Freight Delivery Company RXO (NYSE: RXO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 36.6% year on year to $1.42 billion. Its non-GAAP profit of $0.01 per share was $0.03 below analysts’ consensus estimates.

Is now the time to buy RXO? Find out by accessing our full research report, it’s free for active Edge members.

RXO (RXO) Q3 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.43 billion (36.6% year-on-year growth, in line)

- Adjusted EPS: $0.01 vs analyst estimates of $0.04 ($0.03 miss)

- Adjusted EBITDA: $32 million vs analyst estimates of $35.31 million (2.3% margin, 9.4% miss)

- EBITDA guidance for Q4 CY2025 is $25 million at the midpoint, below analyst estimates of $43.64 million

- Operating Margin: -0.5%, up from -1.9% in the same quarter last year

- Free Cash Flow was $9 million, up from -$18 million in the same quarter last year

- Sales Volumes rose 1% year on year (-5% in the same quarter last year)

- Market Capitalization: $2.89 billion

RXO Chairman and CEO Drew Wilkerson said, “Market conditions tightened late in the third quarter as truckload capacity exits accelerated, which impacted both our buy rates and Brokerage gross margin. We also saw a further weakening of demand across our business as the quarter progressed. Both of these dynamics have continued into the fourth quarter. As we navigate this market, everyone at RXO remains focused on delivering results for our customers, carriers, employees and shareholders.”

Company Overview

With access to millions of trucks, RXO (NYSE: RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

