Friday at last. Friday at last!

For those who aren’t paying attention to the Winter Olympics, Italy leads the medal count with 17, Norway has the most gold medals with 7, and the U.S. is in third with 14. My country, Canada, has 7 medals, none of them gold. Not to worry, our men’s hockey team will rectify that soon enough.

As for the markets, they were all solidly in the red yesterday -- S&P 500 down 1.6%, Nasdaq Composite down 2%, and the Dow off by 1.3% -- as tech stocks, especially software-related ones, continued to sell off amid concerns about AI's impact on these businesses.

Speaking of software stocks, Intuit (INTU) lost 0.4% on the day. It has now lost nearly 40% of its value in 2026. As a result, if you bet on INTU five years ago, your investment is worth nearly 4% less.

CEO Sasan Goodarzi has his hands full. When he took the job in January 2019, Intuit shares were around $195; they peaked last June at $813.48. They’ve lost 51% since hitting their all-time high eight months ago.

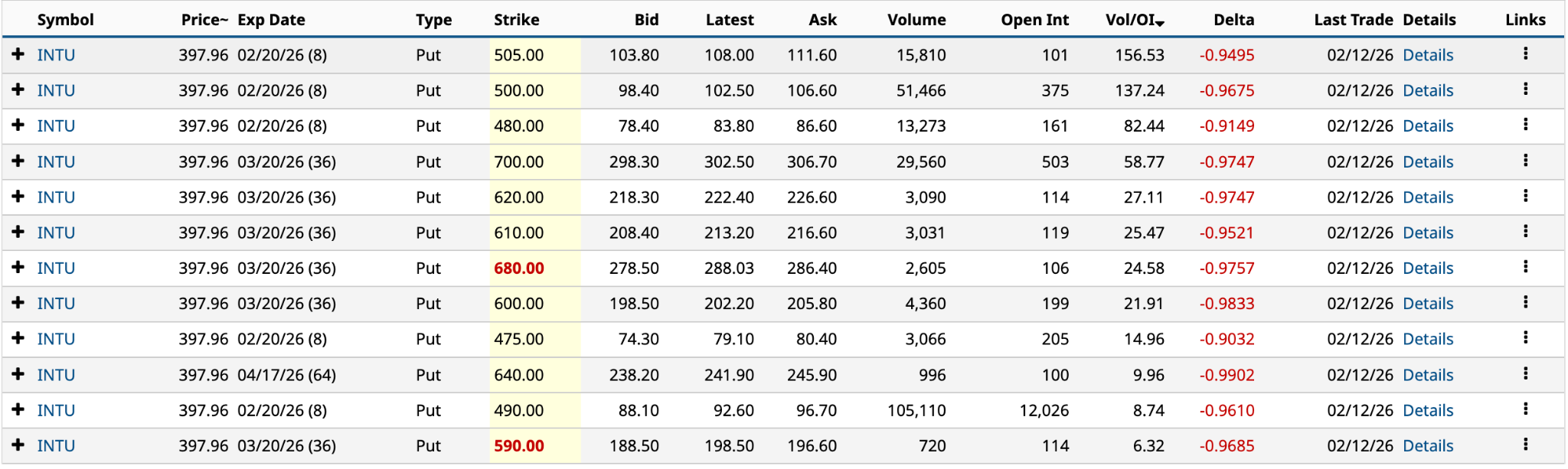

Yesterday’s unusual options activity saw Intuit rank fourth and fifth in Vol/OI (volume-to-open-interest) at 156.53 and 127.24, respectively. Overall, it had 12 of the 1,224 unusually active options on Thursday, with five in the top 100.

Its options volume on the day was 270,966, nearly seven times its 30-day average. It was three times the second-highest daily options volume over the past 24 months.

A deep dive into Intuit’s unusual options activity from yesterday screams a bullish reversal. Here’s why.

Intuit’s Unusual Options Activity

As mentioned in the introduction, Intuit’s options volume (the highest in 24 months) and unusual options activity (two in the top five Vol/OI ratios) speaks to the significant investor interest in software stocks at the moment.

Interestingly, while its options volume was off the charts -- probably the highest single-day volume in its history -- its overall share volume was about equal to its 30-day average.

What’s happening here?

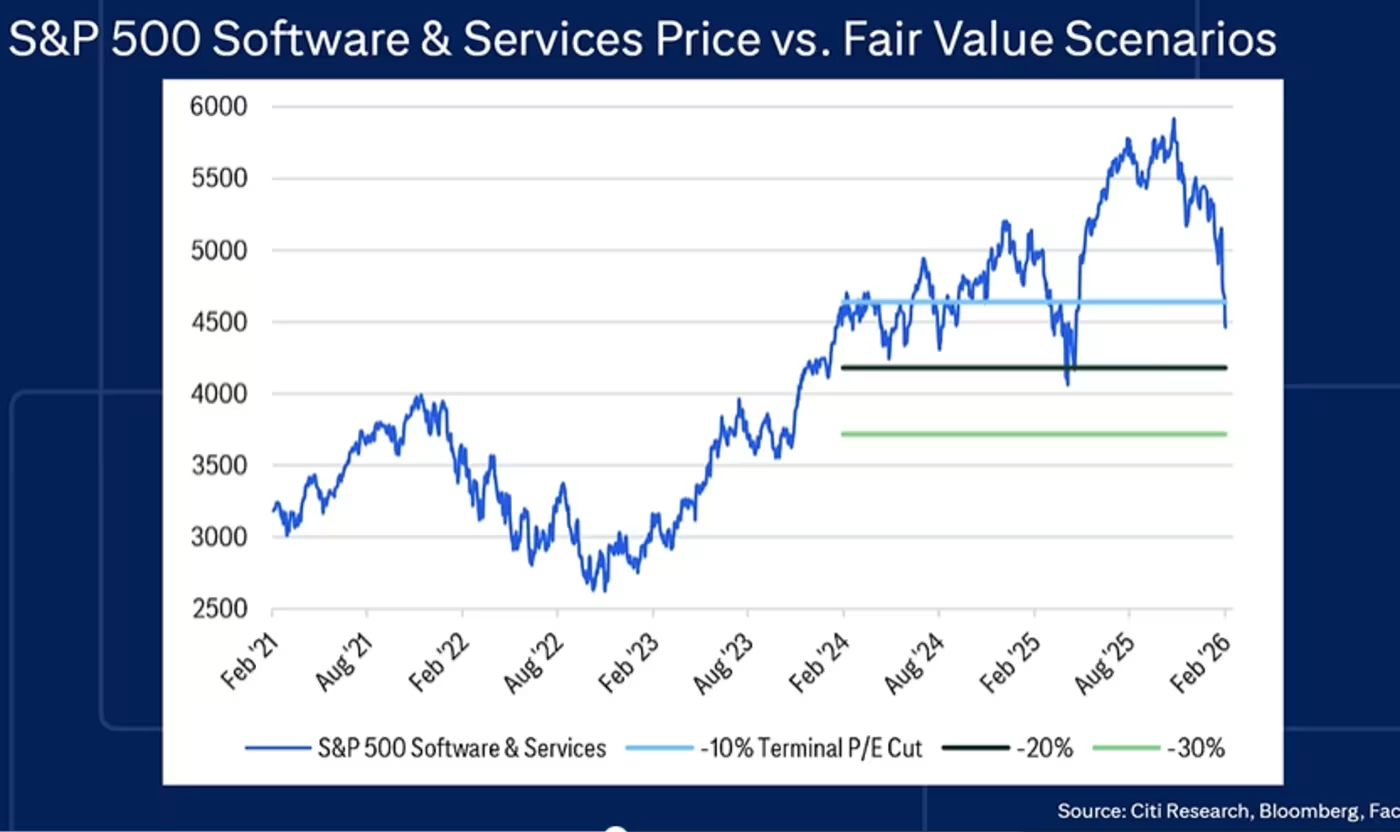

A MarketWatch article from today does a good job explaining the forces at work vis-à-vis software stocks with an assist from Scott Chronert, Citigroup’s head of U.S. equity strategy.

To Chronert, it all comes down to terminal values.

“Terminal value represents the estimated value of a business assuming it will continue to grow at a stable, constant rate indefinitely. It is a major component of discounted cash-flow analysis,” MarketWatch contributor Jaimie Chisolm writes.

The problem, as Chronert sees it, the markets have priced in a 10% reduction in terminal values, but prices have yet to reflect a 20% reduction. It’s a fancy way of saying the bloodletting might not be done.

Source: Citigroup, MarketWatch

He believes in the near-term, a bottom is in -- hence why 11 of Intuit’s 12 unusually active put options yesterday had DTEs (days to expiration) of less than 45 days -- but moving forward, investors will be looking more closely at software stocks, assessing on a company-by-company basis, which have sustainable business models 5-10 years out, and those that don’t.

I believe Intuit’s strong brands (Intuit, QuickBooks, TurboTax, Credit Karma) and its adoption of AI will enable it to maintain a strong market share going forward.

But for now, let’s consider why yesterday’s unusual options activity signals a bullish reversal, and the options strategy investors are using to benefit.

Aggressive Investors Ought to Love the Cash-Secured Put

Barchart’s Options Flow page from yesterday shows Intuit’s options had a net trade sentiment of nearly $675 million. That’s very bullish. The Feb. 20 puts had 21 trades with volumes of 1,000 or higher; seven over 10,000.

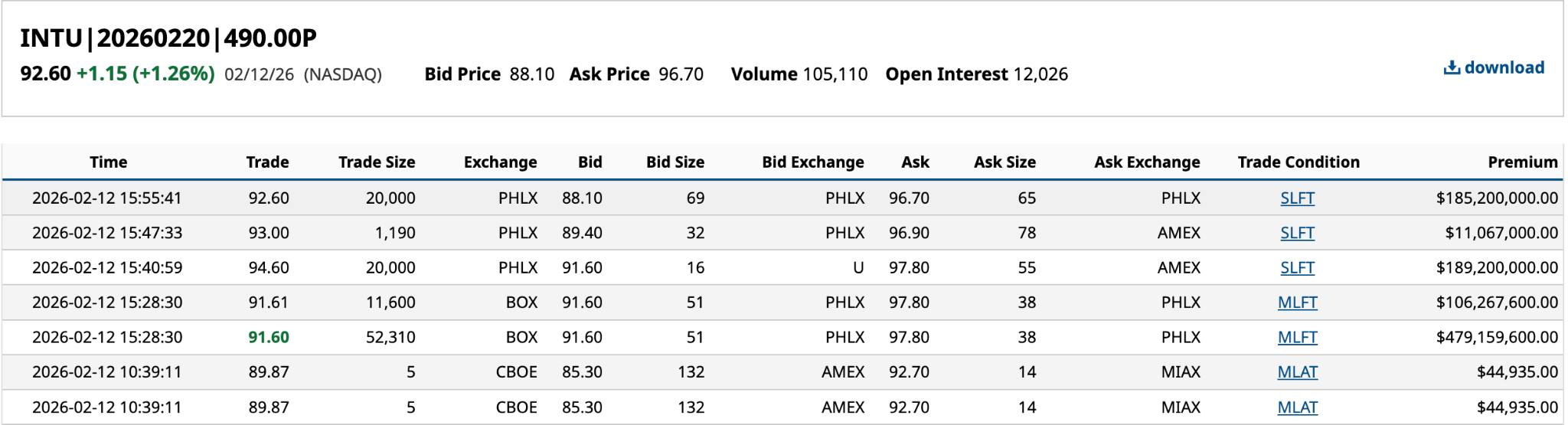

The put option that stands out for me is the Feb. 20 $490 strike price. With a volume of 105,110 (39% of the day’s total) and open interest of 12,026, it was very popular both yesterday and in the preceding days.

The biggest trade was 52,310 for $479.2 million premium. The trade price was at the bid price of $91.60, indicating a bullish view for INTU stock. The 11,600 contracts traded at the same time were one cent off the bid, also bullish. The other five trades were relatively neutral in sentiment.

The biggest trade was 52,310 for $479.2 million premium. The trade price was at the bid price of $91.60, indicating a bullish view for INTU stock. The 11,600 contracts traded at the same time were one cent off the bid, also bullish. The other five trades were relatively neutral in sentiment.

It will be interesting to see what it does today. Early in trading, INTU is down a couple of bucks with low options volume. My guess, like yesterday, the options volume will pick up in the last hour of trading.

Both the 52,310 and 11,600 trades were multi-leg, which leaves out a single-leg cash-secured put strategy. But let’s consider it.

Based on the bid price of $91.60, selling the $490 put would generate an 23% return [$91.60 bid price / $490 strike price - $91.60 bid price], 1,049% on an annualized basis [23% * 365 / 8].

That’s some return.

Of course, because it’s ITM (in-the-money) by 23% and only eight days to expiration, barring a miracle of epic proportions, you will have the shares assigned to you, resulting in a net purchase of 100 INTU shares at $398.40 [$490 strike price - $91.60 bid price (premium)].

If the shares have bottomed, as Chronert suggests, it’s not a bad move. However, if the downward spiral continues, leading up to its Q2 2026 results being released on Feb. 26 after the markets close, you could be sitting on a decent-sized paper loss.

The expected move is 5.2% over the next week. Based on a share price of $399.57, the lower price is $378.79, and the upper price is $420.35. Assuming the worst, you’re looking at a paper loss of $20.78 a share ($2,078).

Only aggressive investors need apply.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart