Outdoor equipment company Toro (NYSE: TTC) announced better-than-expected revenue in Q3 CY2025, but sales were flat year on year at $1.07 billion. Its non-GAAP profit of $0.91 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy The Toro Company? Find out by accessing our full research report, it’s free for active Edge members.

The Toro Company (TTC) Q3 CY2025 Highlights:

- Revenue: $1.07 billion vs analyst estimates of $1.05 billion (flat year on year, 2% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.87 (4.2% beat)

- Adjusted EBITDA: $135.8 million vs analyst estimates of $148.6 million (12.7% margin, 8.6% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.43 at the midpoint, missing analyst estimates by 4.5%

- Operating Margin: 8.7%, down from 10.1% in the same quarter last year

- Free Cash Flow Margin: 26.9%, up from 18.6% in the same quarter last year

- Market Capitalization: $7.11 billion

“We delivered fourth quarter and full-year performance that exceeded our expectations, driven by strength in our Professional segment and strategic investments in productivity improvement measures,” said Richard M. Olson, chairman and chief executive officer.

Company Overview

Ceasing all production to support the war effort during World War II, Toro (NYSE: TTC) offers outdoor equipment for residential, commercial, and agricultural use.

Revenue Growth

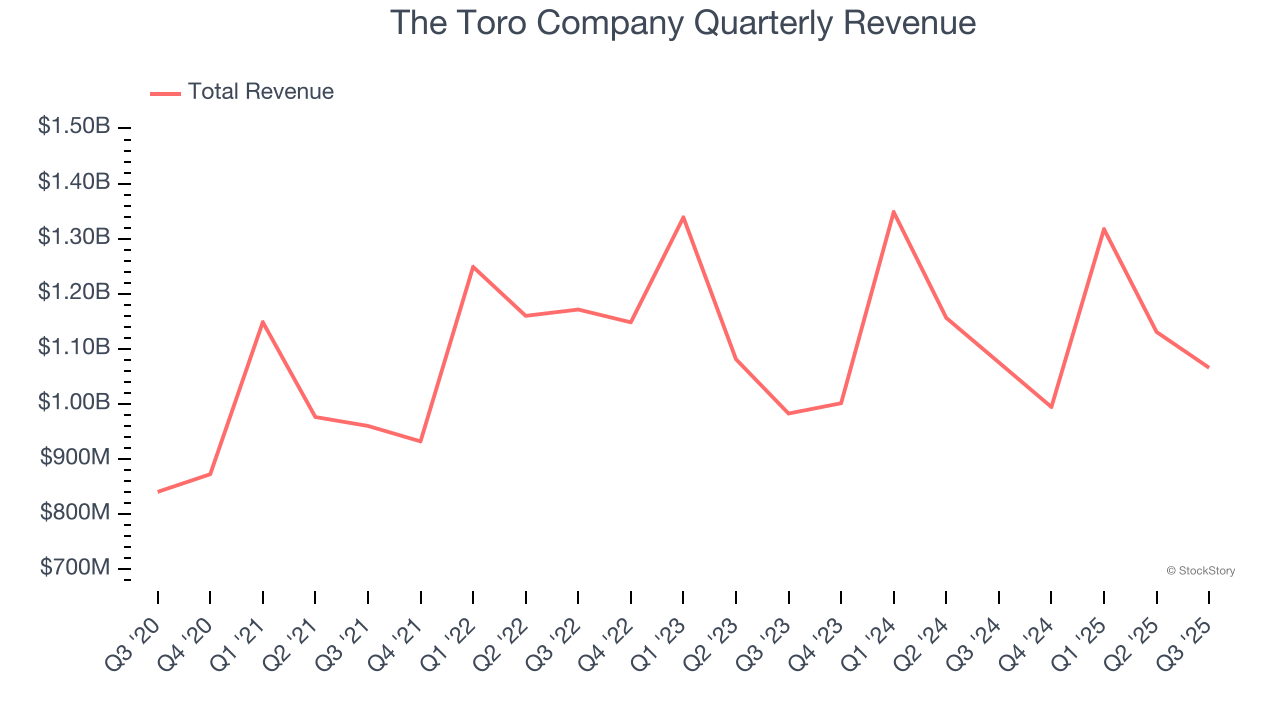

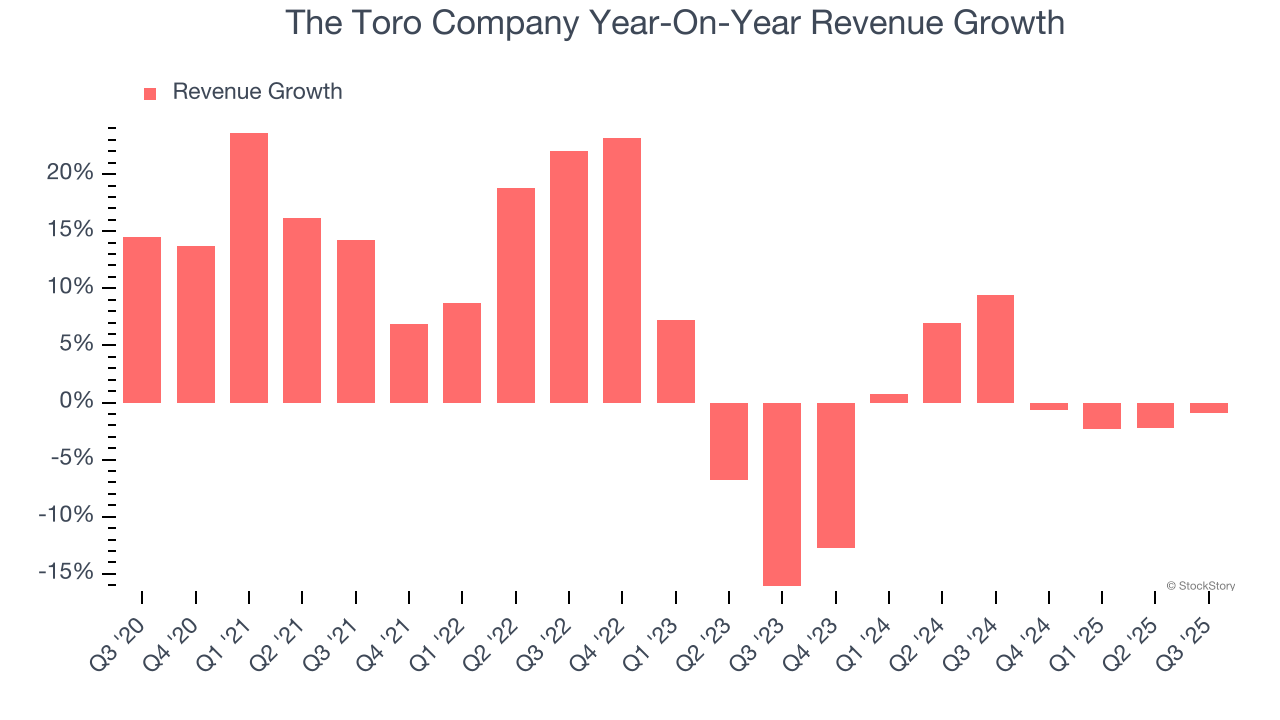

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, The Toro Company grew its sales at a tepid 5.9% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. The Toro Company’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Agricultural Machinery businesses have faced declining sales because of cyclical headwinds. While The Toro Company’s growth wasn’t the best, it did do better than its peers.

