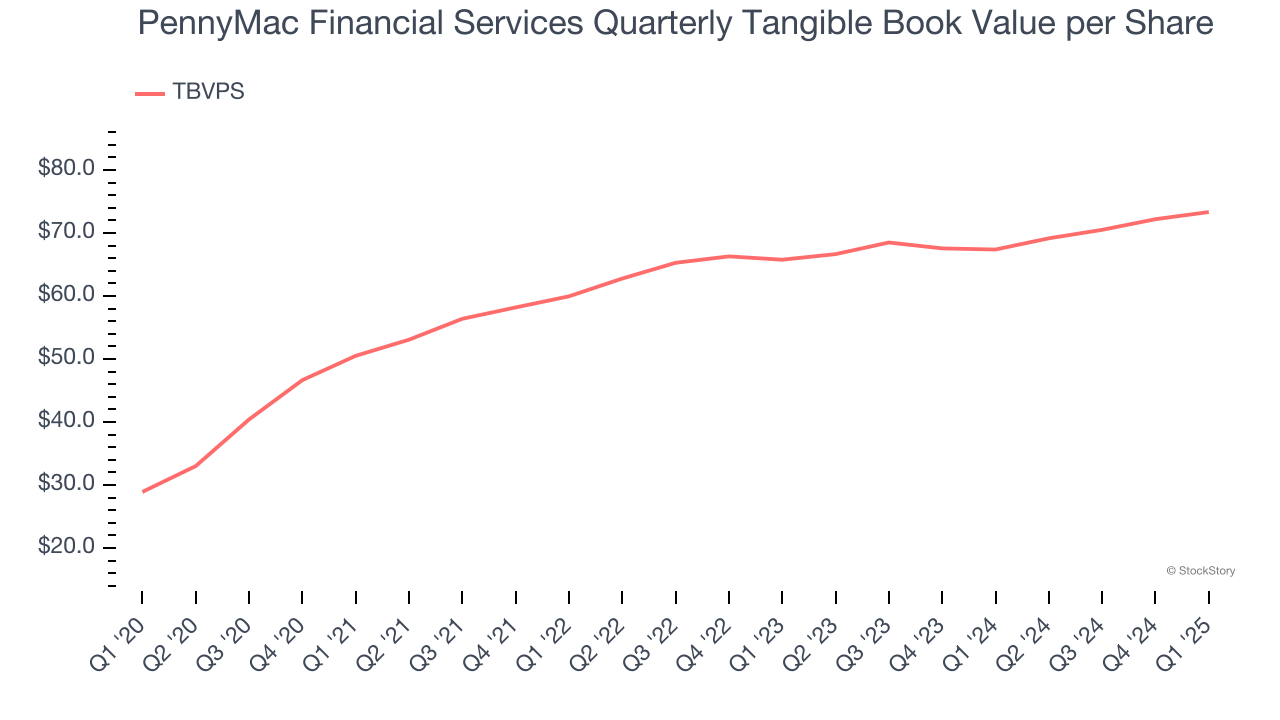

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although PennyMac Financial Services’s TBVPS increased by 20.5% annually over the last five years, growth has recently decelerated to a sluggish 5.6% over the past two years (from $65.76 to $73.32 per share).

One Reason to be Careful:

Revenue Spiraling Downwards

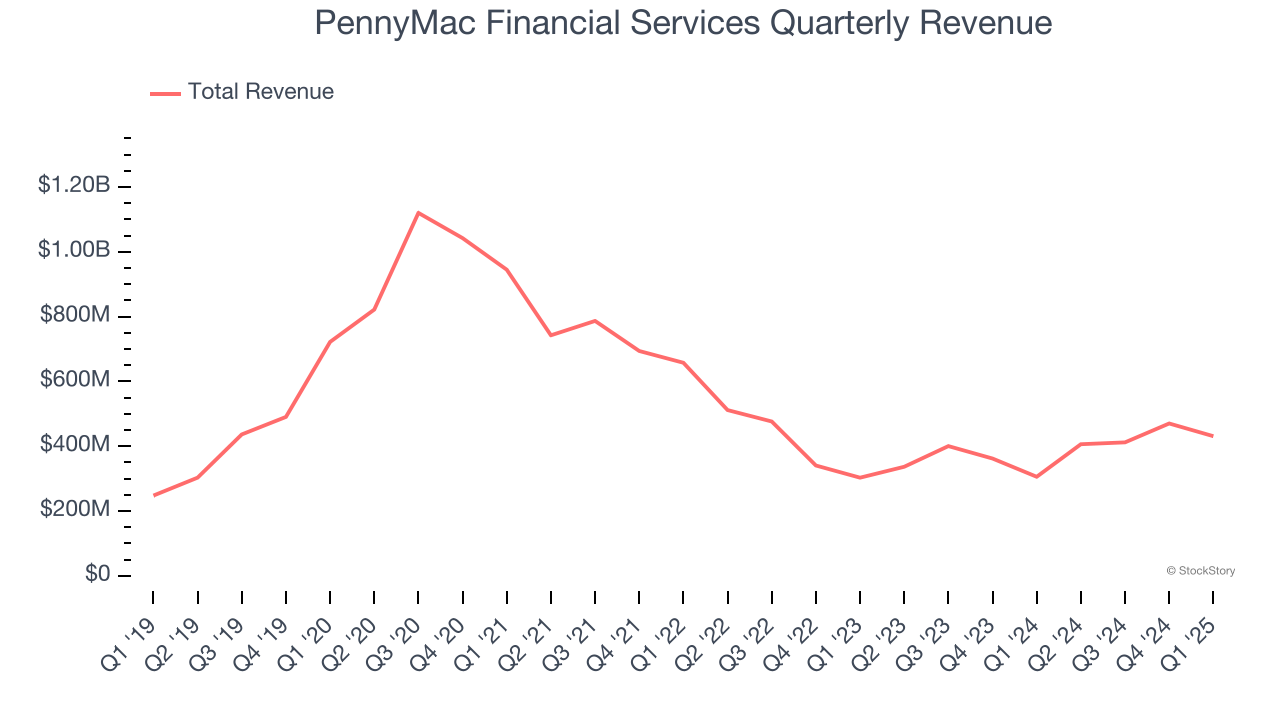

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Over the last five years, PennyMac Financial Services’s demand was weak and its revenue declined by 2.5% per year. This wasn’t a great result, but there are still things to like about PennyMac Financial Services.

Final Judgment

PennyMac Financial Services’s positive characteristics outweigh the negatives, but at $102.29 per share (or 1.2× forward P/B), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than PennyMac Financial Services

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.