Investors are bailing on Tesla (TSLA) shares today after the electric vehicle (EV) behemoth saw its first-ever revenue decline in 2025. Additionally, the company warned its robotaxi and humanoid robot ambitions will see capital expenditures more than double year-over-year to about $20 billion this year.

Following the post-earnings decline, Tesla stock is down some 14% versus its 52-week high.

Why Tesla Stock Sold Off on Capex Guidance

Investors are feeling nervous about the capex guide primarily because it adds a layer of uncertainty to TSLA’s future trajectory, according to senior UBS analyst Joseph Spak.

According to Spak, the EV stock is significantly riskier to own now since there’s no clarity on when these investments will pay off — or if they ever will.

On the earnings call, Elon Musk confirmed that Tesla will stop producing its Model S and Model X vehicles and optimize its factories to make humanoid robots instead.

Translation: Musk is replacing the cash flow of vehicle sales with the yet-to-be-proven potential of autonomous bots, which of course means a more challenging road ahead for TSLA stock.

Why TSLA Shares Aren’t Worth Buying Today

Caution is warranted in playing Tesla shares at current levels also because the company’s core EV business — despite the headline beat in fiscal Q4 — isn’t performing all that well.

In the fourth quarter, the Nasdaq-listed firm saw deliveries decline 16% on a year-over-year basis.

For low- to moderate-risk investors, this makes TSLA’s premium valuation (north of 250x forward earnings) even more precarious, especially when combined with the “speculative” nature of its AI pivot.

Note that the post-earnings decline has pushed Tesla decisively below its 100-day moving average (MA), indicating the bearish momentum may sustain in the weeks ahead.

What’s the Consensus Rating on Tesla?

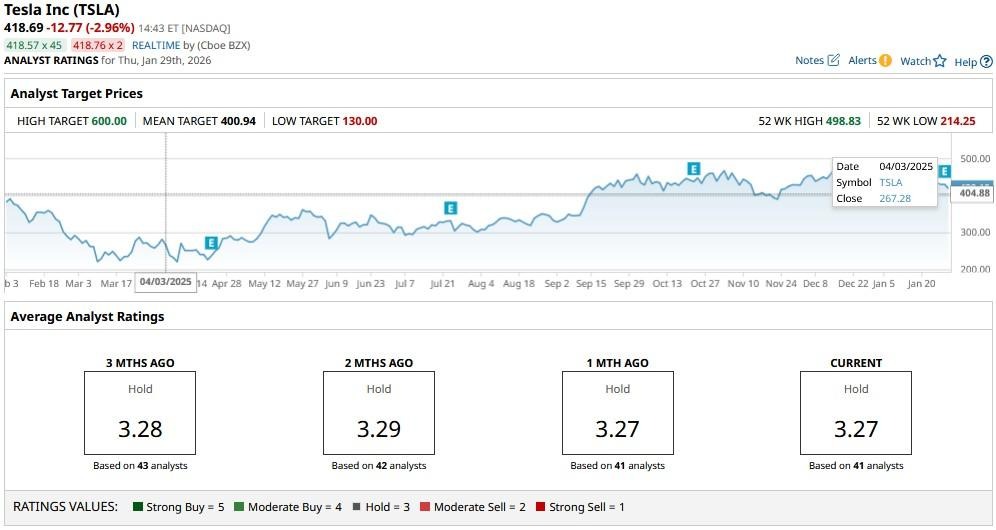

Wall Street analysts aren’t particularly bullish on Tesla Inc either due to its stretched valuation.

The consensus rating on TSLA shares sits at a “Hold," with the mean target of about $401 signaling potential downside of another 4% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Dividend King to Buy and Hold Through Any Market

- Intel Has a Problem Investors Might Actually Love: Is INTC a Buy Now?

- The S&P 500 Is Near Record Highs, But Volatility Is Rearing Its Ugly Head. The Best Way to Play It Now.

- This Old-School Company Is Up 100% on AI Demand. Should You Buy Shares Now?