Chicago, Illinois-based Mondelez International, Inc (MDLZ) manufactures, markets, and sells snack food and beverage products. Valued at $76.2 billion by market cap, the company offers a wide range of products such as biscuits, baked snacks, chocolates, gums, candies, cheese, and powdered beverages under brands like Oreo, Ritz, LU, CLIF Bar, Tate’s Bake Shop, Cadbury Dairy Milk, Milka, and Toblerone.

Shares of this global snacking giant have underperformed the broader market over the past year. MDLZ has gained 1.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15%. However, in 2026, MDLZ stock is up 7.3%, surpassing the SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, MDLZ’s outperformance is apparent compared to the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has declined about 1.7% over the past year. Moreover, MDLZ’s returns on a YTD basis outshine the ETF’s 5.2% gains over the same time frame.

Mondelez International's underperformance is driven by rising input costs, weakening consumer demand, and downward earnings revisions. Unprecedented cocoa price inflation has squeezed margins, forcing price hikes that dampened volume growth. Soft demand in Europe and North America, coupled with competition, are also weighing on the stock.

For the current fiscal year, ended in December 2025, analysts expect MDLZ’s EPS to decline 13.7% to $2.90 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

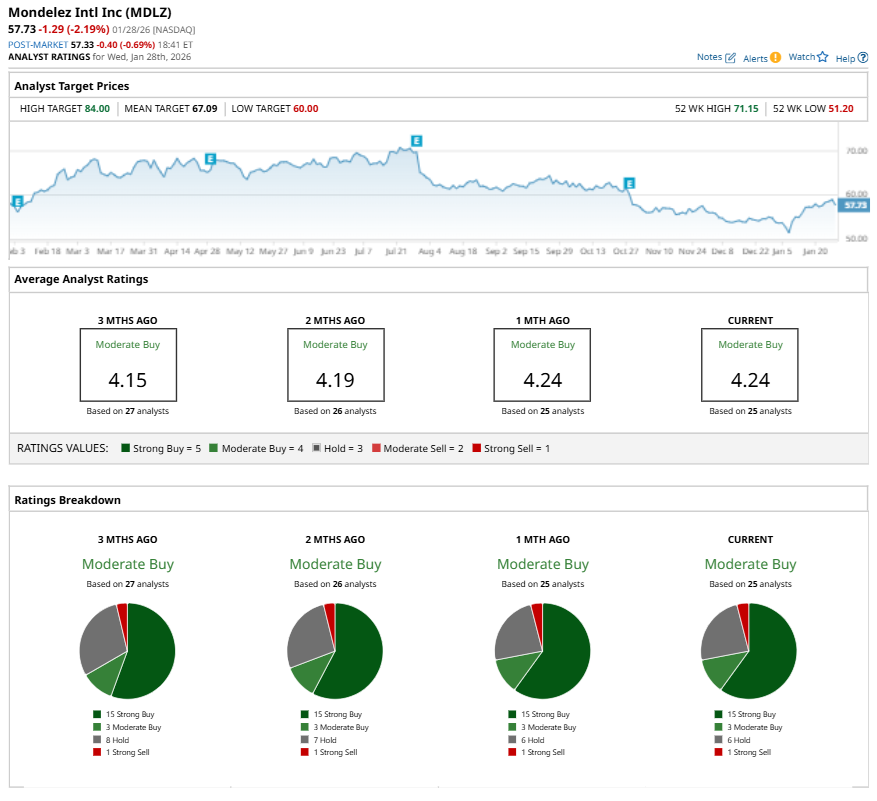

Among the 25 analysts covering MDLZ stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, three “Moderate Buys,” six “Holds,” and one “Strong Sell.”

The configuration has been fairly stable over the past three months.

On Jan. 27, Jefferies Financial Group Inc. (JEF) analyst Scott Marks CFA reiterated a “Buy” rating on MDLZ and set a price target of $70, implying a potential upside of 21.3% from current levels.

The mean price target of $67.09 represents a 16.2% premium to MDLZ’s current price levels. The Street-high price target of $84 suggests a notable upside potential of 45.5%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart