Griffon currently trades at $69.07 and has been a dream stock for shareholders. It’s returned 316% since May 2020, more than tripling the S&P 500’s 96.9% gain. The company has also beaten the index over the past six months as its stock price is up 8.7% thanks to its solid quarterly results.

Is there a buying opportunity in Griffon, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Griffon Not Exciting?

Despite the momentum, we don't have much confidence in Griffon. Here are two reasons why GFF doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

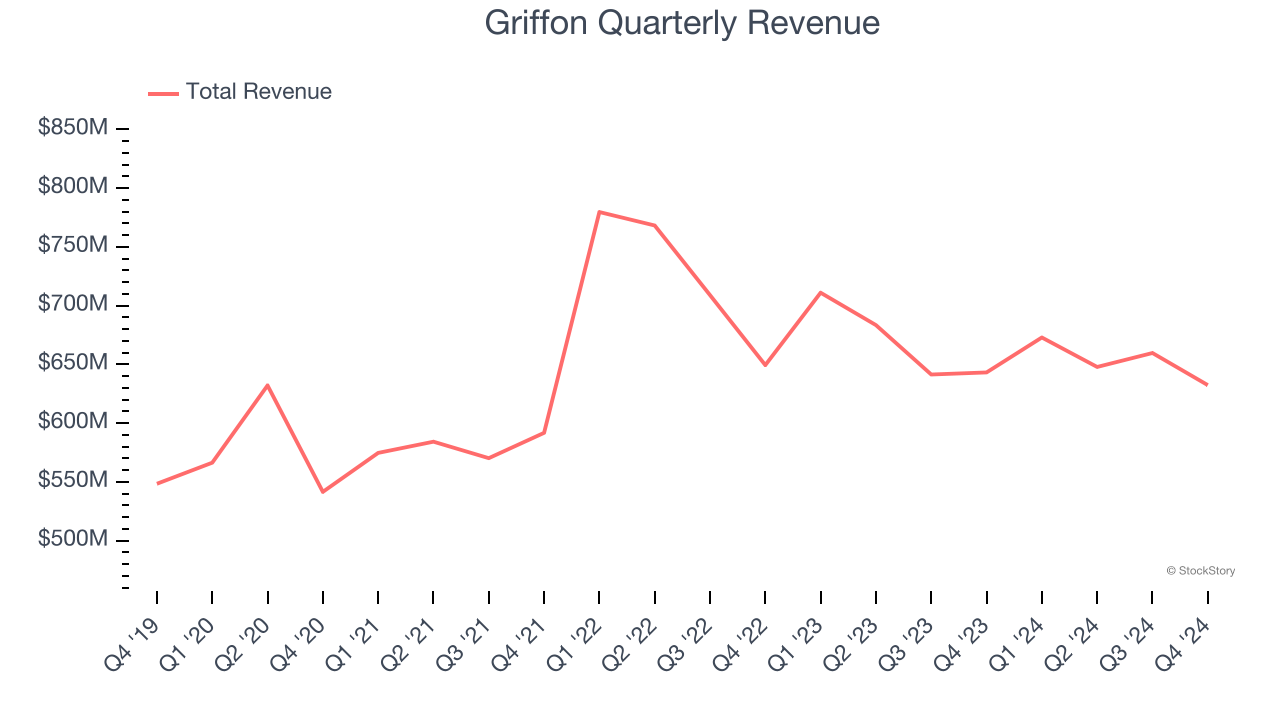

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Griffon grew its sales at a sluggish 3.1% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Griffon’s revenue to rise by 1.4%. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Final Judgment

Griffon isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 12× forward P/E (or $69.07 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Griffon

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today.