Digital transformation consultancy Grid Dynamics (NASDAQ: GDYN) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 25.8% year on year to $100.4 million. The company expects next quarter’s revenue to be around $101 million, close to analysts’ estimates. Its non-GAAP profit of $0.11 per share was 24.9% above analysts’ consensus estimates.

Is now the time to buy Grid Dynamics? Find out by accessing our full research report, it’s free.

Grid Dynamics (GDYN) Q1 CY2025 Highlights:

- Revenue: $100.4 million vs analyst estimates of $98.44 million (25.8% year-on-year growth, 2% beat)

- Adjusted EPS: $0.11 vs analyst estimates of $0.09 (24.9% beat)

- Adjusted EBITDA: $14.61 million vs analyst estimates of $13.02 million (14.5% margin, 12.2% beat)

- The company reconfirmed its revenue guidance for the full year of $425 million at the midpoint

- EBITDA guidance for Q2 CY2025 is $13 million at the midpoint, below analyst estimates of $14.9 million

- Operating Margin: -2%, up from -6.9% in the same quarter last year

- Market Capitalization: $1.19 billion

“For 2025, we are maintaining our full year revenue outlook that we provided to you all in February. We expect the second half of the year to show stronger performance, driven by the ramp-up of several recently signed contracts and continued execution across our active project portfolio. While we must navigate the uncertainties of the current global economic environment, I am confident that Grid Dynamics will continue to uphold the qualities that set us apart. We are building strong momentum across our business and I look forward to giving you an update on the next earnings call,” said Leonard Livschitz, CEO.

Company Overview

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ: GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $371.2 million in revenue over the past 12 months, Grid Dynamics is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

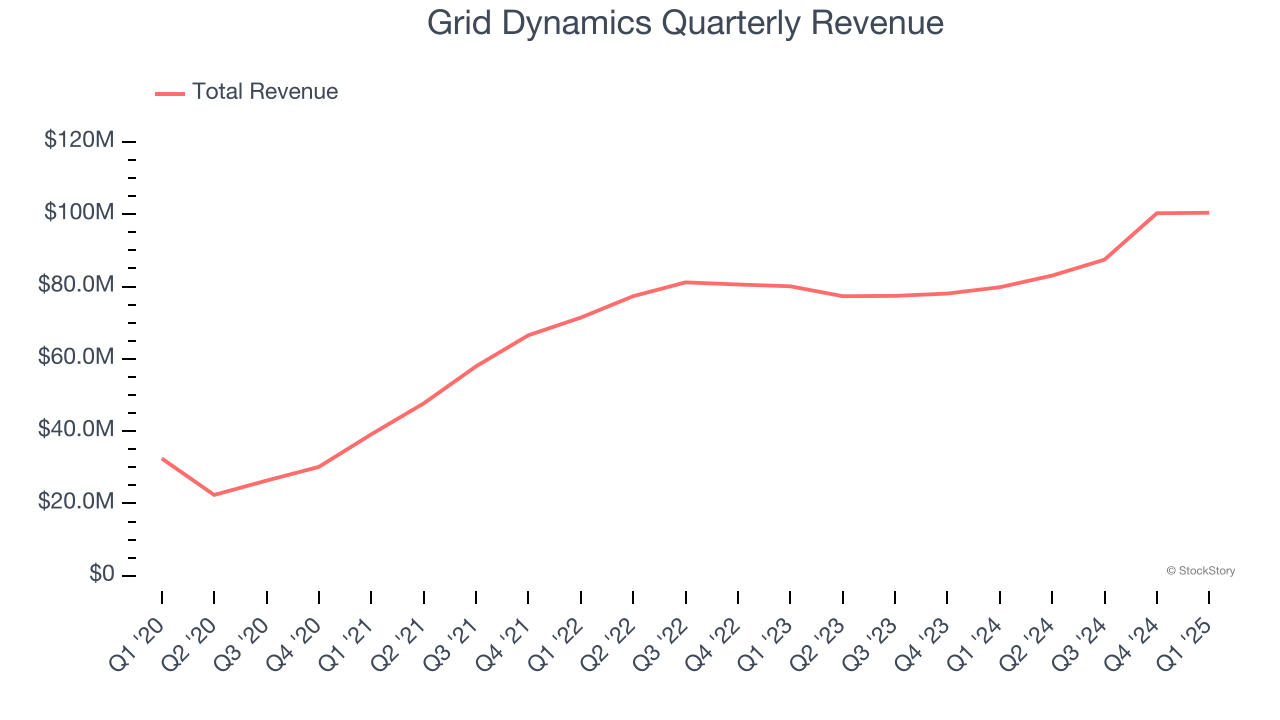

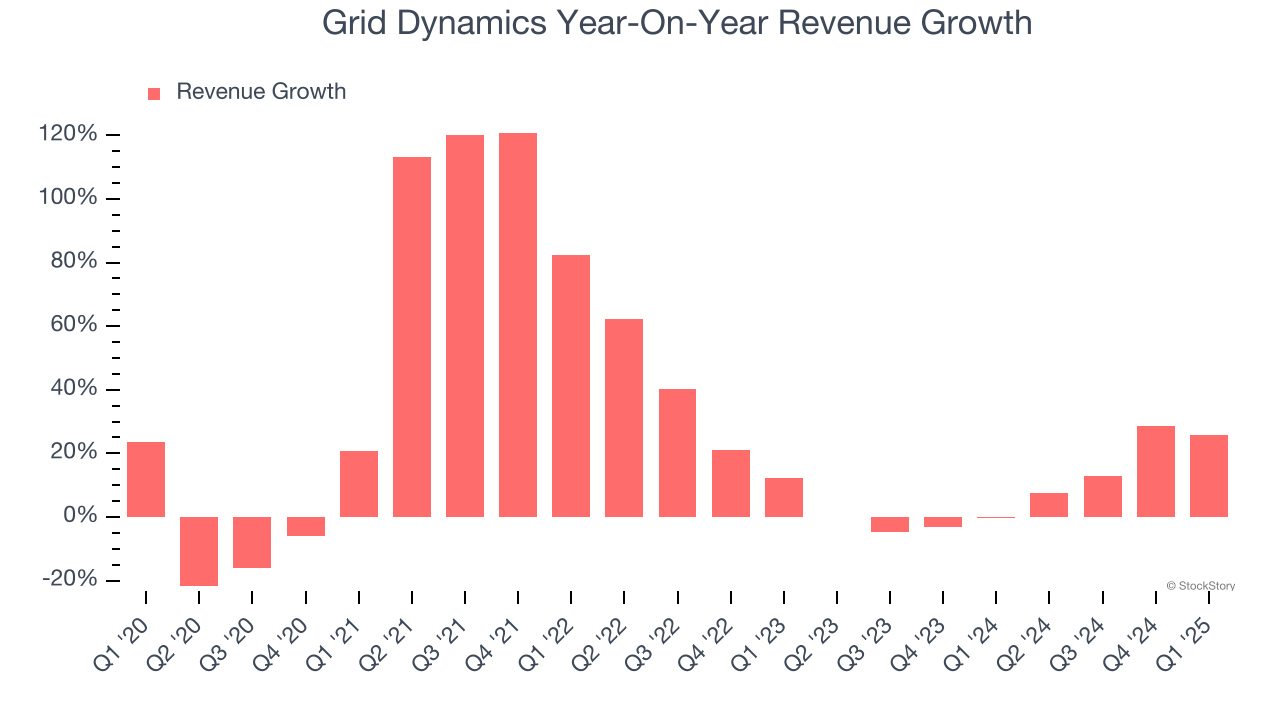

As you can see below, Grid Dynamics’s sales grew at an incredible 24.4% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Grid Dynamics’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Grid Dynamics’s annualized revenue growth of 7.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Grid Dynamics reported robust year-on-year revenue growth of 25.8%, and its $100.4 million of revenue topped Wall Street estimates by 2%. Company management is currently guiding for a 21.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

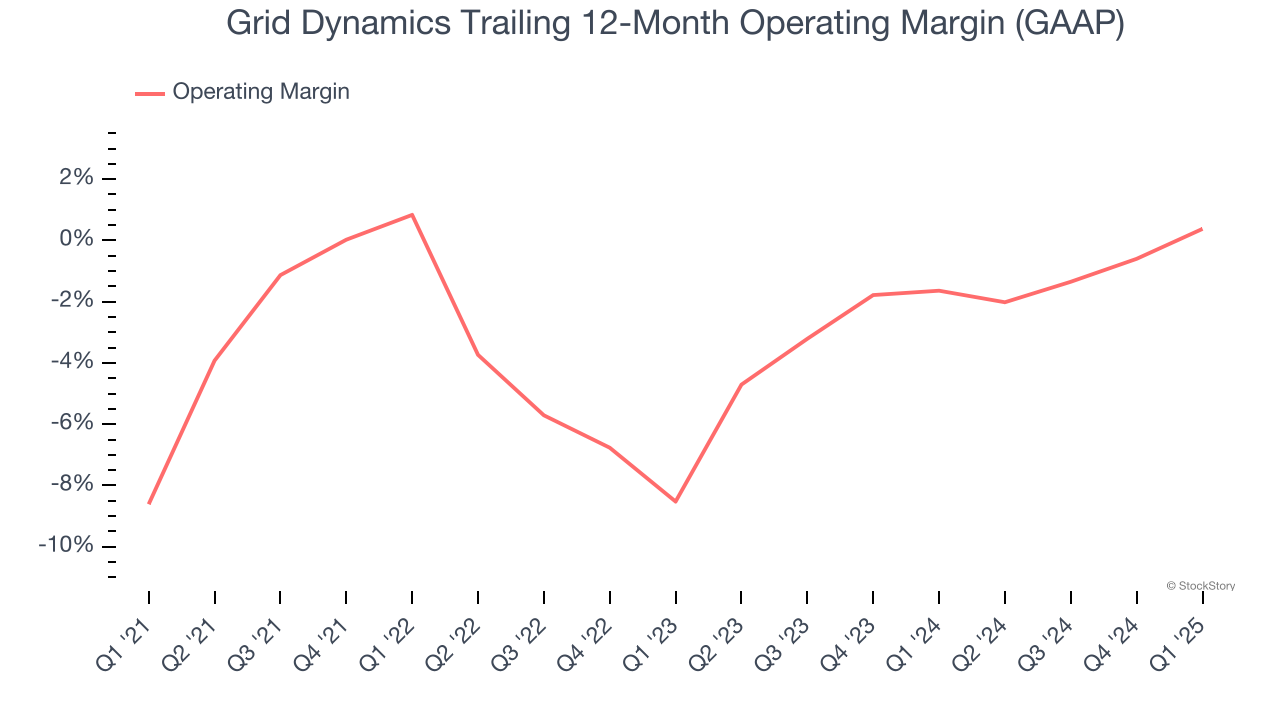

Grid Dynamics’s high expenses have contributed to an average operating margin of negative 2.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Grid Dynamics’s operating margin rose by 9 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Grid Dynamics’s operating margin was negative 2% this quarter.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

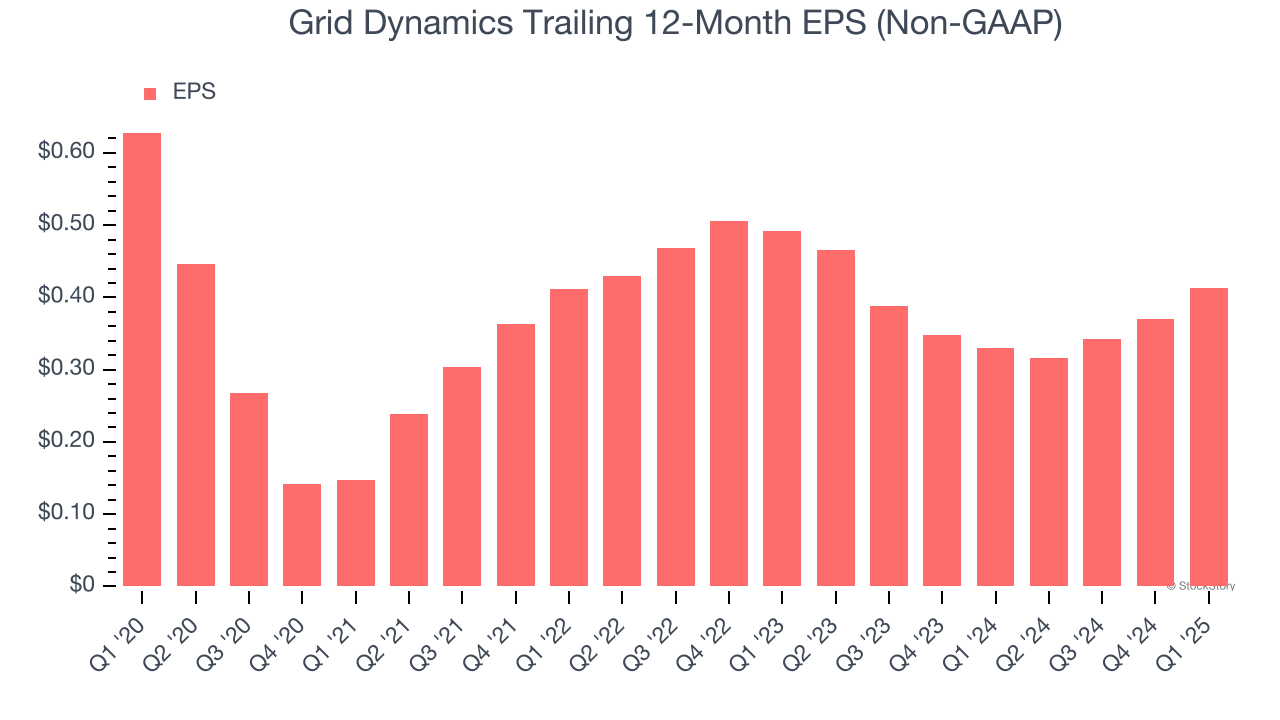

Sadly for Grid Dynamics, its EPS declined by 8.1% annually over the last five years while its revenue grew by 24.4%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

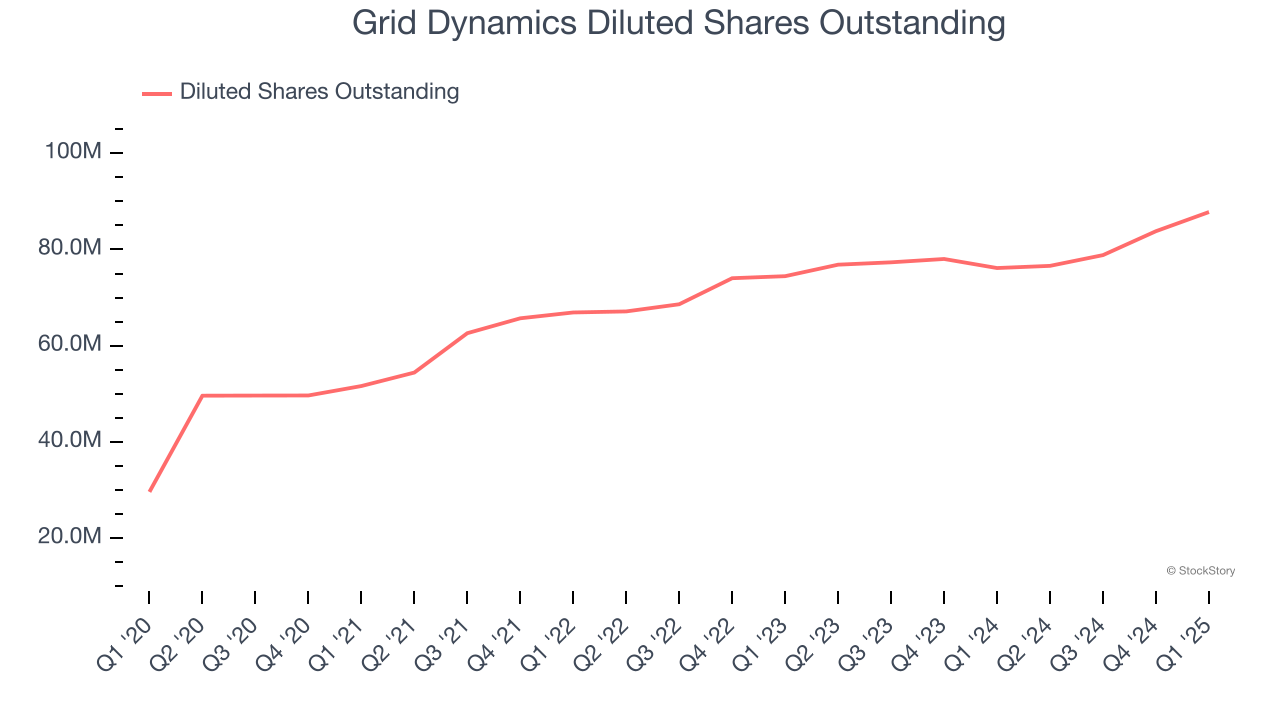

Diving into the nuances of Grid Dynamics’s earnings can give us a better understanding of its performance. A five-year view shows Grid Dynamics has diluted its shareholders, growing its share count by 196%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Grid Dynamics reported EPS at $0.11, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Grid Dynamics to perform poorly. Analysts forecast its full-year EPS of $0.41 will hit $0.42.

Key Takeaways from Grid Dynamics’s Q1 Results

We were impressed by how significantly Grid Dynamics blew past analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $14.04 immediately after reporting.

So do we think Grid Dynamics is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.