Palantir (PLTR) will release its fourth-quarter financial results on Monday, Feb. 2. Once a favorite stock for investors seeking exposure to artificial intelligence (AI), Palantir has struggled in recent months. Shares have fallen more than 24% over the past three months and are down over 27% from their recent high. During this period, the stock has lagged the broader market, reflecting growing investor caution.

The pullback in PLTR stock reflects concerns about Palantir’s significantly high valuation. At the same time, worries about a potential AI bubble have raised doubts about whether the sector’s rapid gains are sustainable, putting added pressure on high-growth stocks like Palantir.

Despite the pullback, PLTR stock is still up more than 88% over the past year, reflecting the enthusiasm built into its price. While its valuation remains rich, the recent correction has eased some downside risk and improved the setup from a technical standpoint.

One key indicator is the stock’s 14-day Relative Strength Index (RSI), which is currently hovering near 31.7. That is well below the level typically associated with overbought conditions, suggesting the shares may be approaching oversold territory. If Palantir delivers stronger-than-expected earnings or offers upbeat forward guidance, the stock could rebound.

Options traders are also preparing for volatility. Derivatives markets are currently pricing in a post-earnings move of about 9.1% in either direction for contracts expiring Feb. 6. The expected move is smaller than Palantir’s average earnings reaction of about 13% over the last four quarters. The stock’s most recent earnings report in Q3 resulted in an 8% decline.

AIP to Boost Palantir’s Performance in Q4

Palantir has been delivering solid revenue growth while also widening its profit margins, driven by soaring demand for its Artificial Intelligence Platform (AIP). This growth trend will once again be reflected in its Q4 financials.

For Q4, Palantir expects revenue of $1.329 billion, which would mark a 13% increase from the prior quarter. Notably, management said during the last quarter’s conference call that Q4 could register the strongest sequential revenue growth. The top line forecast represents 61% growth compared with the same period last year.

Supporting Palantir’s growth is the solid strength in its commercial business. In Q3, total revenue climbed 63% year-over-year (YoY) to $1.18 billion, with commercial sales driving significant growth. Commercial revenue surged 73% YoY and grew 22% sequentially to $548 million. Notably, this was the fourth straight quarter in which Palantir’s commercial revenue exceeded its U.S. government revenue, signaling a meaningful shift in the company’s growth profile.

AIP remains the core growth catalyst behind its soaring commercial revenue. The adoption of its AIP has been strong in the U.S., where commercial revenue jumped 121% YoY.

Palantir is winning new clients, with the customer count increasing by 45% to 911. The total contract value is rising, reaching $2.8 billion in Q3, up 151% YoY. Existing customers are also deepening their spending. Over the past year, Palantir’s top 20 customers generated an average of $83 million each, showing that the company is acquiring clients and expanding relationships significantly. A net dollar retention rate of 134% further shows the strength of customer engagement.

Palantir’s strong revenue growth is translating into stronger profitability. In Q3, Palantir posted its highest-ever adjusted operating margin at 51%, up significantly from 38% a year earlier. Given this performance, management raised its 2025 expectations, projecting more than $2.15 billion in adjusted operating income and up to $2.1 billion in free cash flow.

As for the fourth quarter, analysts expect the company’s accelerating top-line performance to further improve earnings. Consensus estimates call for earnings of $0.17 per share in Q4, reflecting a sharp improvement from a loss of $0.01 per share in the prior year quarter. Palantir has exceeded EPS expectations in each of the last two quarters, including a 50% beat in Q3, which adds to optimism heading into Q4 earnings release.

Could Q4 Spark a Recovery in PLTR Stock?

Palantir is executing exceptionally well, as reflected in accelerating growth, expanding margins, and AIP driving both customer growth and contract values. The challenge, however, is that these positives are already reflected in the stock’s valuation.

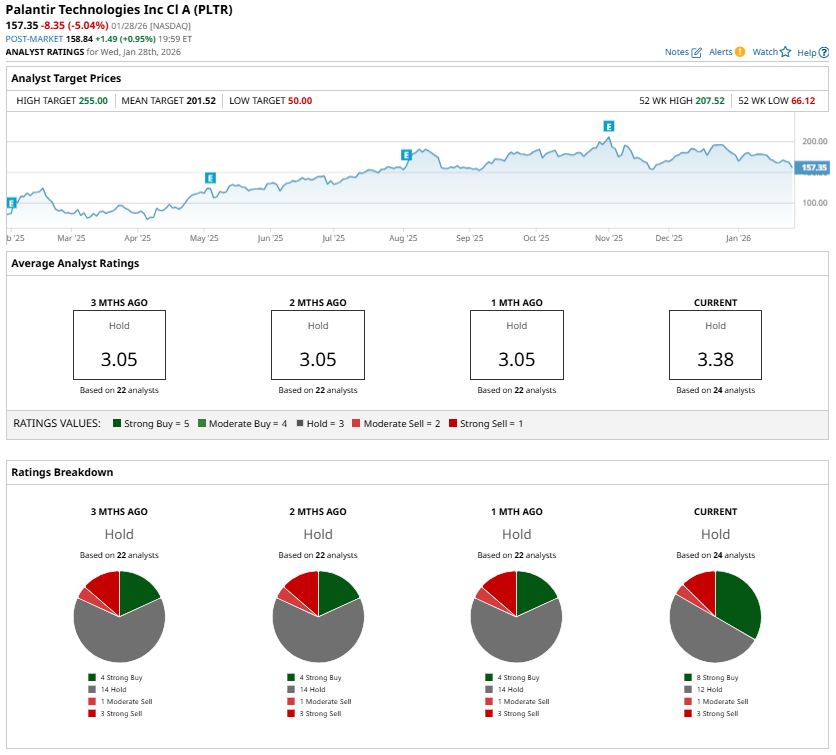

That helps explain why Wall Street maintains a “Hold” consensus rating on PLTR stock ahead of Q4 earnings.

However, if Palantir can deliver another quarter of impressive growth and profitability and boost investors’ confidence in its long-term AIP opportunity, the Q4 earnings release could support the recovery in PLTR stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- HSBC Says Investors Should Stay ‘Aggressively’ Risk-On. Here’s a Top-Rated Stock to Buy Now to Keep Betting on Growth.

- Meta Platforms Breaks Into Overbought Territory on Post-Earnings Rally. Is There Room for More Gains Ahead?

- As Microsoft Stock Crashes Below Key Support Levels, Should You Buy the Dip?

- Needham Analysts Think This Fintech Stock Can Soar 46% from Here. Should You Buy It Now?