Revenue Growth

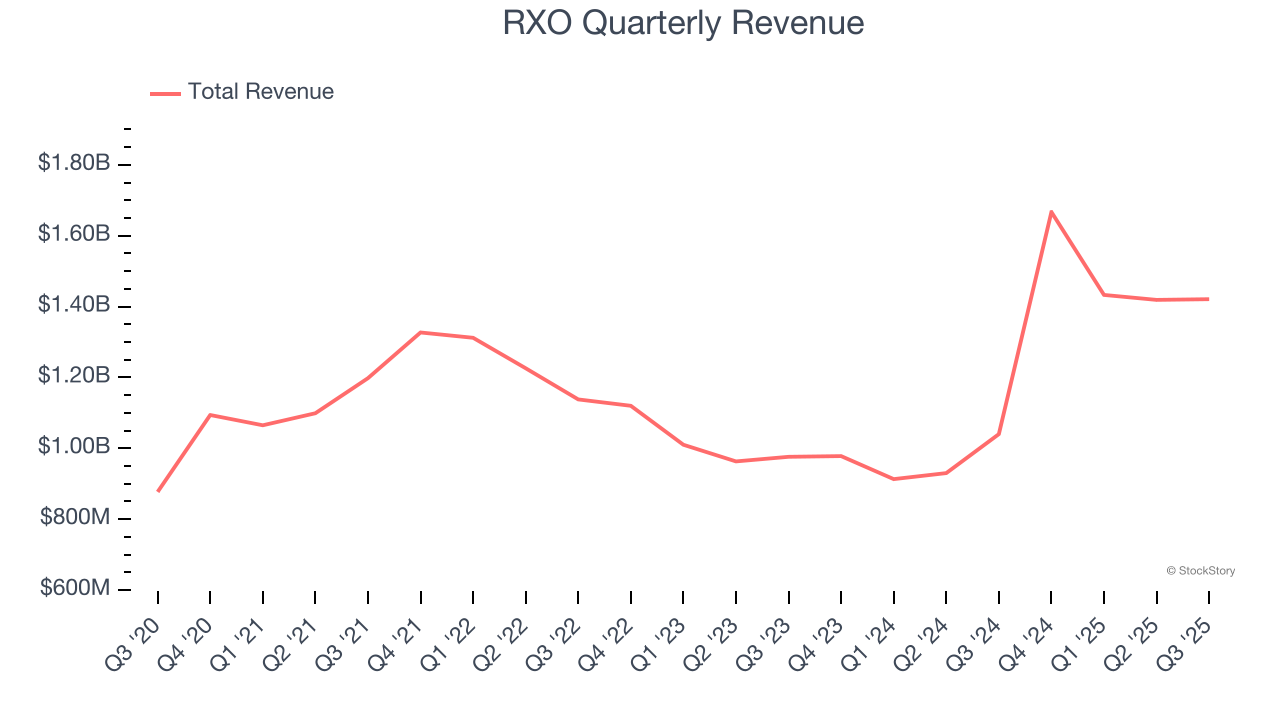

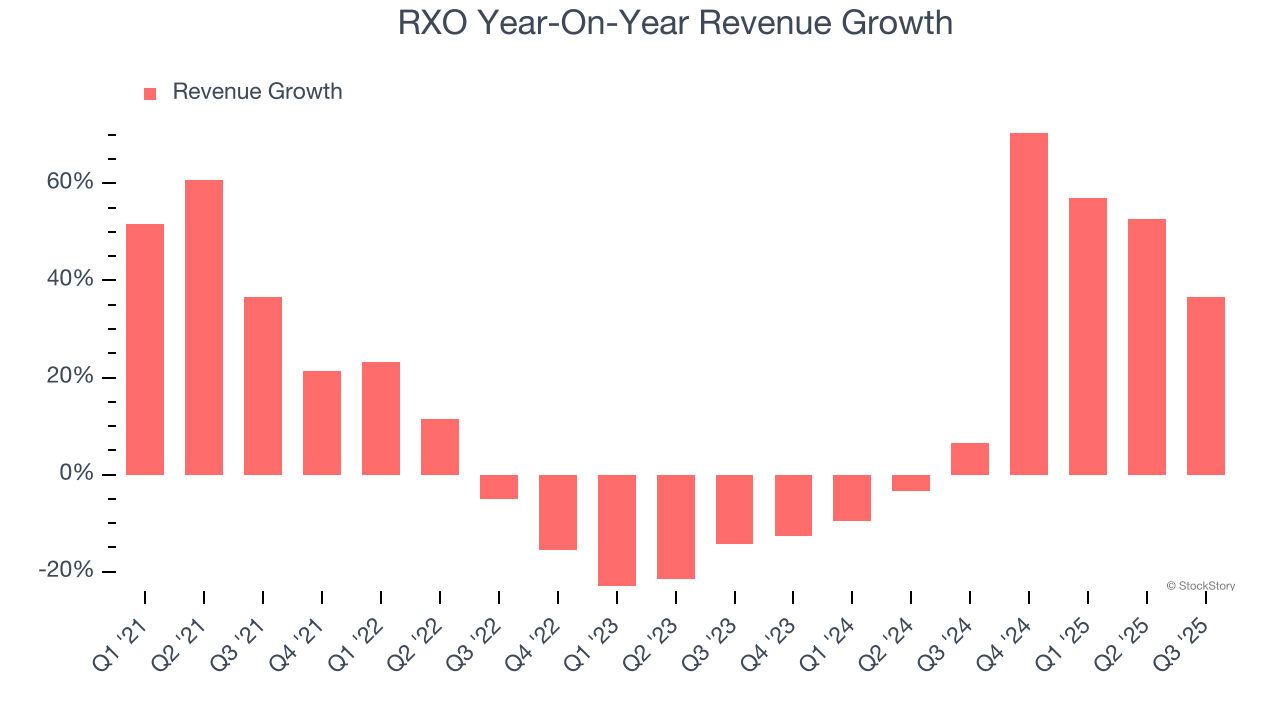

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, RXO grew its sales at an exceptional 13.6% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. RXO’s annualized revenue growth of 20.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. RXO recent performance stands out, especially when considering many similar Ground Transportation businesses faced declining sales because of cyclical headwinds.