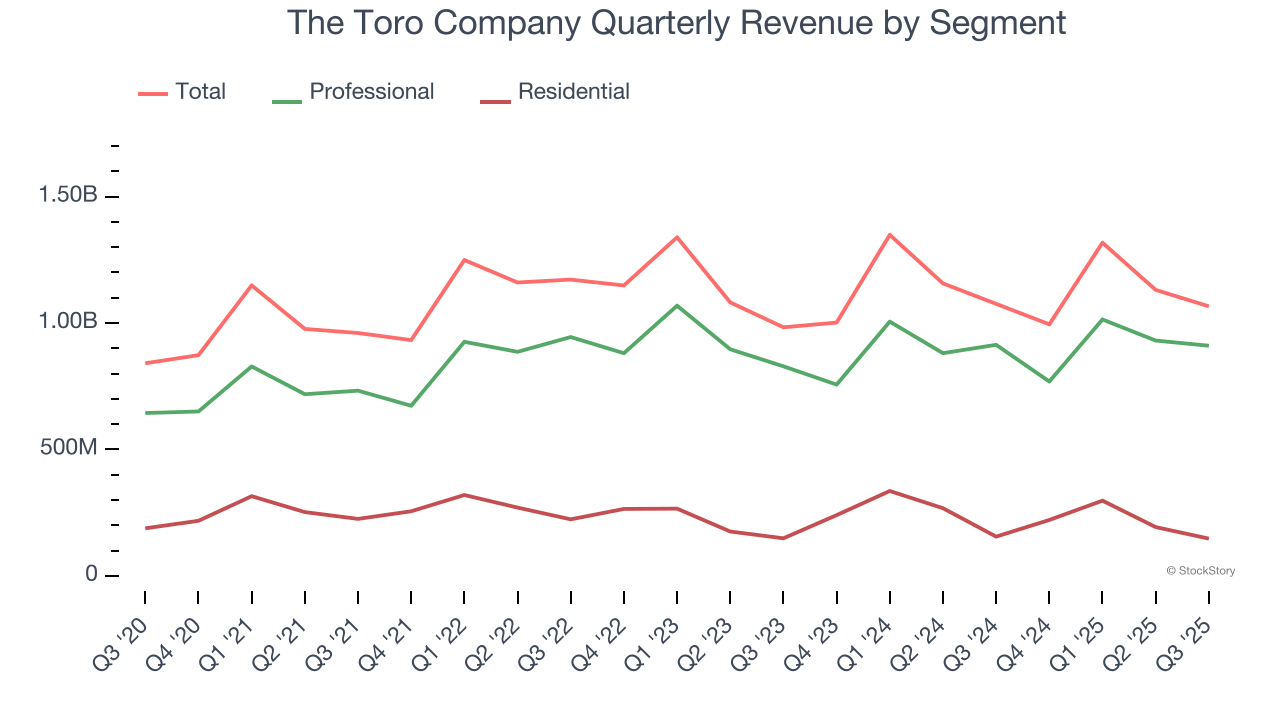

The Toro Company also breaks out the revenue for its most important segments, Professional

and Residential

, which are 85.4% and 13.8% of revenue. Over the last two years, The Toro Company’s Professional

revenue (sales to contractors) was flat while its Residential

revenue (sales to homeowners) averaged 2.7% year-on-year growth.

This quarter, The Toro Company’s $1.07 billion of revenue was flat year on year but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

