Aerospace and defense company Redwire (NYSE: RDW) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 9.6% year on year to $68.64 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $310 million at the midpoint. Its GAAP loss of $0.37 per share was also 190% below analysts’ consensus estimates.

Is now the time to buy Redwire? Find out by accessing our full research report, it’s free.

Redwire (RDW) Q3 CY2024 Highlights:

- Revenue: $68.64 million vs analyst estimates of $70.64 million (2.8% miss)

- EPS: -$0.37 vs analyst estimates of -$0.13 (-$0.24 miss)

- EBITDA: $2.44 million vs analyst estimates of $3.15 million (22.6% miss)

- The company lifted its revenue guidance for the full year to $310 million at the midpoint from $300 million, a 3.3% increase

- Gross Margin (GAAP): 17.5%, down from 27.3% in the same quarter last year

- Operating Margin: -18.2%, down from -4.3% in the same quarter last year

- EBITDA Margin: 3.6%, in line with the same quarter last year

- Free Cash Flow was -$17.67 million compared to -$4.56 million in the same quarter last year

- Market Capitalization: $532.3 million

“Mergers and acquisitions are a core strength of Redwire and important to our growth strategy. During the third quarter, Redwire returned to our M&A roots by closing on the purchase of Hera Systems - our tenth acquisition. Hera Systems brings a highly competent team and two new platforms to Redwire’s spacecraft portfolio, expanding our ability to execute larger missions, particularly in our national security segment,” stated Peter Cannito, Chairman and Chief Executive Officer of Redwire.

Company Overview

Based in Jacksonville, Florida, Redwire (NYSE: RDW) is a provider of systems and components used in space infrastructure.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

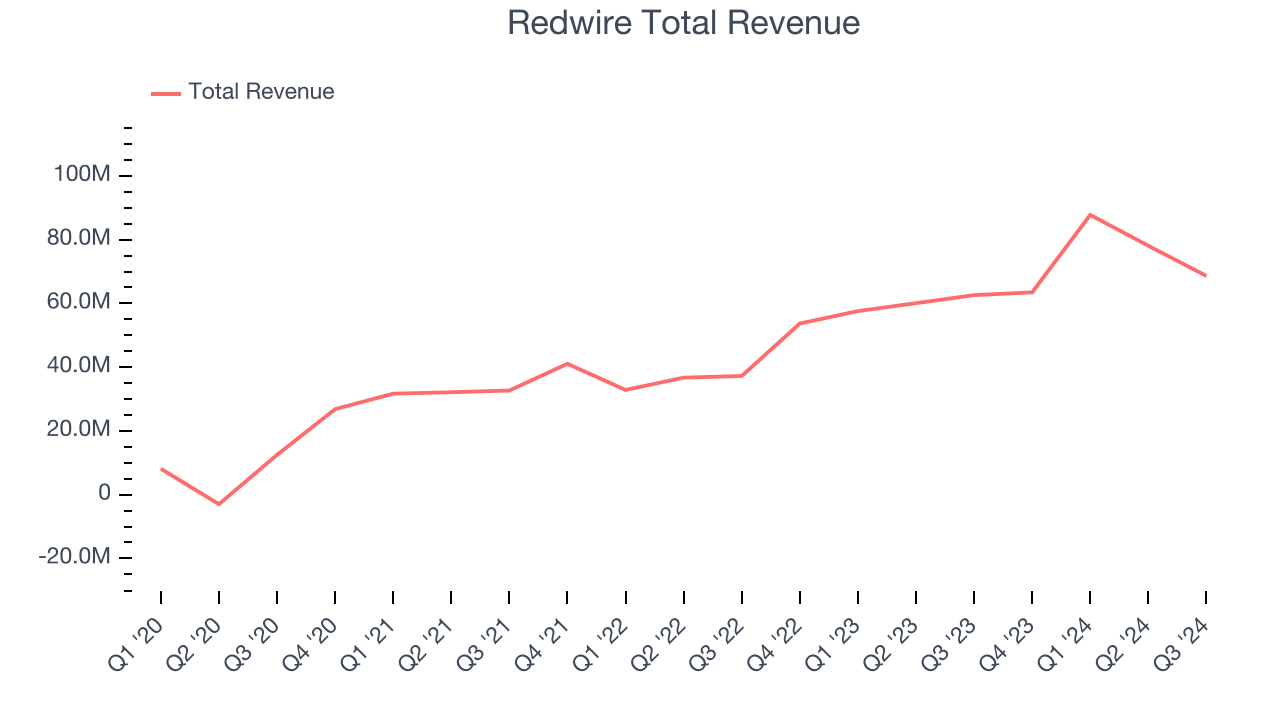

Sales Growth

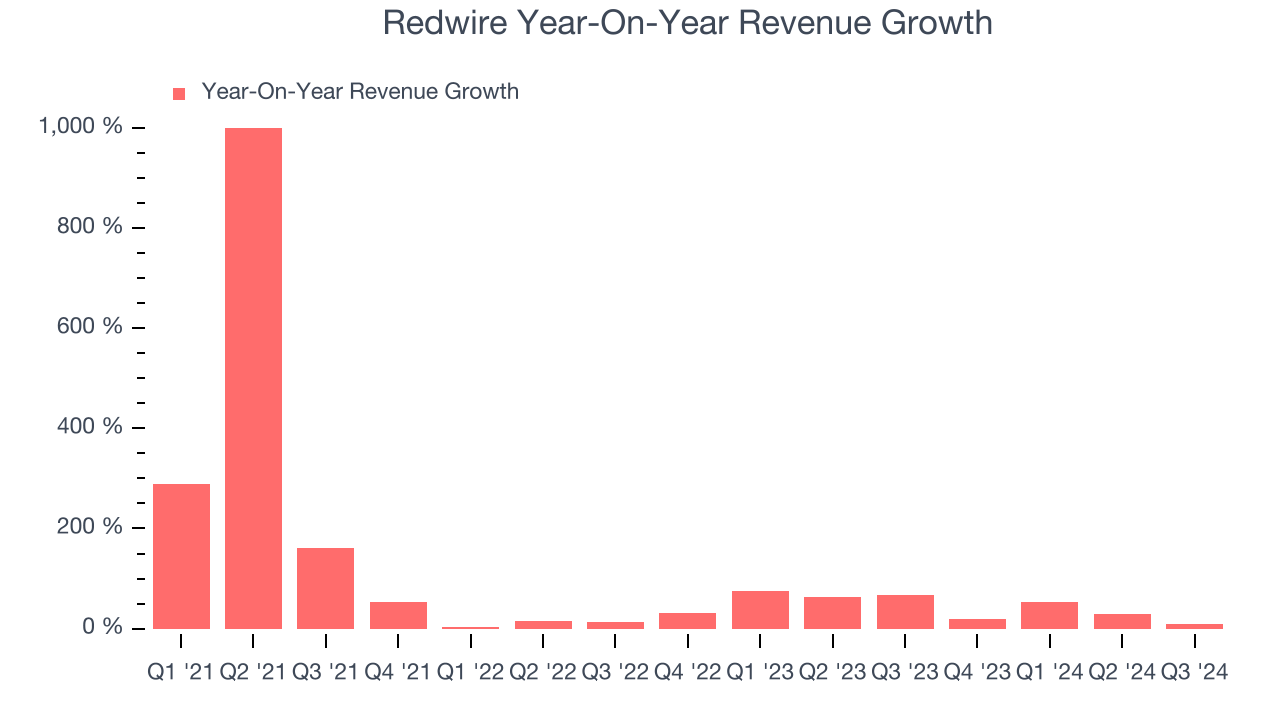

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Redwire’s sales grew at an incredible 90.9% compounded annual growth rate over the last four years. This is a great starting point for our analysis because it shows Redwire’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Redwire’s annualized revenue growth of 41.9% over the last two years is below its four-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Redwire’s revenue grew 9.6% year on year to $68.64 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and shows the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

