Pathward Financial currently trades at $83.75 and has been a dream stock for shareholders. It’s returned 377% since July 2020, blowing past the S&P 500’s 96.5% gain. The company has also beaten the index over the past six months as its stock price is up 16% thanks to its solid quarterly results.

Is now still a good time to buy CASH? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is CASH a Good Business?

Formerly known as Meta Financial until its 2022 rebranding, Pathward Financial (NASDAQ: CASH) provides banking-as-a-service solutions and commercial finance products, enabling partners to offer financial services like prepaid cards, payment processing, and lending options.

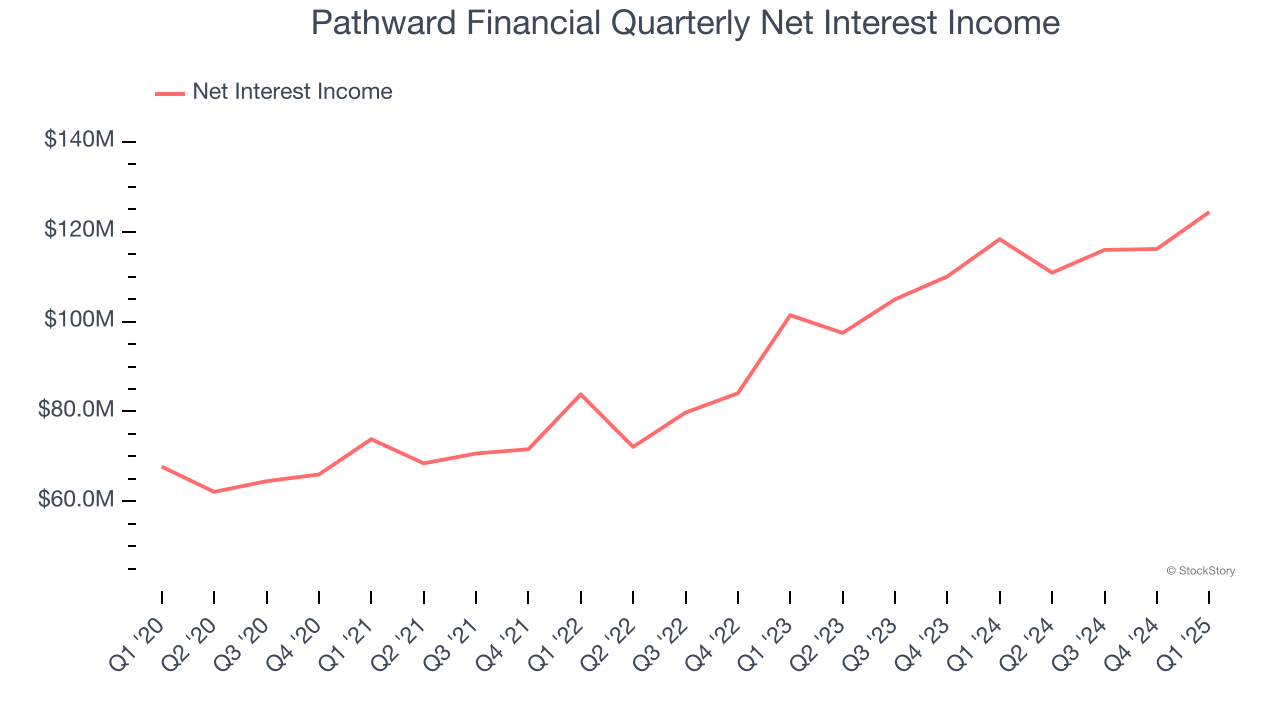

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Pathward Financial’s net interest income has grown at a 15.1% annualized rate over the last four years, better than the broader bank industry.

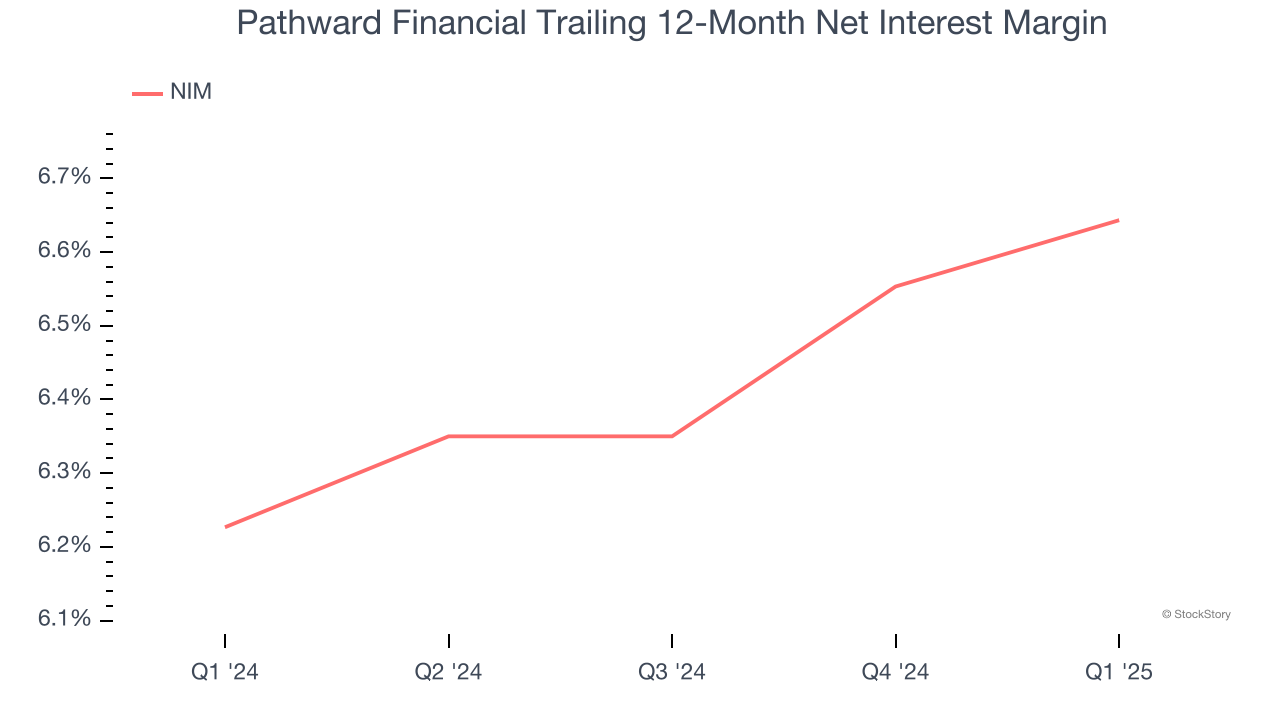

2. Elite Net Interest Margin Powers Best-In-Class Loan Book

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that Pathward Financial’s net interest margin averaged an elite 6.4%, indicating the company has a high-yielding loan book and a low cost of funds.

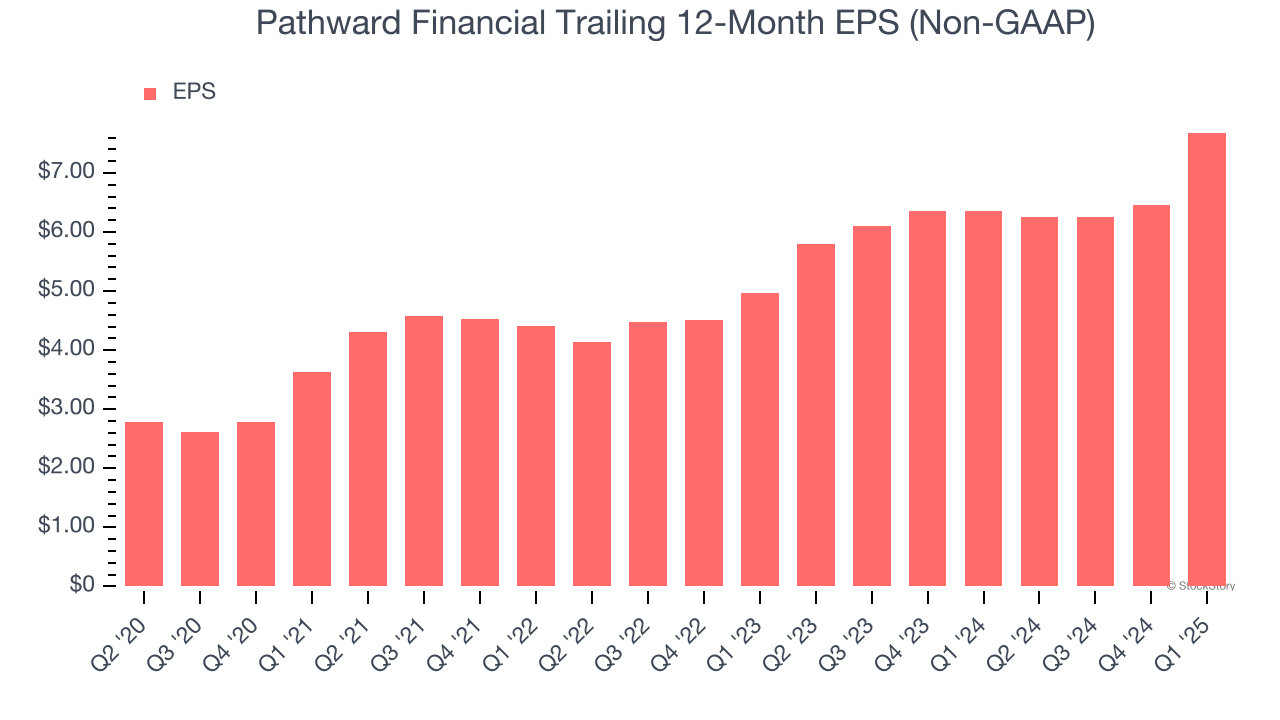

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Pathward Financial’s EPS grew at an astounding 21.6% compounded annual growth rate over the last five years, higher than its 9.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why Pathward Financial is one of the best bank companies out there, and with its shares outperforming the market lately, the stock trades at 2.3× forward P/B (or $83.75 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.