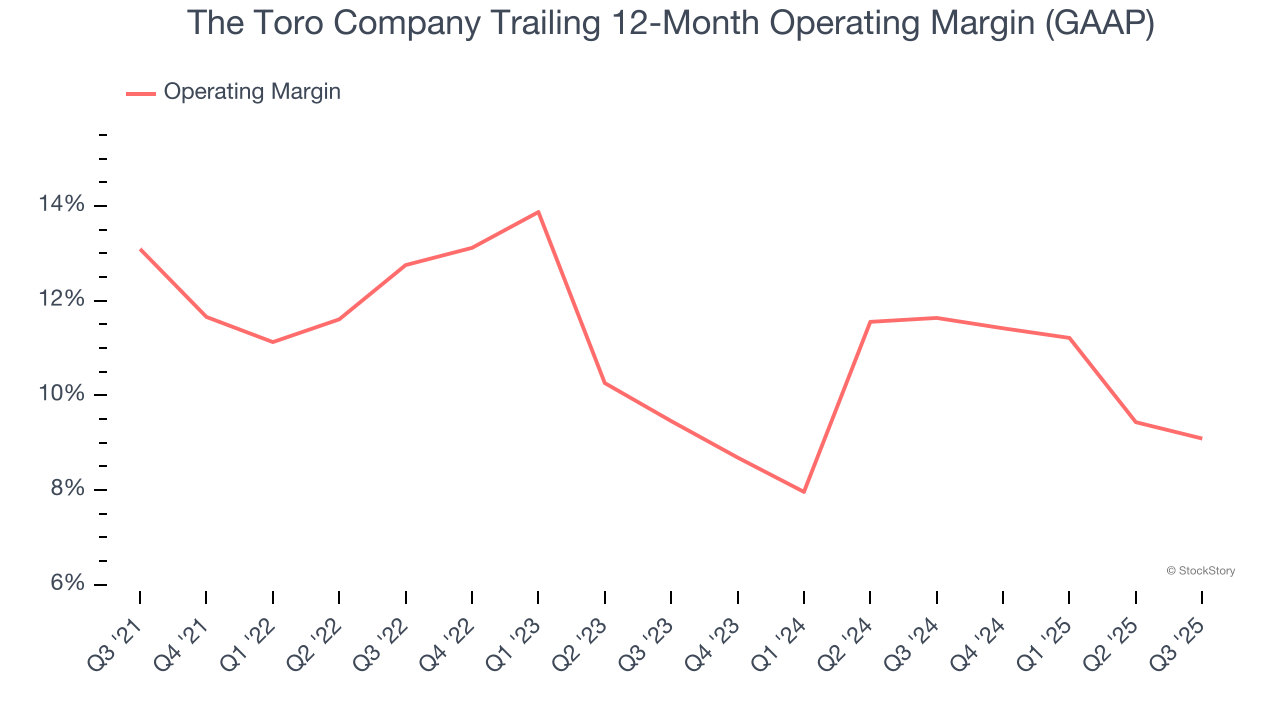

The Toro Company has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.2%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, The Toro Company’s operating margin decreased by 4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, The Toro Company generated an operating margin profit margin of 8.7%, down 1.5 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

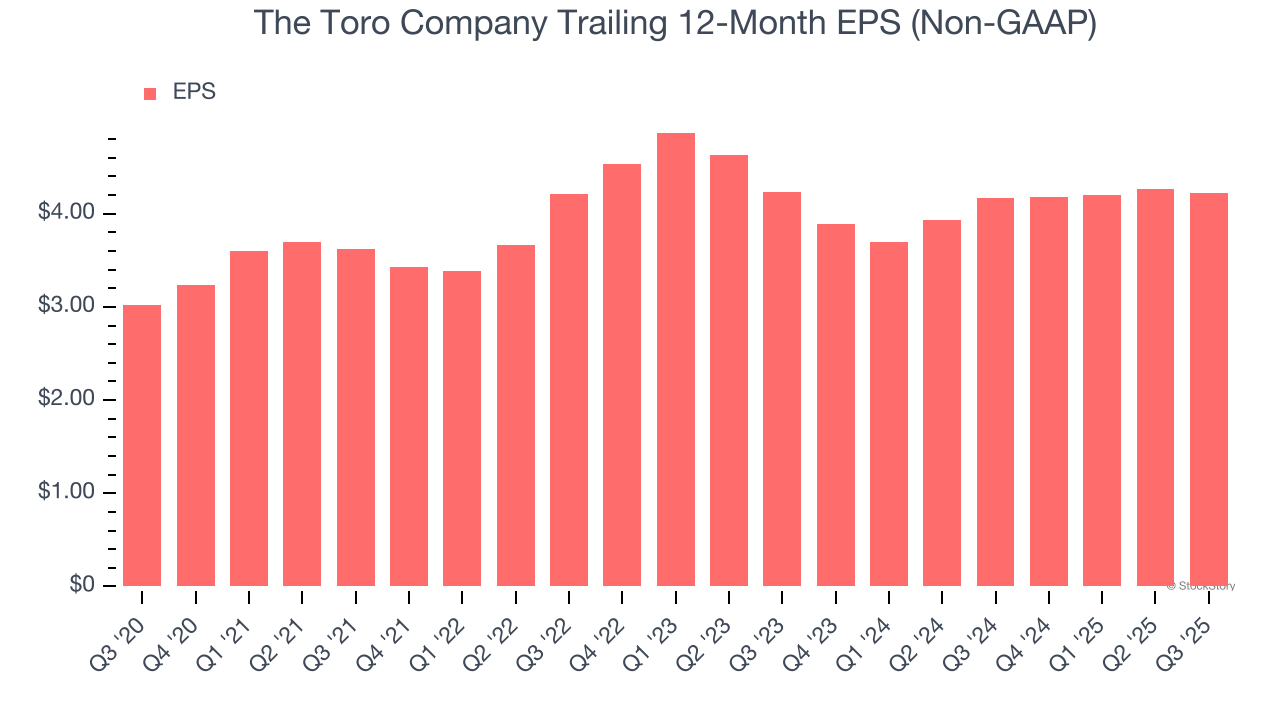

The Toro Company’s unimpressive 6.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For The Toro Company, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q3, The Toro Company reported adjusted EPS of $0.91, down from $0.95 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects The Toro Company’s full-year EPS of $4.22 to grow 10.7%.

Key Takeaways from The Toro Company’s Q3 Results

We were impressed by how significantly The Toro Company blew past analysts’ Residential revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1% to $73.39 immediately following the results.

Is The Toro Company an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.