Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Commercial Vehicle Group (NASDAQ: CVGI) and the best and worst performers in the heavy transportation equipment industry.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 14 heavy transportation equipment stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

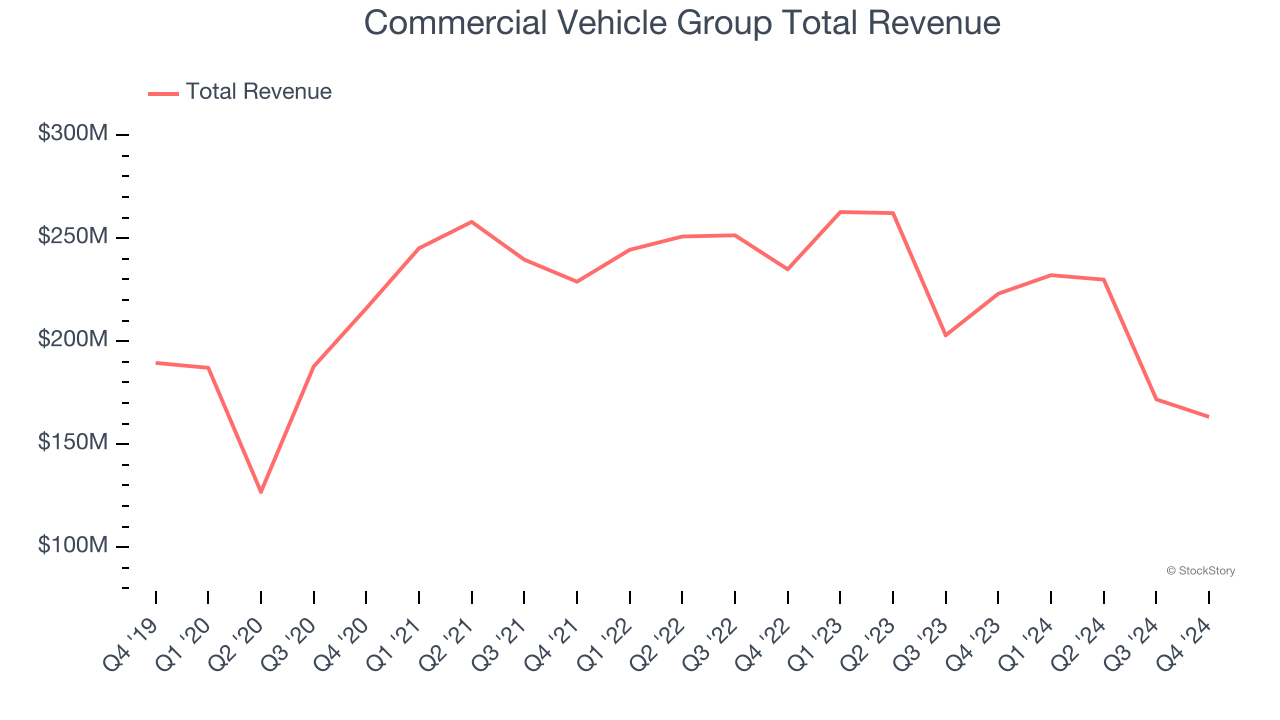

Commercial Vehicle Group (NASDAQ: CVGI)

Formed from a partnership between two distinct companies, CVG (NASDAQ: CVGI) offers various components used in vehicles and systems used in warehouses.

Commercial Vehicle Group reported revenues of $163.3 million, down 26.8% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

James Ray, President and Chief Executive Officer, said, “2024 was a year of meaningful change for CVG. Over the course of the year, we undertook immediate and decisive actions, including the divestitures of non-strategic assets and businesses, and improvement initiatives that we believe position us for future accretive growth. Even in the face of continued external market headwinds, we believe the improvement initiatives executed in 2024 will unlock significant operational efficiencies that we have already started to benefit from in 2025. Additionally, we were pleased to open our new Morocco facility and we continue to ramp up our facility in Aldama, Mexico.”

The stock is down 51.1% since reporting and currently trades at $0.92.

Is now the time to buy Commercial Vehicle Group? Access our full analysis of the earnings results here, it’s free.

