Pharmaceutical company Collegium Pharmaceutical (NASDAQ: COLL) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 31.4% year on year to $209.4 million. The company’s full-year revenue guidance of $780 million at the midpoint came in 3.8% above analysts’ estimates. Its non-GAAP profit of $2.25 per share was 21% above analysts’ consensus estimates.

Is now the time to buy Collegium Pharmaceutical? Find out by accessing our full research report, it’s free for active Edge members.

Collegium Pharmaceutical (COLL) Q3 CY2025 Highlights:

- Revenue: $209.4 million vs analyst estimates of $189.1 million (31.4% year-on-year growth, 10.7% beat)

- Adjusted EPS: $2.25 vs analyst estimates of $1.86 (21% beat)

- Adjusted EBITDA: $133 million vs analyst estimates of $118.2 million (63.5% margin, 12.5% beat)

- The company lifted its revenue guidance for the full year to $780 million at the midpoint from $752.5 million, a 3.7% increase

- EBITDA guidance for the full year is $465 million at the midpoint, above analyst estimates of $442.6 million

- Operating Margin: 29.7%, up from 21.9% in the same quarter last year

- Market Capitalization: $1.13 billion

“We delivered another strong quarter of results driven by our portfolio of differentiated medicines and unwavering commitment to patients,” said Vikram Karnani, President and Chief Executive Officer.

Company Overview

Pioneering abuse-deterrent technology in a field plagued by addiction concerns, Collegium Pharmaceutical (NASDAQ: COLL) develops and markets specialty medications for treating moderate to severe pain, including abuse-deterrent opioid formulations.

Revenue Growth

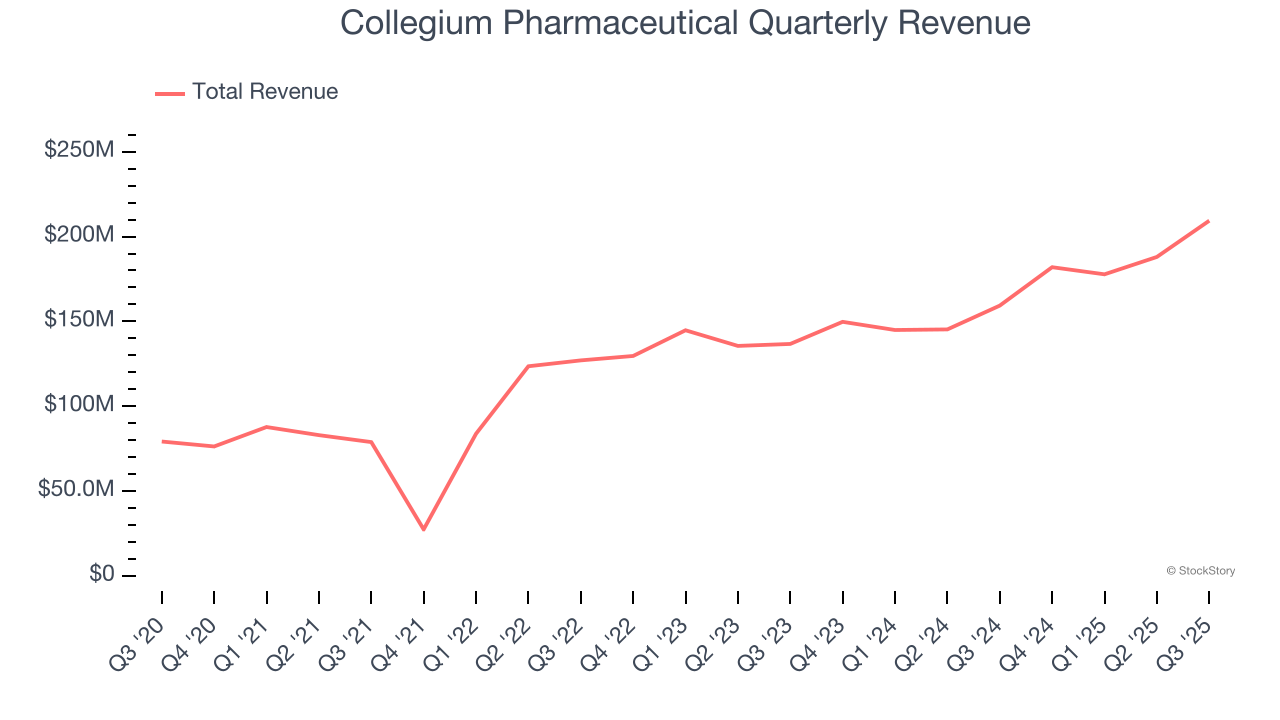

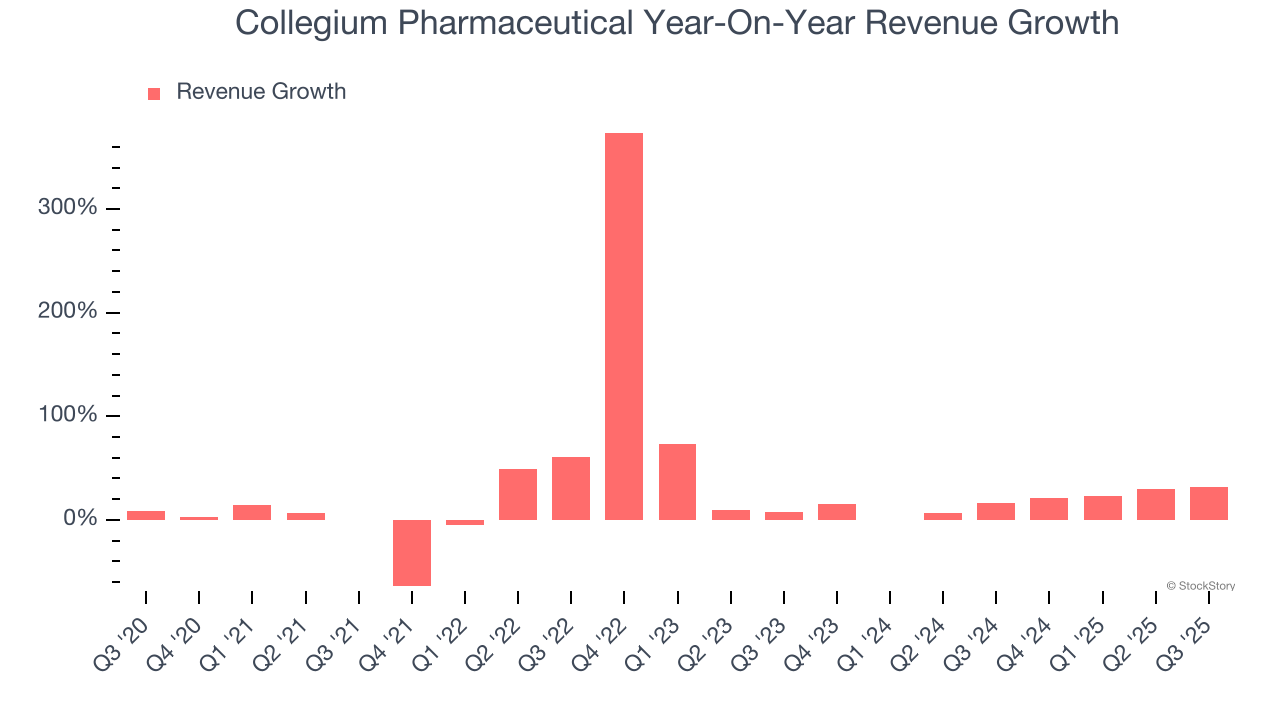

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Collegium Pharmaceutical’s 19.7% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Collegium Pharmaceutical’s annualized revenue growth of 17.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Collegium Pharmaceutical reported wonderful year-on-year revenue growth of 31.4%, and its $209.4 million of revenue exceeded Wall Street’s estimates by 10.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

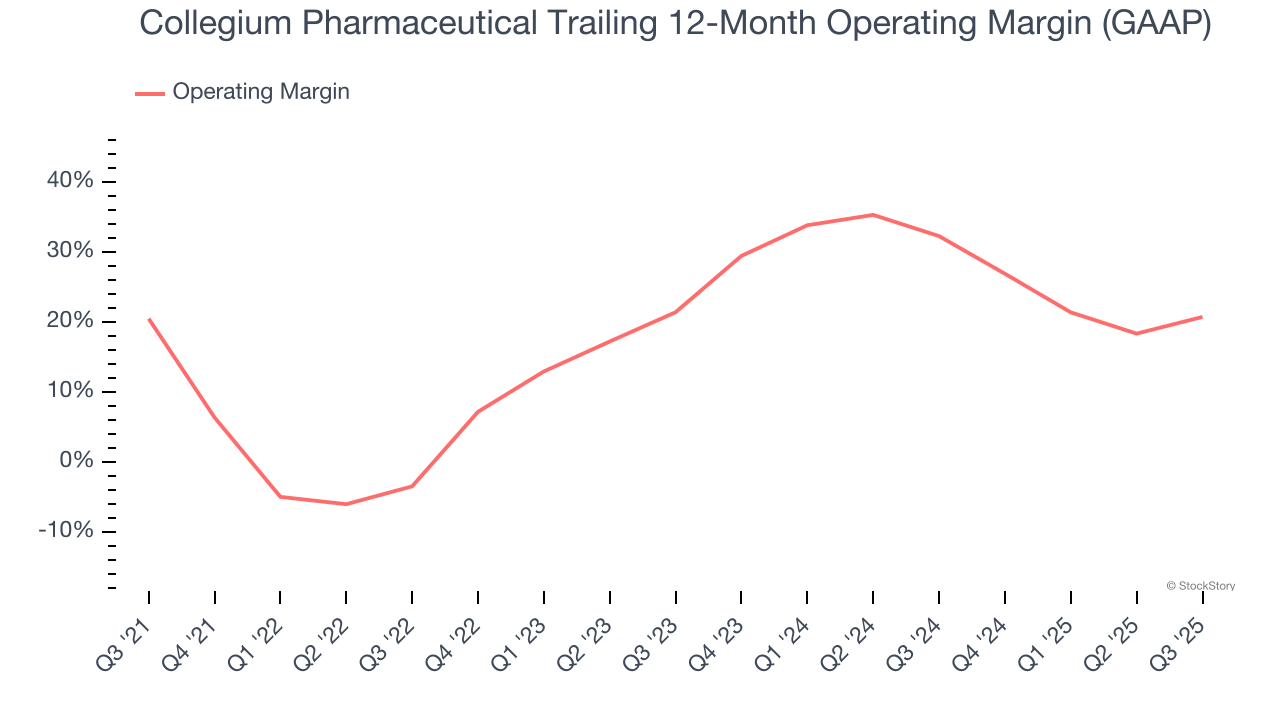

Collegium Pharmaceutical’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 20.1% over the last five years. This profitability was top-notch for a healthcare business, showing it’s an well-run company with an efficient cost structure.

Analyzing the trend in its profitability, Collegium Pharmaceutical’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Collegium Pharmaceutical generated an operating margin profit margin of 29.7%, up 7.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

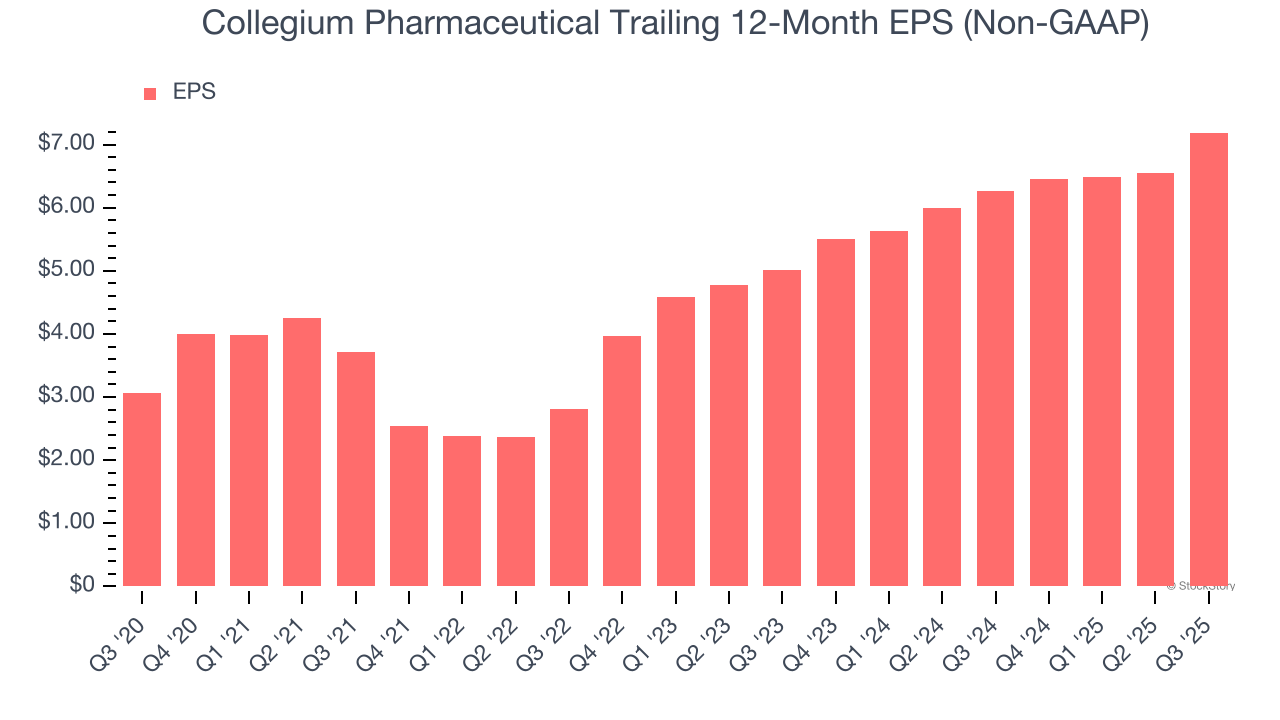

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Collegium Pharmaceutical’s astounding 18.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q3, Collegium Pharmaceutical reported adjusted EPS of $2.25, up from $1.61 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Collegium Pharmaceutical’s full-year EPS of $7.19 to shrink by 1.7%.

Key Takeaways from Collegium Pharmaceutical’s Q3 Results

We were impressed by how significantly Collegium Pharmaceutical blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 12.1% to $40.17 immediately following the results.

Collegium Pharmaceutical had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.