IT project management software company, Atlassian (NASDAQ: TEAM) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 14.1% year on year to $1.36 billion. The company expects next quarter’s revenue to be around $1.35 billion, close to analysts’ estimates. Its non-GAAP profit of $0.97 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Atlassian? Find out by accessing our full research report, it’s free.

Atlassian (TEAM) Q1 CY2025 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.35 billion (14.1% year-on-year growth, in line)

- Adjusted EPS: $0.97 vs analyst estimates of $0.93 (4.9% beat)

- Adjusted Operating Income: $348.3 million vs analyst estimates of $321.6 million (25.7% margin, 8.3% beat)

- Revenue Guidance for Q2 CY2025 is $1.35 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -0.9%, down from 1.5% in the same quarter last year

- Free Cash Flow Margin: 47%, up from 26.6% in the previous quarter

- Billings: $1.53 billion at quarter end, up 2.5% year on year

- Market Capitalization: $59.82 billion

“I am filled with immense pride as I reflect on Team ’25 and our customers’ and partners’ reactions to our relentless focus on innovation,” said Mike Cannon-Brookes, Atlassian’s CEO and co-Founder.

Company Overview

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ: TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

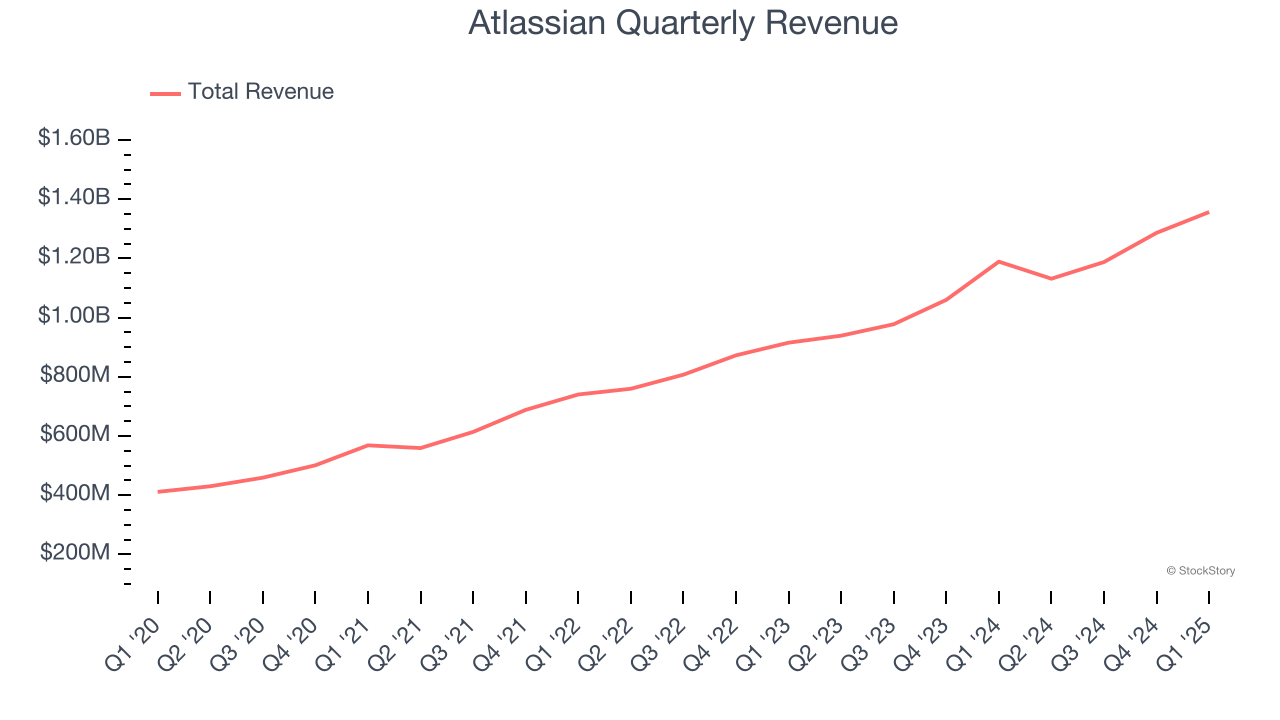

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Atlassian’s sales grew at a solid 24% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Atlassian’s year-on-year revenue growth was 14.1%, and its $1.36 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 19.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and indicates the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

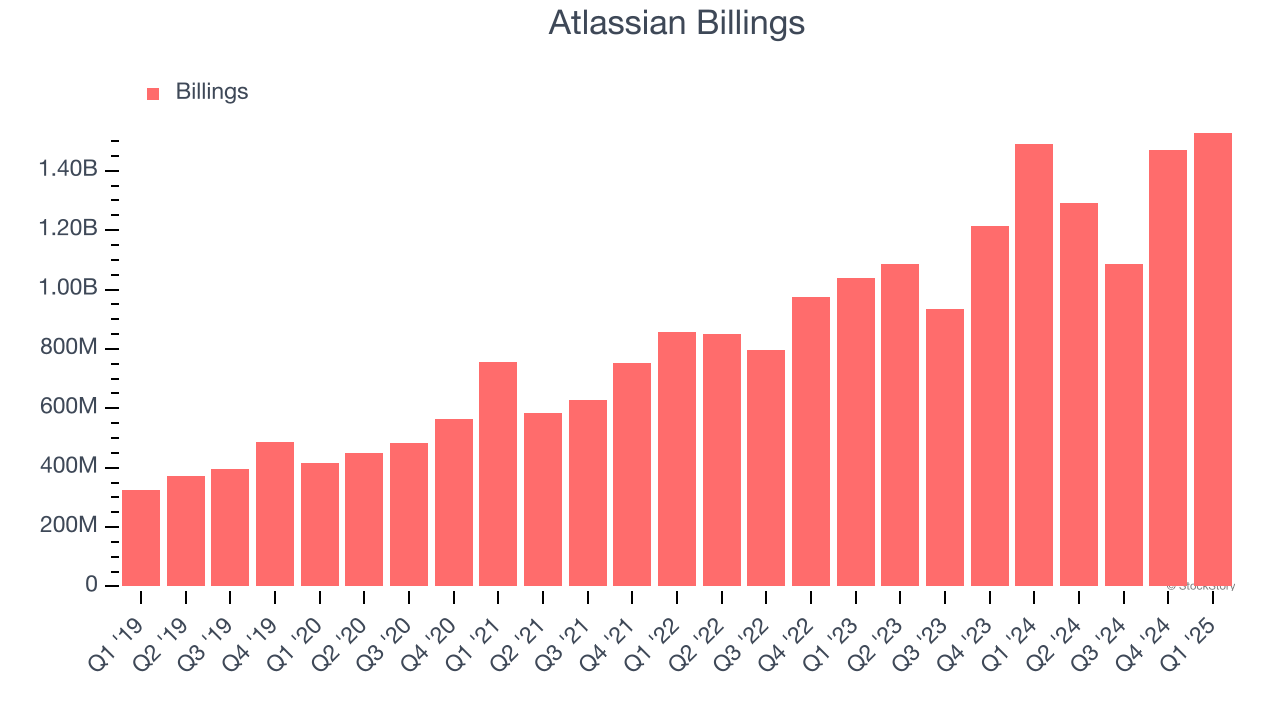

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Atlassian’s billings punched in at $1.53 billion in Q1, and over the last four quarters, its growth was solid as it averaged 14.7% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Atlassian is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.1 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Atlassian more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Atlassian’s Q1 Results

We struggled to find many positives in these results as its revenue guidance was only in line. Overall, this was a softer quarter. The stock traded down 15.7% to $192.95 immediately following the results.

Atlassian’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.