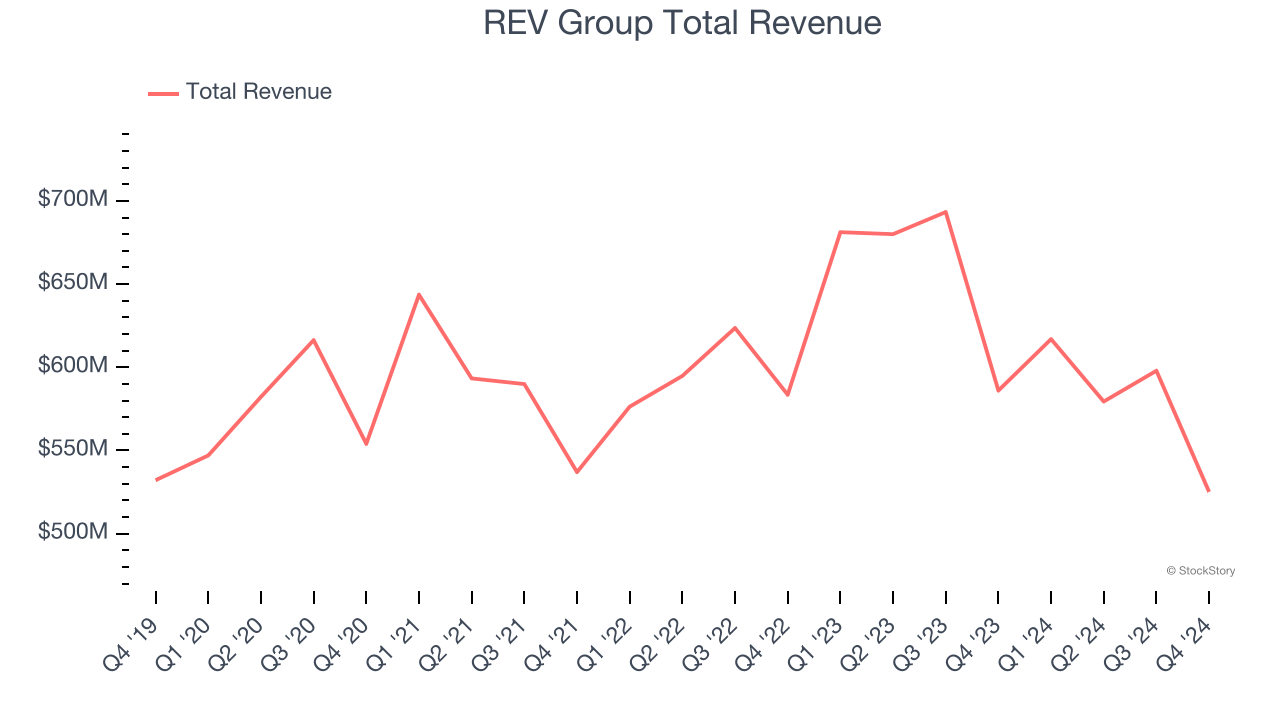

Best Q4: REV Group (NYSE: REVG)

Offering the first full-electric North American fire truck, REV (NYSE: REVG) manufactures and sells specialty vehicles.

REV Group reported revenues of $525.1 million, down 10.4% year on year, outperforming analysts’ expectations by 6.5%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 24.1% since reporting. It currently trades at $33.85.

Is now the time to buy REV Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Greenbrier (NYSE: GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $762.1 million, down 11.7% year on year, falling short of analysts’ expectations by 15.2%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and a significant miss of analysts’ adjusted operating income estimates.

Greenbrier delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 6.8% since the results and currently trades at $41.69.

Read our full analysis of Greenbrier’s results here.

Federal Signal (NYSE: FSS)

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE: FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

Federal Signal reported revenues of $472 million, up 5.3% year on year. This result lagged analysts' expectations by 2.4%. Overall, it was a slower quarter as it also produced a significant miss of analysts’ adjusted operating income estimates and a miss of analysts’ backlog estimates.

The stock is down 14.4% since reporting and currently trades at $77.71.

Read our full, actionable report on Federal Signal here, it’s free.

PACCAR (NASDAQ: PCAR)

Founded more than a century ago, PACCAR (NASDAQ: PCAR) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

PACCAR reported revenues of $7.36 billion, down 14.3% year on year. This number came in 1.3% below analysts' expectations. It was a slower quarter as it also logged a miss of analysts’ EPS estimates.

The stock is down 16.3% since reporting and currently trades at $91.90.

Read our full, actionable report on PACCAR here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.