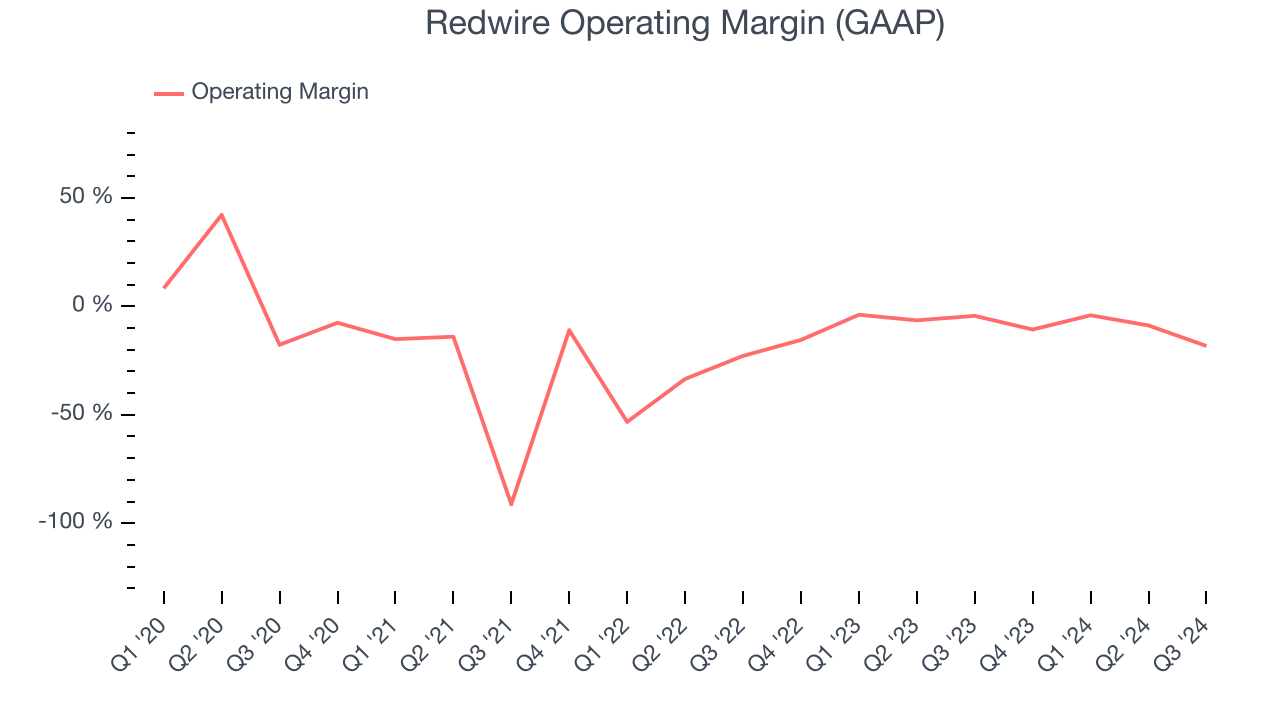

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Redwire’s high expenses have contributed to an average operating margin of negative 16.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Redwire’s annual operating margin rose by 6 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Redwire’s operating margin was negative 18.2% this quarter. The company's lack of profits raise a flag.

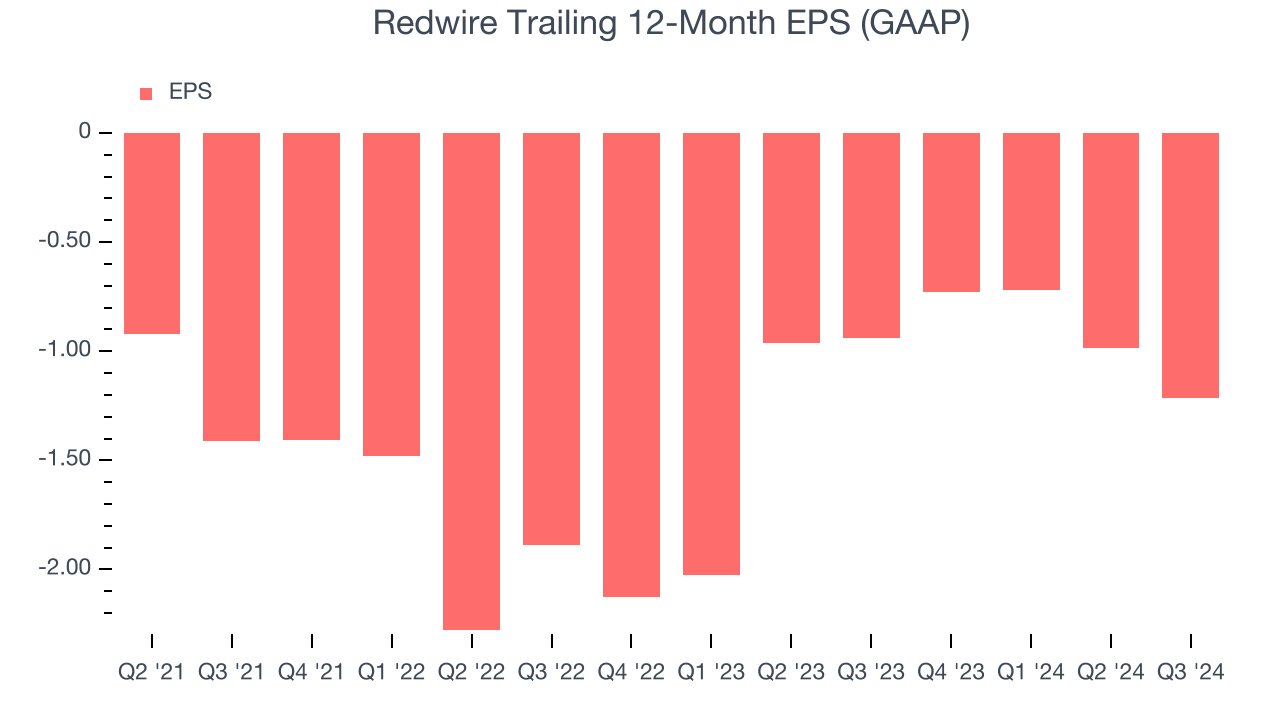

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although Redwire’s full-year earnings are still negative, it reduced its losses and improved its EPS by 19.9% annually over the last two years.

In Q3, Redwire reported EPS at negative $0.37, down from negative $0.14 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Redwire’s full-year EPS of negative $1.21 will reach break even.

Key Takeaways from Redwire’s Q3 Results

It was good to see Redwire’s full-year revenue forecast beat analysts’ expectations. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.8% to $8.19 immediately following the results.

Redwire’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.