Western Digital (WDC) shares extended gains on Wednesday after peer Seagate Technology (STX) issued an exceptional Q2 and upbeat guidance for the future.

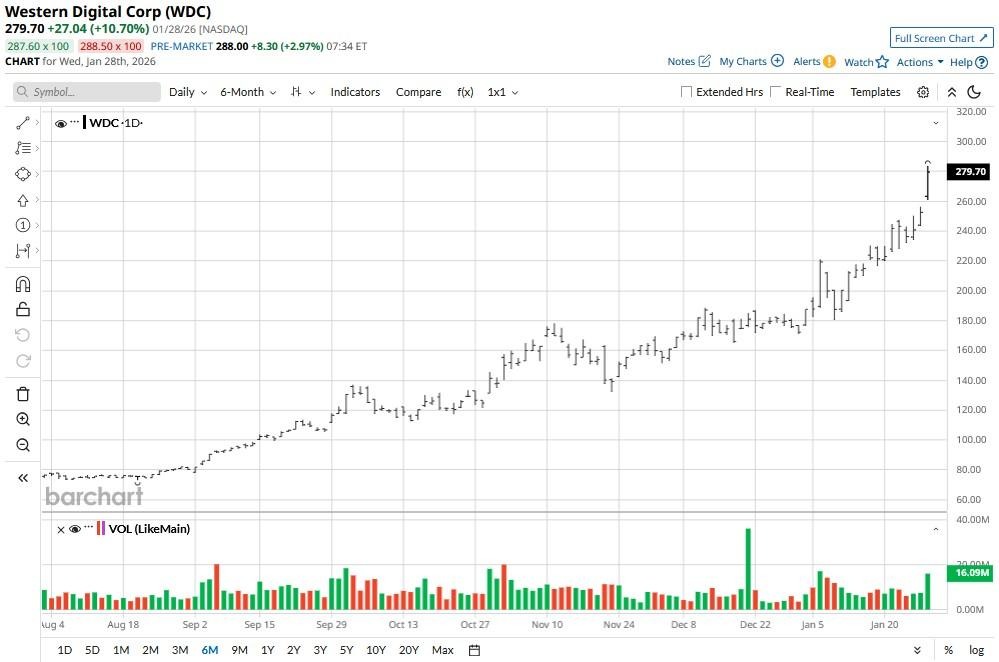

The rally pushed WDC’s relative strength index (14-day) to the 78 level, indicating overbought conditions that often precede a sharp pullback.

At the time of writing, Western Digital stock is trading at roughly 9x its price from April 2025.

Is It Too Late to Invest in Western Digital Stock?

The fundamental bull case for WDC stock remains compelling, supported by strong AI data center adoption and customer commitments extending into 2027.

Western Digital maintains a technical advantage through its emerging HAMR, or “Heat-Assisted Magnetic Recording” technology, entering customer qualification this year.

The Nasdaq-listed firm will then begin volume production in the first half of 2027.

Meanwhile, its current ePMR and UltraSMR products continue to capture market share through superior reliability and cost efficiency.

San Jose-headquartered Western Digital also pays a small dividend yield of 0.18% which makes it even more attractive as a long-term holding in 2026.

WDC Shares to Rally on Upcoming Q4 Earnings

Western Digital shares remain worth owning at current levels also because the storage industry is facing a genuine supply crunch that can’t be readily satisfied by competitors.

This creates authentic pricing power and margin expansion opportunities for strongly positioned manufacturers like WDC.

In the near-term, Western Digital’s earnings scheduled for later today (Jan. 29) may prove a catalyst that drives its stock price higher.

Consensus is for the company to report $1.83 a share of profit for its fiscal Q4, up an exciting 18% on a year-over-year basis.

At the time of writing, WDC sits handily above its major moving averages (50-day, 100-day, 200-day), further reinforcing that bulls remain in control across multiple timeframes.

Wall Street Remains Bullish on Western Digital

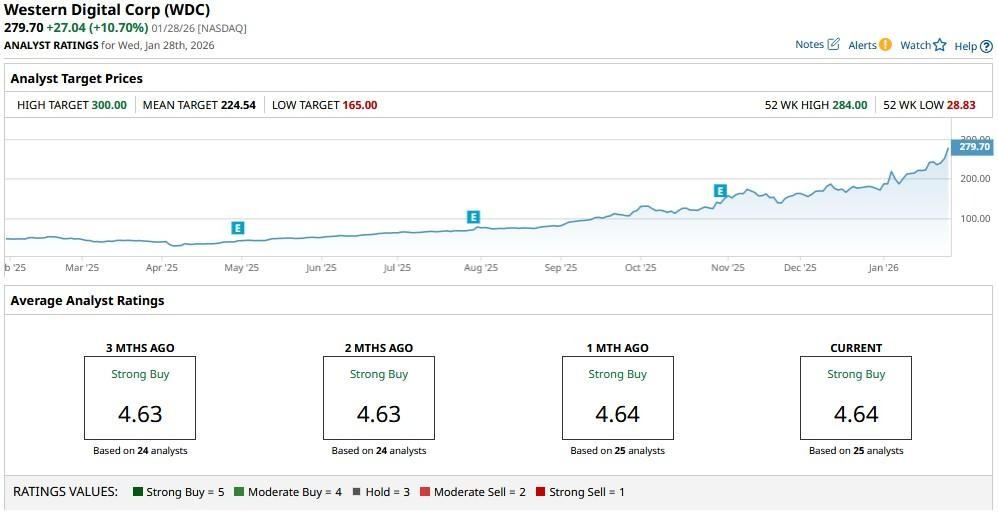

Wall Street firms also remain bullish on Western Digital Corp, especially since it isn’t particularly expensive for an AI stock at about 34x forward earnings.

The consensus rating on WDC shares remains at “Strong Buy” with price targets going as high as $300, indicating potential upside of another 7% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Energy Stock Is Up 700%, But I Wouldn’t Touch It with a 10-Foot Pole

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.

- Analysts Love These 2 Picks-and-Shovels Gold Stocks. Should You Buy Them as Gold Prices Hit New Record Highs?

- Here’s a Critical Pick-and-Shovel Trade to Invest in the NIMBY Backlash Against AI Data Centers