IT infrastructure services provider Kyndryl (NYSE: KD) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 1.4% year on year to $3.72 billion. Its non-GAAP profit of $0.38 per share was 6.2% above analysts’ consensus estimates.

Is now the time to buy Kyndryl? Find out by accessing our full research report, it’s free for active Edge members.

Kyndryl (KD) Q3 CY2025 Highlights:

- Revenue: $3.72 billion vs analyst estimates of $3.83 billion (1.4% year-on-year decline, 2.9% miss)

- Adjusted EPS: $0.38 vs analyst estimates of $0.36 (6.2% beat)

- Adjusted EBITDA: $641 million vs analyst estimates of $618.3 million (17.2% margin, 3.7% beat)

- Operating Margin: 2.6%, in line with the same quarter last year

- Free Cash Flow Margin: 0.6%, similar to the same quarter last year

- Market Capitalization: $6.65 billion

"Our second quarter performance reflects the momentum we're building across key growth priorities – Kyndryl Consult, alliances with hyperscalers and other leading technology providers, and our innovative services in AI, cloud and security. We expect activity to strengthen in the second half of fiscal 2026, supported by our pipeline and the constructive discussions we're having with new and existing customers," said Kyndryl Chairman and Chief Executive Officer Martin Schroeter.

Company Overview

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE: KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $15.01 billion in revenue over the past 12 months, Kyndryl is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, Kyndryl likely needs to tweak its prices, innovate with new offerings, or enter new markets.

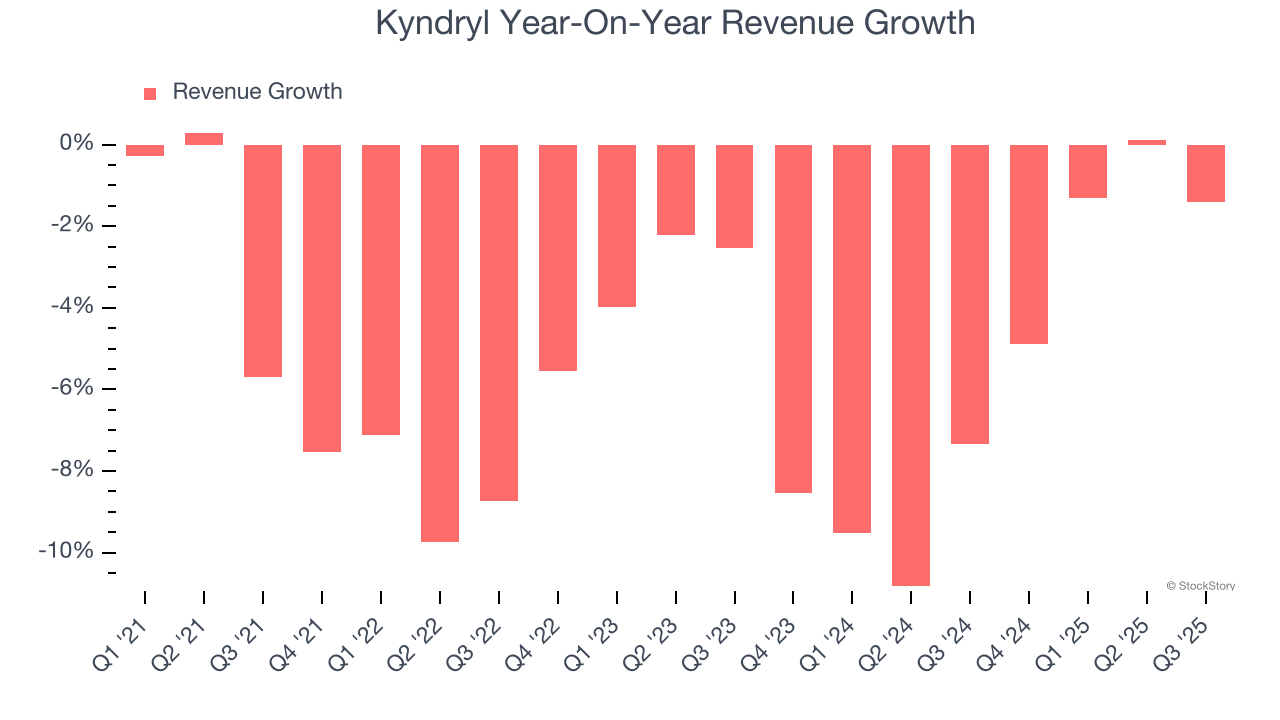

As you can see below, Kyndryl struggled to generate demand over the last five years. Its sales dropped by 4.8% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Kyndryl’s annualized revenue declines of 5.6% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

This quarter, Kyndryl missed Wall Street’s estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $3.72 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

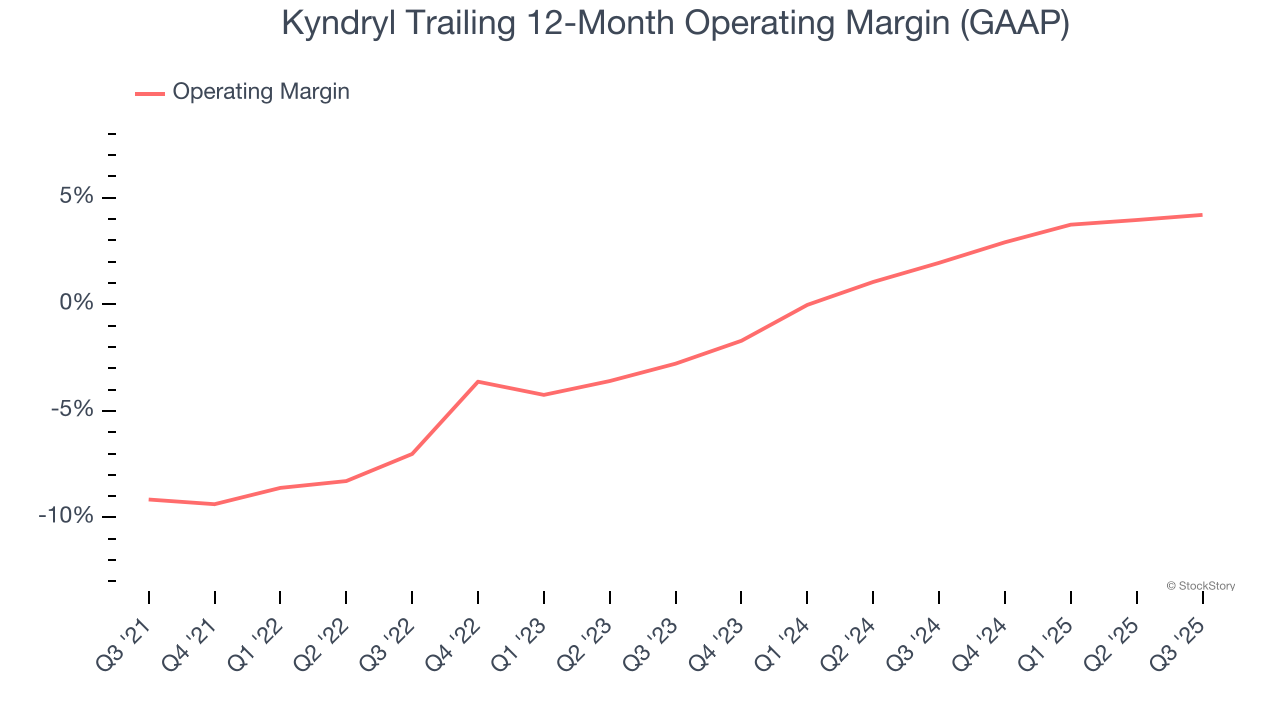

Although Kyndryl was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Kyndryl’s operating margin rose by 13.4 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

In Q3, Kyndryl generated an operating margin profit margin of 2.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

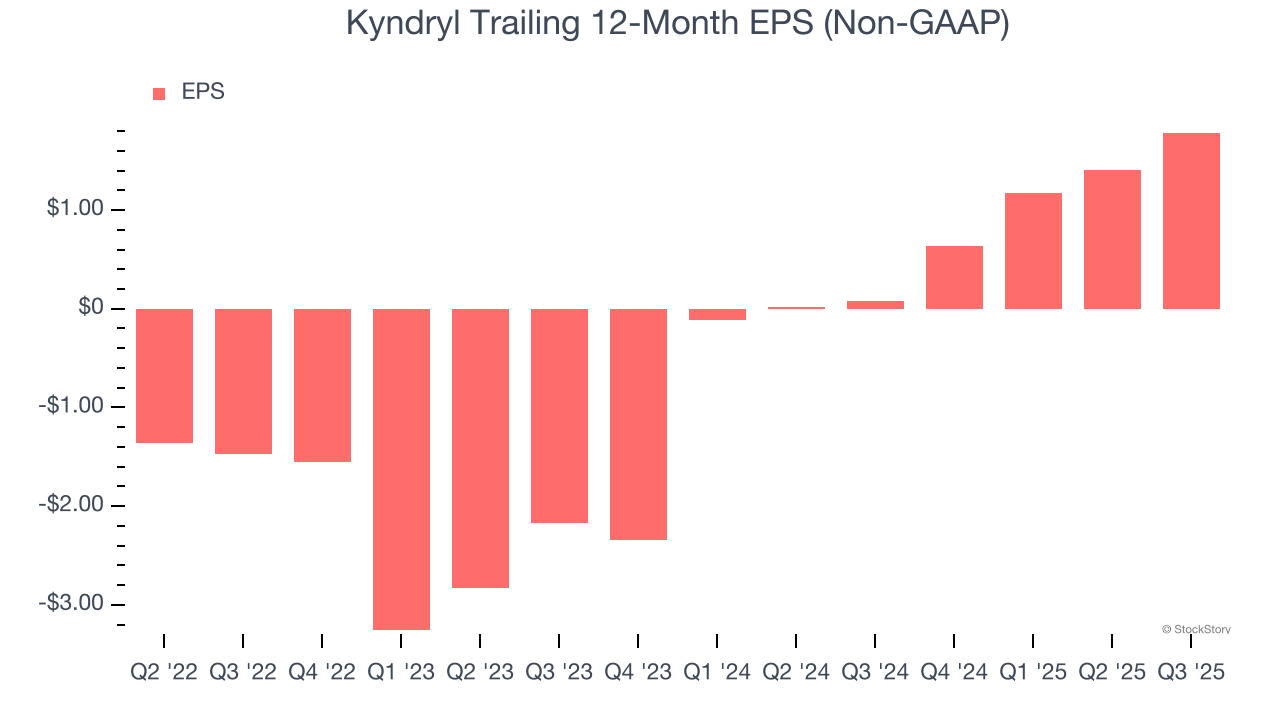

Kyndryl’s full-year EPS flipped from negative to positive over the last two years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Kyndryl reported adjusted EPS of $0.38, up from $0.01 in the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Kyndryl’s full-year EPS of $1.78 to grow 67.2%.

Key Takeaways from Kyndryl’s Q3 Results

It was good to see Kyndryl beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a mixed quarter. The stock traded up 5.8% to $29 immediately after reporting.

So should you invest in Kyndryl right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.