Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Shake Shack (NYSE: SHAK) and its peers.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 7 modern fast food stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 0.9%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.7% since the latest earnings results.

Best Q3: Shake Shack (NYSE: SHAK)

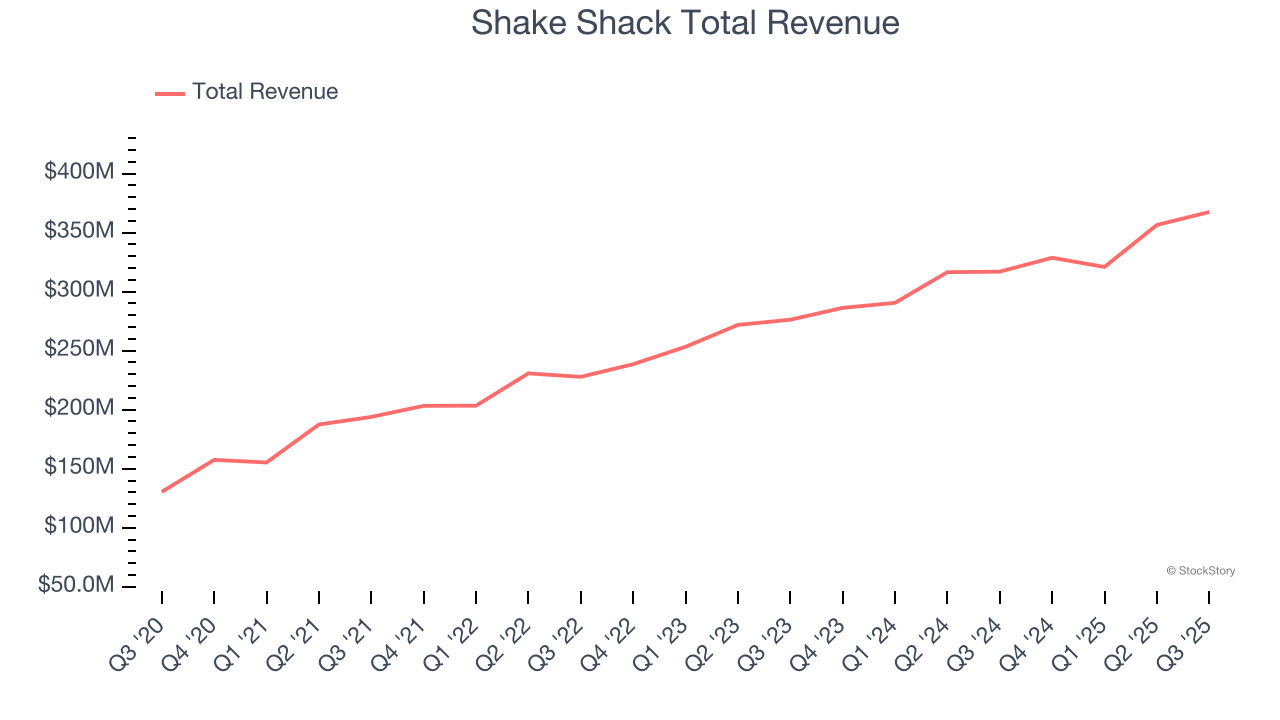

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE: SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $367.4 million, up 15.9% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ same-store sales estimates and an impressive beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 3.9% since reporting and currently trades at $86.34.

Is now the time to buy Shake Shack? Access our full analysis of the earnings results here, it’s free for active Edge members.

