Shareholders of Agilysys would probably like to forget the past six months even happened. The stock dropped 25.2% and now trades at $77.01. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Agilysys, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Agilysys Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Agilysys. Here are two reasons why AGYS doesn't excite us and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

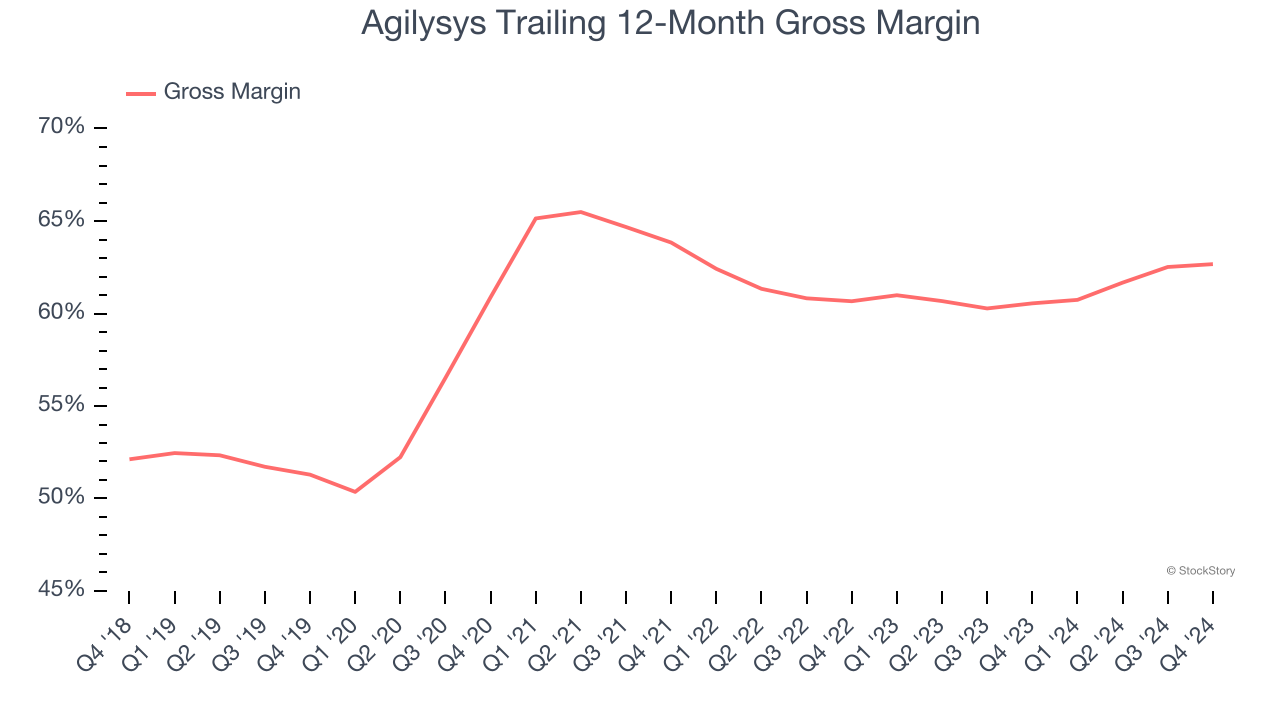

For software companies like Agilysys, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Agilysys’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 62.7% gross margin over the last year. Said differently, Agilysys had to pay a chunky $37.32 to its service providers for every $100 in revenue.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Agilysys’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 21% for the last 12 months will decrease to 16.7%.

Final Judgment

Agilysys isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 6.9× forward price-to-sales (or $77.01 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks That Overcame Trump’s 2018 Tariffs

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.