Stock photography and footage provider Shutterstock (NYSE: SSTK) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 13.2% year on year to $242.6 million. Its non-GAAP profit of $1.03 per share was 1.4% below analysts’ consensus estimates.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it’s free.

Shutterstock (SSTK) Q1 CY2025 Highlights:

- Revenue: $242.6 million vs analyst estimates of $253 million (13.2% year-on-year growth, 4.1% miss)

- Adjusted EPS: $1.03 vs analyst expectations of $1.05 (1.4% miss)

- Adjusted EBITDA: $63.36 million vs analyst estimates of $64.73 million (26.1% margin, 2.1% miss)

- Operating Margin: 4.2%, down from 7.8% in the same quarter last year

- Free Cash Flow was $14.44 million, up from -$952,000 in the previous quarter

- Paid Downloads: 120.9 million, up 85.9 million year on year

- Market Capitalization: $573.3 million

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

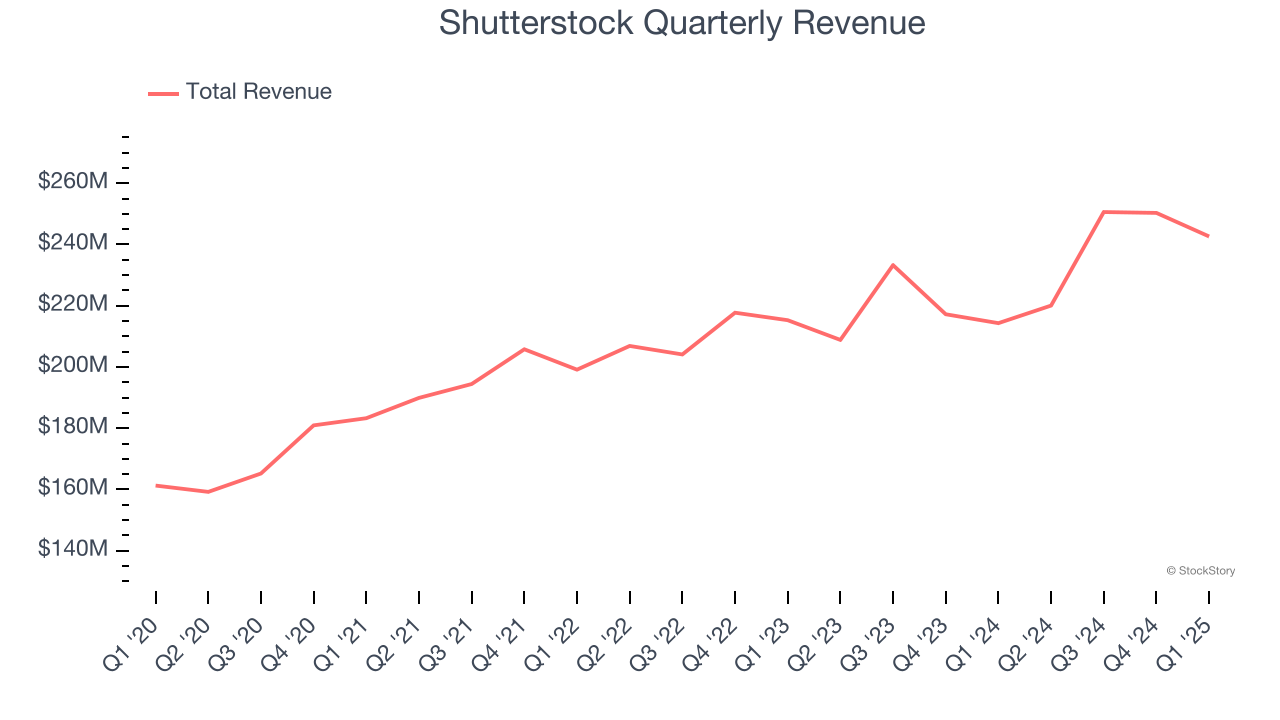

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Shutterstock grew its sales at a tepid 6.9% compounded annual growth rate. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Shutterstock’s revenue grew by 13.2% year on year to $242.6 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Paid Downloads

Request Growth

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock’s paid downloads, a key performance metric for the company, increased by 46.6% annually to 120.9 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q1, Shutterstock added 85.9 million paid downloads, leading to 245% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating request growth.

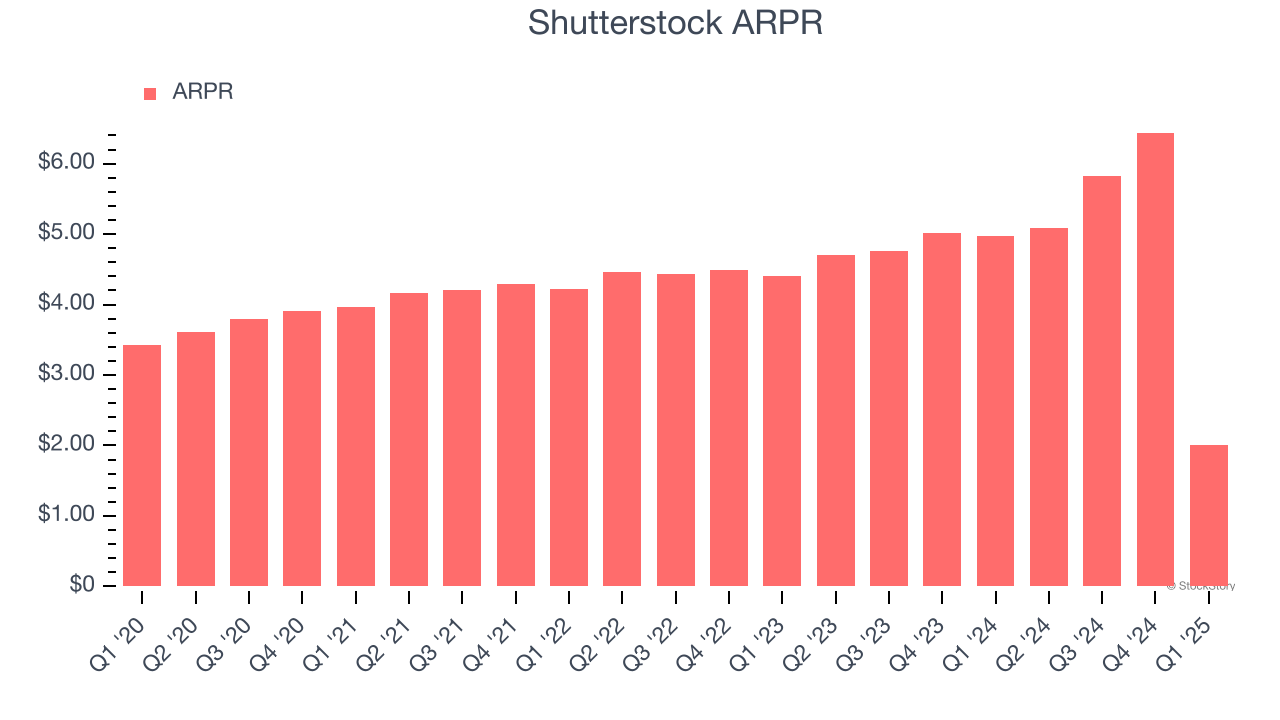

Revenue Per Request

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR growth has been mediocre over the last two years, averaging 4.6%. This isn’t great, but the increase in paid downloads is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Shutterstock tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

This quarter, Shutterstock’s ARPR clocked in at $2.01. It declined 59.6% year on year, worse than the change in its paid downloads.

Key Takeaways from Shutterstock’s Q1 Results

We were impressed by how significantly Shutterstock blew past analysts’ number of paid downloads expectations this quarter. We were also glad it expanded its number of requests. On the other hand, its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 1.7% to $16.75 immediately following the results.

So do we think Shutterstock is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.