Noodles (NASDAQ: NDLS)

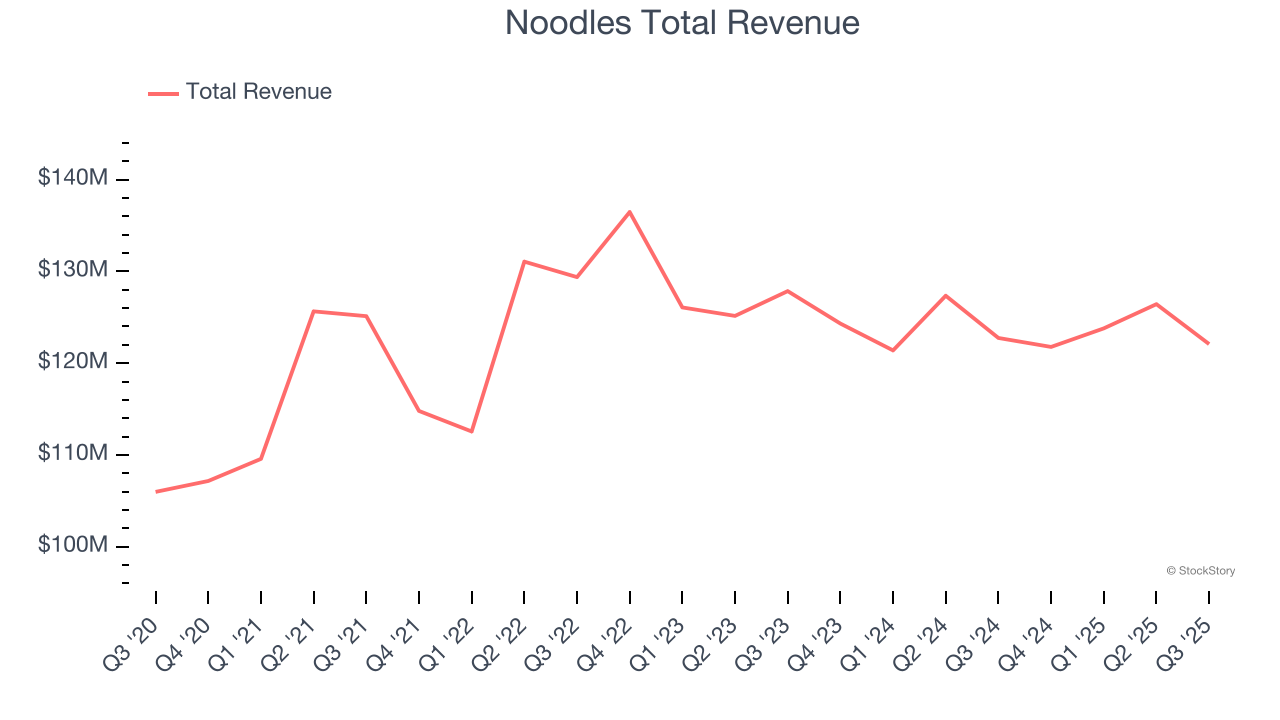

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ: NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

Noodles reported revenues of $122.1 million, flat year on year, outperforming analysts’ expectations by 1.9%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

Noodles pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $0.66.

Is now the time to buy Noodles? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Sweetgreen (NYSE: SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE: SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $172.4 million, flat year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

Sweetgreen delivered the highest full-year guidance raise but had the slowest revenue growth in the group. As expected, the stock is down 4.7% since the results and currently trades at $5.96.

Read our full analysis of Sweetgreen’s results here.

Portillo's (NASDAQ: PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ: PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $181.4 million, up 1.8% year on year. This result missed analysts’ expectations by 0.7%. In spite of that, it was a strong quarter as it logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ same-store sales estimates.

The stock is down 10.5% since reporting and currently trades at $4.69.

Read our full, actionable report on Portillo's here, it’s free for active Edge members.

Wingstop (NASDAQ: WING)

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ: WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Wingstop reported revenues of $175.7 million, up 8.1% year on year. This print lagged analysts' expectations by 5%. It was a softer quarter as it also recorded a significant miss of analysts’ same-store sales estimates and a significant miss of analysts’ revenue estimates.

Wingstop had the weakest performance against analyst estimates among its peers. The stock is up 7.1% since reporting and currently trades at $229.18.

Read our full, actionable report on Wingstop here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.