My last dedicated Barchart article on palladium was on August 12, 2025, when the price was sitting at $1,154.50 per ounce. I concluded with the following:

Palladium broke out of its bearish trend in July 2025. Tariffs and sanctions create the potential for higher highs over the coming weeks and months. However, investors and traders must realize that palladium’s liquidity can exacerbate price rallies and corrections. Expect lots of volatility in the palladium futures market, and you will not be disappointed.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

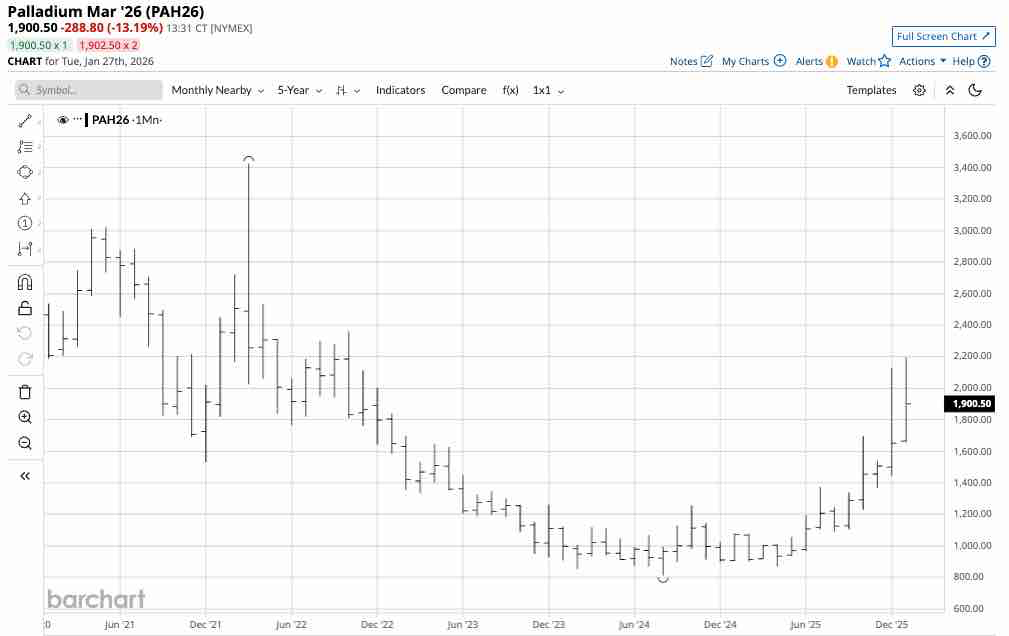

Since mid-August 2025, palladium volatility exploded, with the price near $1,900 per ounce in late January. However, palladium is the only precious metal that has not reached a new all-time high in late 2025 or early 2026.

The bullish trend in palladium continues

After exploding higher in 2025 and closing at $1,651.40 per ounce on December 31, 2025, palladium’s price has continued to motor higher in January 2026.

The monthly chart shows that nearby NYMEX palladium futures have rallied in early 2026 and were trading above $1,900 per ounce on January 27 after reaching a high of nearly $2,200 per ounce.

If gold, silver, and platinum are models, palladium could have lots of upside potential

Gold, silver, and platinum reached new all-time highs in 2025, and the bullish price action continues in January 2025 with all three metals reaching even higher highs.

Nearby COMEX gold futures closed 2025 at $4,431.10 per ounce, up 64.37% in 2025 and rising to a high of $4,556.30 per ounce last year. On January 27, 2025, the nearby COMEX gold futures were higher at over $5,080 per ounce.

Nearby COMEX silver futures closed 2025 at $70.603 per ounce, up 141.44% in 2025 and rising to a high of $79.70 per ounce last year. On January 27, 2025, the nearby COMEX silver futures were higher at over $108 per ounce.

Nearby NYMEX platinum futures closed 2025 at $2,034.50 per ounce, up 127.57% in 2025 and rising to a high of $2,563.50 per ounce last year. On January 27, 2025, the nearby NYMEX platinum futures were steady at over $2,560 per ounce after reaching a high of $2,852.40.

With the three other precious metals traded to new record highs in early 2026, it may not be long until palladium catches up and challenges the March 2022 $3,425 record peak.

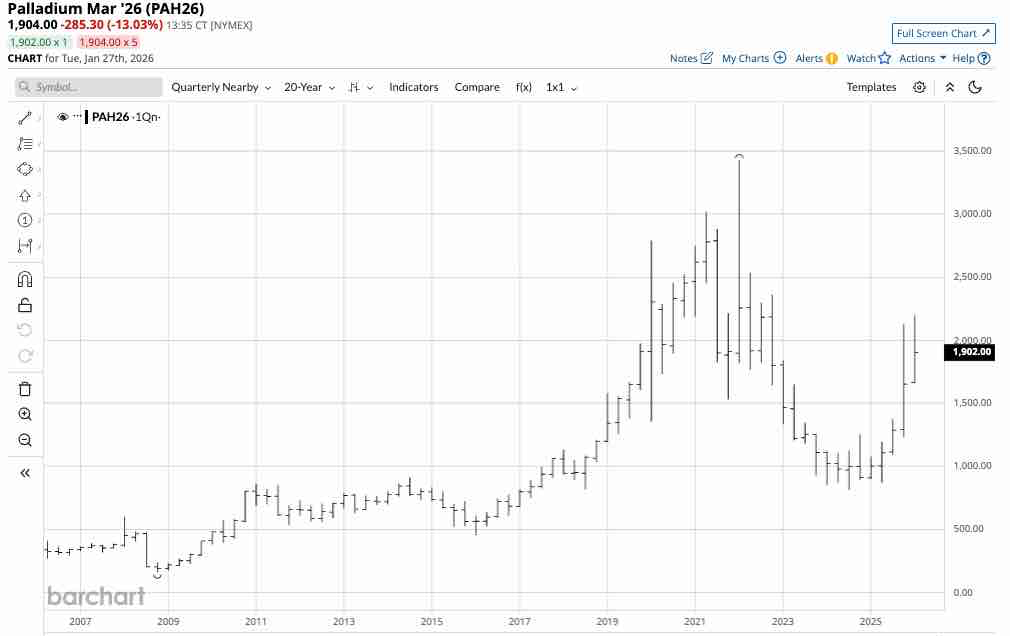

The all-time high was in March 2022 when Russia invaded Ukraine

In 2024, total palladium production was approximately 190 metric tons or just over 6.1 million ounces. Four countries, Russia, South Africa, Zimbabwe, and Canada, produced over 93% of the world’s mine supplies.

The world’s leading palladium-producing countries in 2024 were:

Russia: 75,000 kilograms

South Africa: 72,000 kilograms

Zimbabwe: 15,000 kilograms

Canada: 15,000 kilograms

In Russia, the world’s leading palladium-producing country, palladium is produced as a byproduct of nickel output in Siberia’s Norilsk region.

When Russia invaded Ukraine in early 2022, supply concerns sent palladium prices to a record high of $3,425 per ounce.

Levels to watch in the palladium futures market- Liquidity factors are critical

The twenty-year quarterly NYMEX palladium futures chart highlights the current technical support and resistance levels.

The quarterly continuous contract chart shows that while the upside target is the March 2022 high of $3,425 per ounce, there is resistance at the Q2 2022 high of $2,534 per ounce. Technical support is at the Q1 2023 high of $1,841 and the Q2 2023 high of $1,649 per ounce.

When compared to gold, silver, and platinum futures trading on the CME’s COMEX and NYMEX divisions, palladium is the least liquid precious metal as it has the lowest daily volume and open interest, the total number of open long and short positions. Less liquid markets tend to be more volatile as bids to purchase can disappear during downside trends and offers to sell can evaporate during rallies. Therefore, with the liquid gold, silver, and platinum futures markets experiencing parabolic rallies, the odds of palladium experiencing an upside explosive move are high.

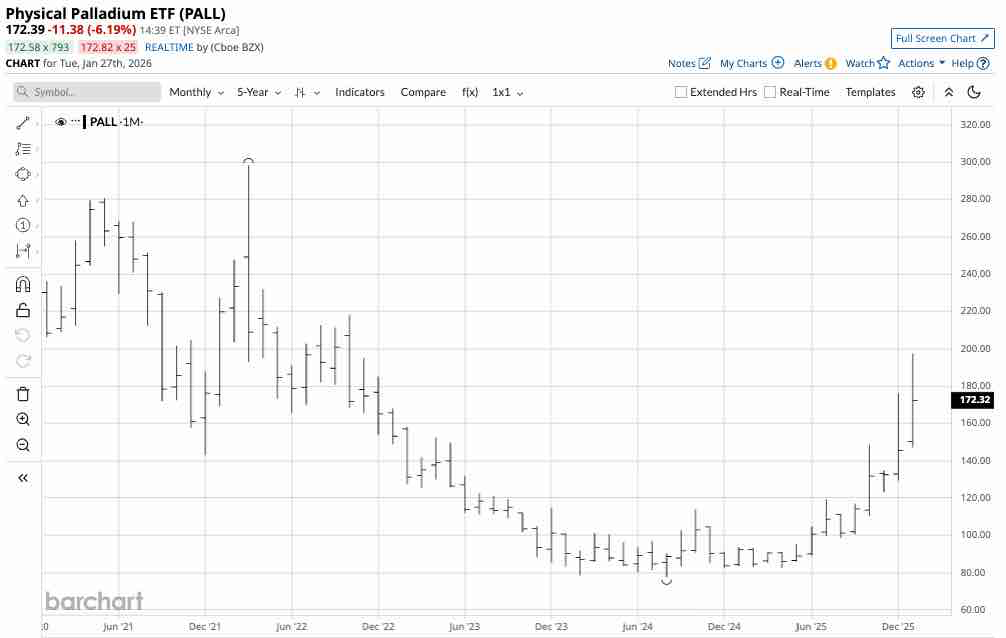

PALL is the palladium ETF product

The most direct route for investment or a risk position in palladium is the physical market for palladium bars and coins. However, buying and selling physical palladium can involve wide bid-offer spreads and premiums for buyers and discounts for sellers.

The NYMEX futures market involves leverage and margin, requiring special accounts. At $1,900 per ounce, one NYMEX palladium futures contract containing 100 ounces is worth $190,000. The CME’s current original margin requirement of $23,115 means that a market participant can control $190,000 worth of palladium for a 12.2% downpayment. If equity falls below $21,014 per contract, the exchange requires maintenance margin payments. Meanwhile, as palladium market volatility rises, the exchange will increase the margin requirements.

The Aberdeen Physical Palladium ETF (PALL) is a liquid alternative to physical palladium or futures. At $172.39 per share on January 27, PALL had over $1.387 billion in assets under management. PALL trades an average of over 760,000 shares per day and charges a 0.60% management fee.

Palladium futures rallied 81.51% in 2025.

The chart highlights the 74% 2025 increase in PPLT from $83.52 at the end of 2024 to $145.38 per share on December 31, 2025. PALL underperformed palladium due to the ETF’s expense ratio and because while palladium futures trade around the clock, PALL only trades during U.S. stock market hours. PALL can miss highs or lows occurring when the stock market is closed.

Palladium prices were already over $1,900 per ounce in late January 2026, up by over $250 per ounce from the December 2025 closing level. The trend is always a trader’s or investor’s best friend, and it remains higher in the palladium futures market, with lots of room before the price reaches the March 2022 all-time high. I remain bullish on palladium and expect higher highs over the coming months. However, periodic downdrafts, as the market experienced when palladium futures fell by over $300 per ounce on January 27, are likely. The higher precious metals prices rise, the greater the odds of violent selloffs, which could be golden buying opportunities.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart