Vancouver, BC – MARCH 6, 2023 – BASIN URANIUM CORP. (CSE:NCLR) (“Basin Uranium” or the “Company”) is pleased to announce that it has entered into an option agreement (the “Option Agreement”) dated xx with Cowboy Exploration and Development LLC (“Cowboy Exploration”), St. Cloud Trading Corp. and Thomas Byrne pursuant to which Cowboy Exploration has granted the Company the right to acquire a 90% interest (the “Option”) in the Chord property located in East Fall River County, South Dakota (the “Property”).

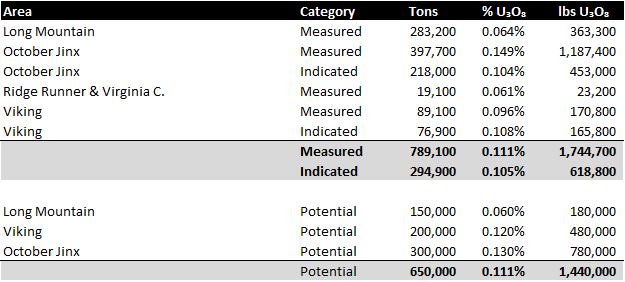

The Chord property is comprised of 147 contiguous lode mining claims (~ 3,037 acres) located in Edgemont, South Dakota approximately 3 miles southwest of encore Energy Corp.’s (EU-NYSEAM) Dewey-Burdock development project which is targeting initial production in 2025[1]. Mineralization at Chord is hosted within typical roll front deposits in the Cretaceous age Fall River and Lakota formations, in particular the Chilson member which is the same host for mineralization at Dewey-Burdock. The property has been the subject of extensive exploration since the 1970’s with over 1,000 holes drilled by Union Carbide Corp. (“UC”) and is host to an historic resource totaling 2.4 million pounds U3O8 plus a potential resource of 1.4 million pounds U3O8[2].

Chord Detailed Historical Resources by Area

Disclaimer to Historic Resource and Resource Classification:

The current 147 claims cover materially all of the historic resource. The historic resource are not contained in a National Instrument 43-101 report and no qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The Company is not treating the historical estimate as current mineral resources or mineral reserves. Further the classification of the noted reserved are not classifications pursuant to Canadian Institute of Mining Metallurgy and Petroleum (“CIM”) definitions and readers are cautioned not to rely on the resource definitions in assessing the potential of the Chord property. The resource estimates and classifications are historic and provided for context only in regards to the prospective nature of the Chord property.

Basin plans to engage in the permitting process for the Chord property to conduct both exploration and confirmatory drilling, in addition to aquifer testing. The Company is also plans to acquire additional public and private datasets, confirm historic results, investigate the ISR amenability and conduct exploration to increase the currently known mineralized footprint.

Mineralization at enCore’s adjacent Dewey-Burdock project is also hosted in the Chilson member sandstones. The Dewey-Burdock project is host to a M&I resource of 17.1 Mlbs U3O8 (7.4 Mt at 0.116% U3O8) plus an Inferred resource of 0.7 Mlbs U3O8 (0.6 Mt at 0.055% U3O8), a positive Preliminary Economic Assessment[3] (PEA) outlining a low-impact in-situ recovery (ISR) operation producing 14.3 Mlbs U3O8 at an all-in sustaining cost of US$28.88/lb U3O8. The Dewey-Burdock project also has received its Radioactive Materials License (RML) from the U.S. Nuclear Regulatory Commission (NRC) and is currently navigating the State Licensing process.

Chord Project, Fall River County, South Dakota

Mineralization on the Chord property is hosted within typical roll front deposits in the Cretaceous age Fall River and Lakota formations, in particular the Chilson member. The contiguous claim block covers uranium mineralization drilled by Union Carbide Corp. (“UC”) in the late 1970s. The property consists of 147 lode mining claims (approximately 3,037 acres) and is located 3 miles southwest of the enCore Energy Corp., Dewey Burdock ISR (“In Situ Recovery”) uranium deposit, which is also hosted in the Chilson member sandstones. Union Carbide estimated resources, reserves and potential reserves for the Long Canyon, October Jinx, Ridge Runner, Virginia C and Viking deposits. These deposits were historically evaluated from an open pit or underground mining scenario and never evaluated for their ISR potential. Specifically, the October Jinx and Viking areas vary from depths of 350 to 500 feet deep and, based on historic depth-to-groundwater measurements[4], are believed to, at least in part, lie below the water table which could potentially allow for ISR extraction. Mineralization is hosted in the sands of the lower Chilson member of the Lakota formation. Resource calculations are documented in UC and subsequent claimant reports and UC radiometric ore maps covering most of the reported mineralization.

October Jinx: Mineralization lies in the Chilson member, is unoxidized and lies at depths varying from 400 to 500 feet. Resources were based on 100-foot drill hole spacing except for three areas that were drilled on 500-foot offsets to test the continuity with results showing good continuity of mineralization. A cutoff grade of 0.06% U3O8 and a minimum grade thickness product (GT) of 0.30 was used and diluted to a minimum width of 8 feet.

Ridge Runner & Virginia C: Mineralization lies in the Fall River Formation with sallow depths of less than 50 feet. Resources were based on drill spacing of 50-foot or less with chemical assays of 2 foot samples of rotary drill cuttings (where available) and radiometric results. A cutoff grade of 0.04% U3O8 and a minimum grade thickness product (GT) of 0.08 (2.0 feet of 004% U3O8) was used and diluted by 30% of 0.02% U3O8.

Viking: Mineralization lies in the Lakota formation and accessed via a decline in a gulch west of the deposit. Resources are based on 100-foot drill hole spacing and chemical assays of 2 foot samples of rotary drill cuttings. A cutoff grade of 0.04% U3O8 and a minimum grade thickness product (GT) of 0.30 was used and diluted to a minimum width of 8 feet.

Long Mountain: Mineralization lies in the Chilson member and generally shallow varying from 60 to 150 feet to a maximum of 200 feet deep. Resources are based on 50-foot drill hole spacing and chemical assays of 2 foot samples of rotary drill cuttings. A cutoff grade of 0.04% U3O8 and a minimum grade thickness product (GT) of 0.08 (2.0 feet of 004% U3O8) was used and diluted by 30% of 0.02% U3O8. The claims under option cover 90% of the Measured and Potential historic resources at Long Mountain.

Resource Modelling: Measured resources drilled on 50-foot centres were computed using the Polygonal Block Method. Measured resources drilled on 100-foot centres were computed using 300 tons per foot of ore intercept. Indicated resources were derived by subtracting the measured resources from the total resources computed by using the standard formula which relates the ratio of ore holes to total holes of the volume of the area of equally-spaced drilling. Potential resources were based on projections of favorable ore-bearing formations. Density tests have been run on Lakota ores mined from Long Mountain and on core samples taken in 1978. The density used to compute the Chord resources was 14 ft3 per ton and Fall River resources are computed using 15.5 ft3 per ton.

Source: Geologic Review of Chord Uranium Project dated September 1982 by E.K. Pinnick, Consulting Geologist

Basin Uranium believes the historic estimate are a relevant data point as they clearly demonstrate the potential of the Chord property.

Basin Uranium cautions investors it has not yet verified the historical information.

The Option

Pursuant to the terms and conditions of the Option Agreement and in order to acquire a 90% interest in and to the Property, the Company must: (i) pay a total of US$50,000 in cash, (ii) issue common shares in the capital of the Company (“Shares”) equivalent to a value of US$950,000, and (iii) incur US$1,200,000 in exploration expenditures on the Property. The timing of the Share issuances and exploration expenditures will be dependent on the receipt of permits from applicable regulatory authorities in accordance with the terms of the Option Agreement. Following the exercise of the Option, the Company and Cowboy Exploration will commence a joint venture on the Property.

The Option Agreement also provides for the Company to make contingent payments in certain circumstances. The Company will make a contingent payment in relation to the first mineral resource in the measured or indicated mineral resource category, established on the Property by the “Third Anniversary Date” (as defined in the Option Agreement) of: (i) US$100,000 in Shares if the resource established is holds between 3,000,000-3,999,999 lbs of U3O8, (ii) US$200,000 in Shares if the resource established holds between 4,000,000-4,999,999 lbs of U3O8, and (iii) US$300,000 in Shares if the resource established holds between 5,000,000 lbs or more of U3O8. The Company will also make a payment of US$400,000 in Shares following the announcement of a positive Preliminary Economic Assessment (PEA) on the Property.

The issuance of the Shares is subject to approval by the board of directors of the Company and the Canadian Securities Exchange. All securities issued in connection with the Option will be subject to a four-month plus one-day hold period from the issuance date. The Company will pay a finder’s fee to ● of ● in connection with the Option Agreement.

Qualified Person:

- Tim Henneberry, PGeo (B.C.), a technical advisor to the Company, is the Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the technical data in this news release.

About Basin Uranium Corp.

Basin Uranium Corp. is a Canadian junior exploration company focused on mineral exploration and development in the green energy sector. The Company owns the Wray Mesa project in southeastern Utah which has seen significant historic uranium and vanadium exploration and is located adjacent to the fully- permitted and production ready La Sal project. The Company has an option to acquire a 75% interest in the Mann Lake uranium project, located in the Athabasca basin in Northern Saskatchewan, Canada and holds an option in the CHG gold exploration project located approximately 15 kilometers northwest of the town of Clinton in south-central British Columbia.

For further information, please contact Mr. Mike Blady or view the Company’s filings at www.sedar.com.

On Behalf of the Board of Directors

Mike Blady

Chief Executive Officer

info@basinuranium.ca

604-722-9842

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this news release.

FORWARD-LOOKING STATEMENTS:

Cautionary Note Regarding Forward-Looking Statements: This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this news release. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary include, without limitation, uncertainties affecting the expected use of proceeds. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

[1] Source: enCore Energy February 2023 Corporate Presentation “enCore: production pipeline”

[2] Source: Geologic Review of Chord Uranium Project dated September 1982 by E.K. Pinnick, Consulting Geologist

[3] Source: Azarga Uranium NI 43-101 PEA dated December 22, 2020

[4] Source: W.T. Cohan, 1984, Report on Water Sampling and Limited Aquifer Testing, Chord Project

SOURCE: BASIN URANIUM CORP.

The post BASIN URANIUM TO ACQUIRE ADVANCED CHORD URANIUM PROJECT IN SOUTH DAKOTA appeared first on Financial News Media.