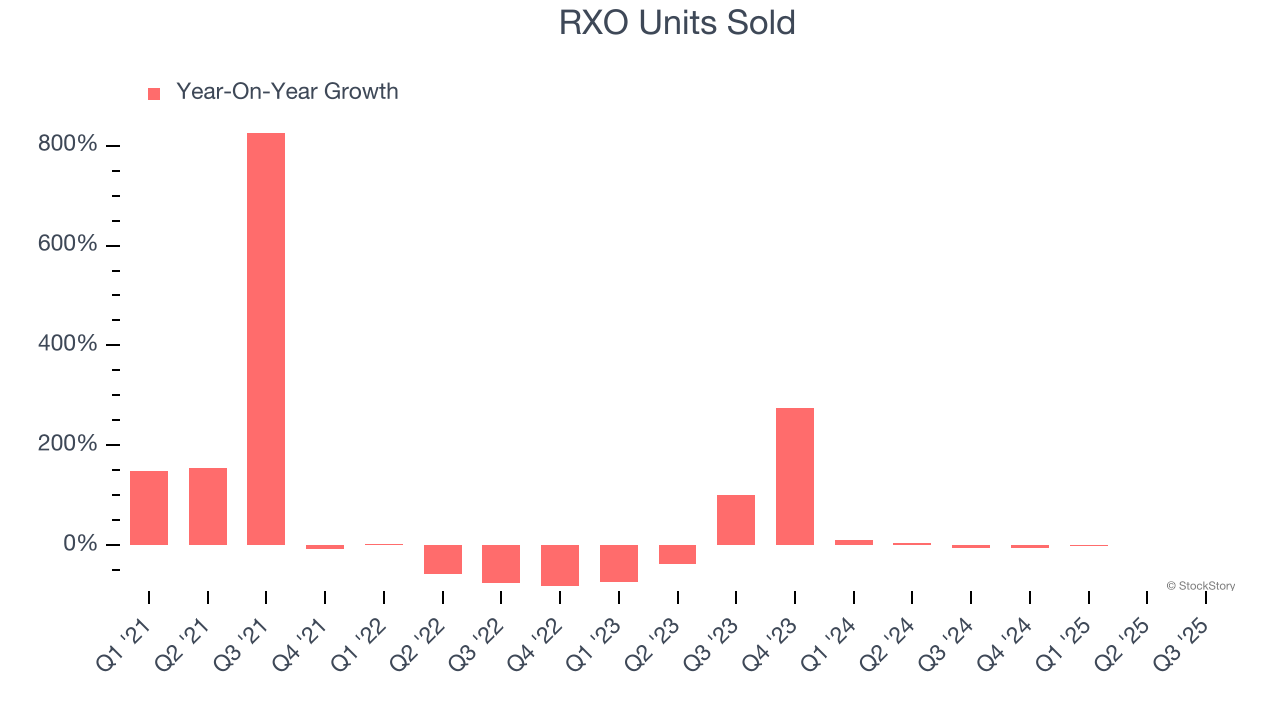

We can better understand the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, RXO’s units sold averaged 35% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, RXO’s year-on-year revenue growth of 36.6% was wonderful, and its $1.42 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

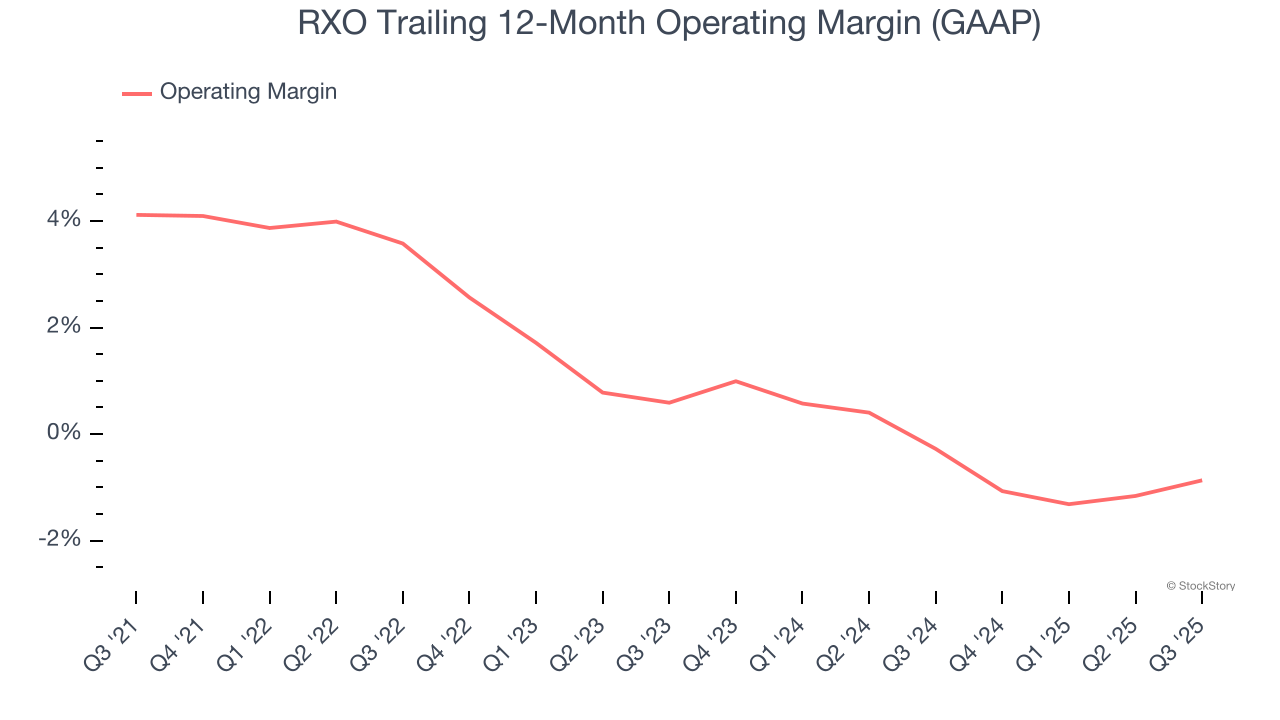

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

RXO was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, RXO’s operating margin decreased by 5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but RXO’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, RXO’s breakeven margin was up 1.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

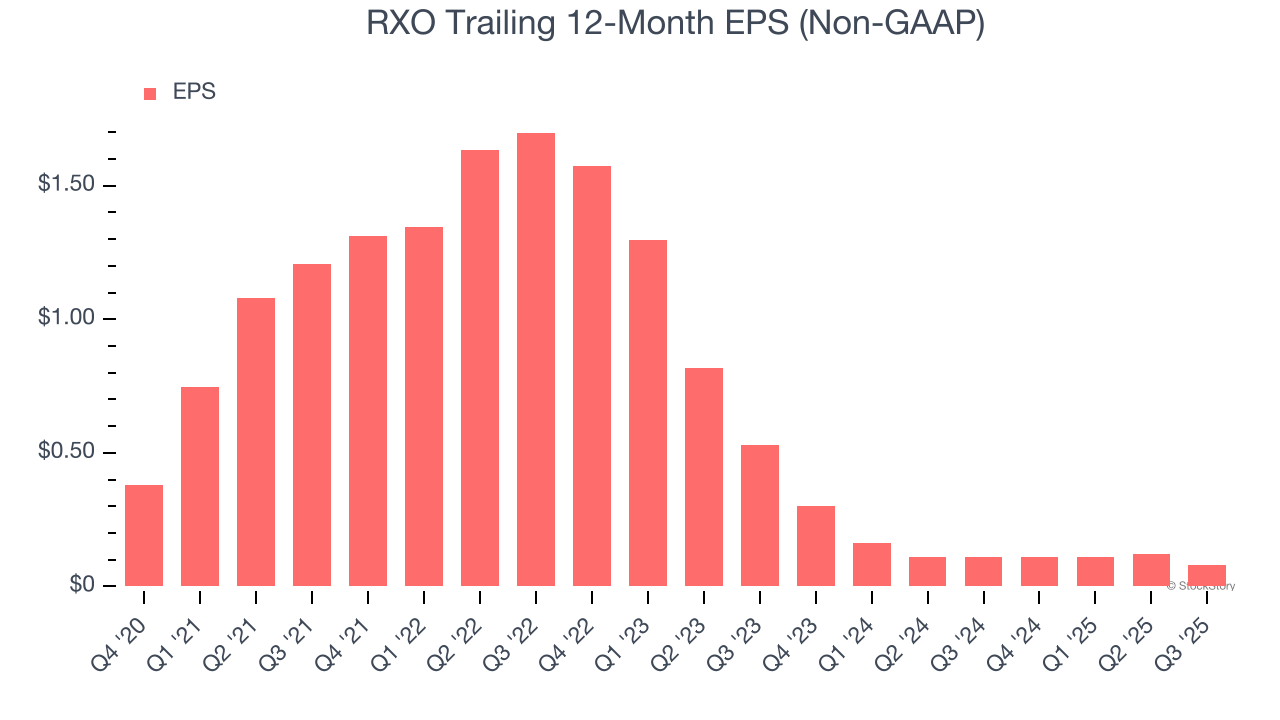

Sadly for RXO, its EPS declined by 22.7% annually over the last five years while its revenue grew by 13.6%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of RXO’s earnings can give us a better understanding of its performance. As we mentioned earlier, RXO’s operating margin expanded this quarter but declined by 5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For RXO, its two-year annual EPS declines of 61.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, RXO reported adjusted EPS of $0.01, down from $0.05 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects RXO’s full-year EPS of $0.08 to grow 250%.

Key Takeaways from RXO’s Q3 Results

We struggled to find many positives in these results. Its EBITDA missed and its EBITDA guidance came in below Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 15% to $15 immediately following the results.

RXO underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.