From footlong subs and chips to big screen TVs and sectional couches, BJ’s Wholesale Club Holdings, Inc. (NYSE: BJ) wants to be your one-stop Super Bowl party shopping destination.

The East Coast warehouse club operator’s “Big Game Event” deals are the latest in a string of budget-friendly promotions designed to draw shoppers to BJ’s locations and website. Over the past few months, the Massachusetts-based retailer has offered members:

- a free Butterball turkey for spending at least $150

- Black Friday discounts including buy one, get one 50% off a revamped lineup of toys

- Cyber Week savings of up to 65% at BJs.com

- a 10-day ‘Holidealssavings’ event leading up to Christmas for last minute shoppers.

The heavy promotional period could lead to some doorbusting financials when BJ’s reports fourth quarter results next month. In what was a record 2023 holiday shopping season, the company’s broadening merchandise assortment and below-peer prices may prove to be a winning formula.

For Q4 of 2023, Wall Street is projecting 10% and 6% year-over-year growth in revenue and earnings per share (EPS), respectively. Based on the momentum in the business, BJ’s could very well deliver a second consecutive outperformance.

For the three months ended October 28th, the Costco and Sam’s Club challenger grew sales 2.8% to $4.82 billion. This was largely because of merchandising improvements and foot traffic. Management noted that it saw signs of grocery disinflation (inflation at a slower pace) and budget-minded consumers shopping closer to need. While both factors drove a smaller average ‘basket size’ in Q3, things may have reversed in Q4.

More affordable prices and a steady flow of holiday deals are potential sources of holiday quarter outperformance. Heading into 2024, prospects for lower interest rates could swing customer spending habits towards discretionary categories like electronics and furniture.

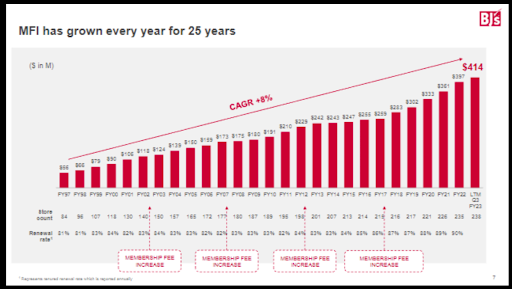

Not surprisingly, another driver of BJ’s consensus-topping Q3 numbers was strong membership metrics. Thanks to high renewal rates and upgrades to higher tier plans, membership fees increased 6.6% to $106 million. Although this is a tiny portion of overall revenue, it shows that more Americans are willing to pay for the warehouse club’s value proposition and premium subscriptions.

Over the last 25 years, BJ’s has grown its fee income at an 8% annualized rate, successfully executing four membership fee increases along the way. With the last fee hike occurring in 2017, BJ’s appears to be overdue for another bump.

Warehouse clubs are winning

BJ’s humble beginnings started in 1984 when discount department store chain Zayre decided to launch a warehouse arm. Four years later, Zayre sold its business to rival Ames, setting the stage for the birth of TJ Maxx parent TJX Companies. By 1997, BJ’s was spun-off to become its own independent company with 84 stores. Since then, it has nearly tripled its footprint — and is showing no signs of slowing down.

Last week, BJ’s held a grand opening for its latest club in Johnson City, NY. This marks its 243rd location. The chain has a presence in 20 eastern U.S. states and a stranglehold on New England, where it has three-times as many clubs as its next largest competitor. Yes, that includes Costco and Walmart-owned Sam’s Club. With two new stores already up and running in 2024, BJ’s plans to open approximately 10 units per year going forward.

In the uber-competitive retail space, BJ’s is in the right places and at the right time. That’s because the U.S. warehouse club channel is one of the fastest growing retail segments nationwide. Why? Americans love to save money and time. Cheaper per unit bulk size packages and broad merchandise assortments are driving time-constrained consumers to crave convenient, all-in-one pit stops.

As a seller of groceries, household essentials, personal care items, electronics, furniture and a range of services, BJ’s more than fits the bill. Roughly 70% of stores have gas stations. Many have tire, optical, home improvement and wireless phone service. Members’ ability to get all of the above in one spot and at good prices is at the crux of the booming business model.

‘Poor man’s Costco’ with affluent customers

BJ’s membership options are straightforward. The basic Club Card membership for $55 per year gets you up to 25% off grocery store prices, gas savings, the ability to combine manufacturer and store coupons, and a complimentary household membership. Double it to $110 annually, and Club Card+ tosses in more savings and rewards. BJ’s also offers business memberships with the same benefits and prices.

While these aren’t dissimilar to what’s available at Costco and Sam’s Club, a BJ’s membership does have its advantages over much larger competitors. Don’t need a 24-pack of chicken breasts? BJ’s has smaller package sizes. Find sprawling Costco stores to be overwhelming and inefficient? Square footage is more pedestrian-friendly at BJ’s. And while the nearest Costco or Sam’s Club is often out in the boonies, BJ’s locations tend to be more accessible. BJ’s ability to offer many of the same benefits of a Costco — including the treasure hunt-like shopping experience — on a smaller scale gives it a unique edge.

BJ’s has another advantage that may not be fully appreciated by the stock market. In September 2023, sell-side research firm TD Cowen started covering the stock with an Outperform rating. A core tenant of its opinion — BJ’s superior digital analytics capabilities. The analyst noted that compared to Costco, BJ’s has been able to incorporate digital tools that younger, wealthier consumers find appealing. The BJ’s app, e-commerce site, digital coupons, curbside pickup and same-day delivery have all been points of strategic emphasis. According to the analyst, this could lead to significant market share gains among the key demographic of young spenders.

Following the company’s Q3 earnings release, TD Cowen reiterated its bullish rating and stuck with a Street-high $80.00 target. BJ’s shares have since traded sideways but still have a 24% upside, according to TD Cowen and three other analysts.

Meanwhile, BJ’s focus on private-label products may be a game-changer. The company is broadening its lineup of Wellsley Farms and Berkley Jensen SKUs across meats, produce, snacks, bakery and other categories. This could lead to not only increased customer loyalty but also increased profitability. Since such in-house brands typically have higher profit margins, growing member adoption of these ‘Kirkland’s equivalents’ could lead to positive earnings surprises.

Buybacks provide a floor for the stock

One thing that BJ’s does not offer is a dividend. To some income-oriented investors, this is a major shortcoming versus Costco, which routinely pays a ‘special dividend’ and has raised its regular dividend for 20 straight years.

What BJ’s does provide in terms of shareholder value though is an active buyback program. Through the first three quarters of fiscal 2024, the company bought back $103.6 million worth of its own stock. Roughly $210 million remains on the current repurchase authorization.

Share repurchases enhance investor value because they drive up the stock price and reduce the number of shares outstanding. With fewer shares outstanding, shareholders have a larger claim on earnings and quarterly EPS figures stand to improve. Buybacks can also limit a stock’s downside, or create a ‘floor,’ because the market knows the company can swoop in and buy shares when prices get too low.

MarketBeat’s ‘Stock Buyback Announcement’ hub is a great place to discover companies that are buying back their shares.

$BJ is a cheap way to play warehouse club growth

When it comes to BJ’s lack of dividend payments, investors may wish to look the other way. That’s because BJ’s stock valuation is far more reasonable than those of most industry peers. On a trailing 12 months basis, $BJ is trading at 17x earnings. At 15x, only Dollar General is less expensive. Costco and Walmart are trading at 47x and 27x, respectively.

At a huge discount to its closest peers, BJ represents a way to gain exposure to the fast-growing warehouse club space without having to pay a premium price-to-earnings (P/E) multiple. With a P/E of 18x, Target is also arguably undervalued but lacks the diversified growth levers of the warehouse clubs in merchandise assortment and auxiliary services.

From a chart perspective, BJ closed at $64.73 on Friday, which is about 20% off its November 2022 peak. A month ago, a continuation diamond formed on the daily chart. The bullish technical pattern has yet to materialize to gains but still has time to play out. In the meantime, the stock has 250-day support at the $64.55 level, which suggests the near-term downside is limited — and the upside/downside ratio favorable.

Bottom Line

BJ’s has leading positions in the eastern U.S. portion of the warehouse club market. As brick-and-mortar expansion continues, digitization is proving to be an emerging growth driver and differentiator. Heading into a year in which consumer inflation and rate pressures are expected to subside, BJ’s mix of everyday staples and big ticket non-essentials could make it a retail stock winner.